The Wall Street Journal has been running a very interesting series of articles on the state of ecommerce and efulfillment in the food sector - both from restaurants and grocery stores.

An article last week by Heather Haddon started out by noting some of the inventory challenges grocers face in ecommerce - and how that can lead to sometimes confused and unhappy customers when the grocers make sometimes odd substitutions for out of stock items.

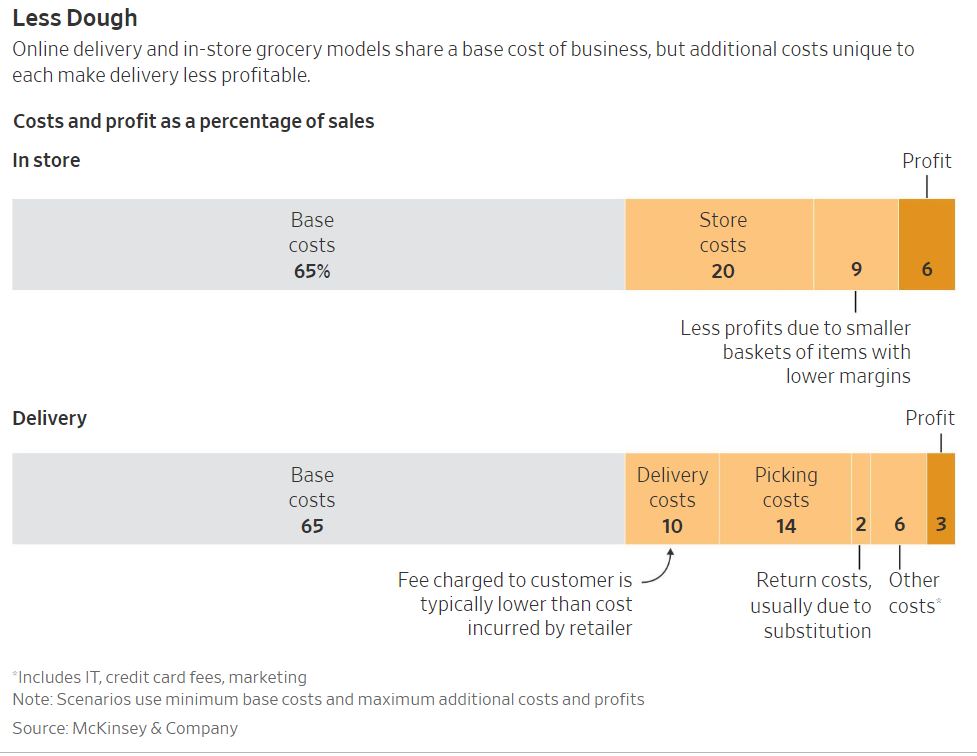

The article later takes a look at costs and margin for grocers when comparing the numbers between traditional in-store sales and those for ecommerce orders with home delivery, as shown in the graphic below.

As can be seen, both types of orders begin with food costs of 65 cents out of a dollar of sales. In-store sales have total store overhead costs of 20% of sales, versus a combined 24% for in-store picking/packing and delivery costs.

That cost advantage for stores sales is somewhat offset (add in 9%) for the smaller "basket" on average for store sales, but delivery sales have higher costs for returns (2%) as well as 6% higher costs for other areas such as credit card fees (assume many in-store shoppers must still use cash,) and IT and marketing expense.

That leaves in-store sales providing a profit of six cents on the dollar, versus half - just three cents - for home delivery orders.

But on-line is where the growth is, and we expect these costs to change over time (e.g., picking may get more efficient, IT costs should come down). On the other hand, delivery costs may head northward, in our view.

Supply Chain Graphic of the Week? Let us know your thoughts at the Feedback section below.

Your Comments/Feedback

|