The data relative to the US economy continues to be mixed. For example, US GDP growth in the first two quarters of 2016 has been very weak, while the jobs picture remains relatively strong.

It has been this way almost since the end of the Great Recession.

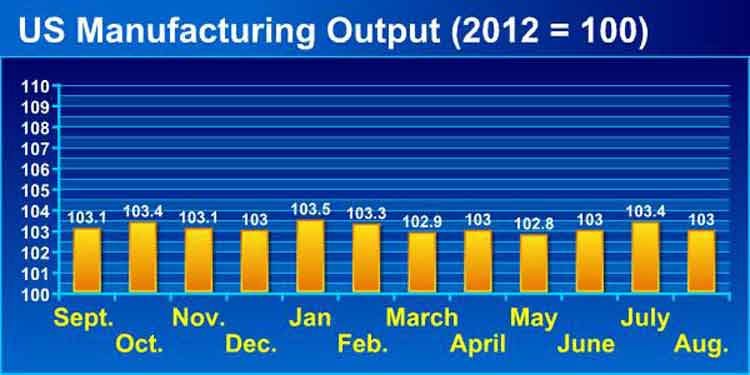

Last week, however, came more data that points to US economic weakness. Each month, we track US manufacturing output, as estimated by the Federal Reserve.

The data comes in the form of an index, measured against the average month in the baseline year of 2012 (index = 100). With the numbers for August just out, here is a look at the index over the past year.

Source: SCDigest, from Federal Reserve Data

As can be seen, output has been almost completely flat for the past 12 months along a very tight range. The lowest score over that time was seen in May (102.8) versus a high not much above that in January (103.5).

So, US manufacturing has simply not been growing.The August figure was 0.4 percentage point below the 2015 number.

Worse, at a level of 103 it means US production last month is up just 3% over the average month in the baseline year of 2012, indicating average annual growth since then of under 1% - not good.

While US GDP growth has also been tepid over that same period, in the 2% annual range, this Fed data would indicate manufacturing continues to lose share as a percent of the US economy.

There is a lot of wishful thinking out there in terms of US manufacturing. These numbers say US manufacturing is hanging in there, but not growing.

Any Feedback on our Supply Chain Graphic of the Week? Let us know your thoughts at the Feedback section below.

Your Comments/Feedback

|