Like the old joke about economists predicting eight of the last three recessions, in 2021 and 2022 a number of analysts focused the trucking sector forecast an imminent “freight recession.”

Supply Chain Digest Says...

|

|

For the first two years of the pandemic, sales of many physical soared in a home-based economy. More recently, consumers are back to spending on services – maybe good for the economy but bad for freight.

|

|

What do you say? |

| Click here to send us your comments |

|

| |

|

While there was some softness amid and after that period, what most would term a deep slump in freight volumes never really showed.

That’s been changing here is 2023 – even as the overall US economy remains decent.

“I don’t know that we’ve ever seen freight demand fall this far, so fast and for so long, without an accompanying economic recession,” David Jackson, CEO at truckload carrier, Knight-Swift Transportation, told investors this month.

And that is leading some drivers to leave the industry, as loads and rates decline.

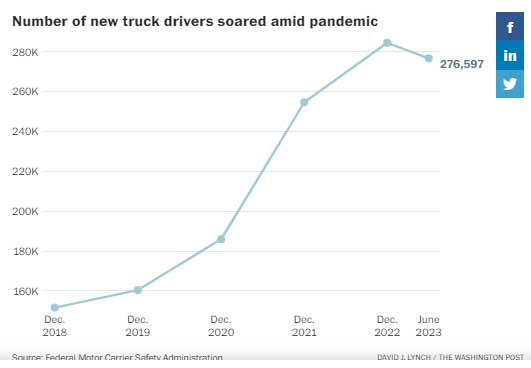

As shown in the graphic below, the number of new drivers entering the sector has fallen a bit in the past few months, it came after gains of new drivers since the start of the pandemic soared to more than 280,000 in late 2022.

But the signals remain mixed.

In June, the Freight Tonnage Index from the American Trucking Associations was down year-over-year for fourth straight month – but modestly.

Yet, “The freight recession is real and it stretches across modes, across air, trucking and rail,” Phil Levy, chief economist for Flexport, a transportation services company, recently told the Washington Post.

That even as the US economy rose a decent 2.4% in Q2, according to the Commerce Department last week.

There is a disconnect somewhere.

Source: David Lynch

Washington Post

(See More Below)

Changing consumer behavior may be the key factor. For the first two years of the pandemic, sales of many physical soared in a home-based economy. More recently, consumers are back to spending on services – maybe good for the economy but bad for freight.

That spending change has also caused retailers to cut back inventories, reducing the need to move those goods.

The Post, for example, says inventory levels at Target fell in the first months of this year by 16%, led by apparel and home goods.But at the end of the day, “There’s still more capacity than freight to be moved. It’s a tough time to be a carrier,” Ken Adamo, chief of analytics for DAT Freight & Analytics, told the Post.

Any thoughts on this new Amazon program? Let us know your thoughts at the Feedback section below.

|