Can we still learn supply chain lessons today from the Efficient Consumer Response (ECR) era of the early 1990s nearly twenty years later?

The answered would be Yes, based on a fairly recent book - The Real Wow Factor - by ex-Procter & Gamble executive Bill Peace, who was there for more than 30 years until his 2007 retirement. The book covers a lot more than just ECR, to be clear.

The reality is I have had this book sitting around for a number of months now since Peace sent me a copy earlier this year (one of the perks of the being a supply chain media person), and I kept meaning to write a review, but never quite found the right week to do so. That week is now, and I found the book quite worth the fast read that it is, though I wished for a little more detail in one area.

| GILMORE SAYS: |

"One critical element of the CDSN concept - very similar to how Dell would position its supply chain "velocity" model in the late 1990s - was that the goal from this supply chain initiative was not as much about cost savings as it was expanding P&G's markets."

WHAT DO YOU SAY?

Send us your

feedback here

|

The book itself is a bit of a hybrid,part supply chain history as told through the great advances Procter & Gamble made over time for itself and the consumer goods to retail industry, part text book not so much for traditional students as current supply chain professionals (there are many powerpoint type charts that have/are being used by Peace in his still active teaching efforts), part motivational work to get your supply chain moving to capture the potential that is still there for so many companies, whether in consumer goods or other sectors.

Though he might have chosen a different title, given, as I have discovered by searching, there are a large number of books out there with a name like "The Wow Factor," the idea here is very simple. The way to "wow" both retail and end consumers is generally not so much about fancy marketing and other more transient tactics, but through a focused supply chain effort totally integrated with the rest of the business, built "from the shelf back," focused on consistency of performance and value delivery. Easy to say, but harder to get there for sure. That "how" part of the equation is what the book aims to teach.

Two quick observations before some detail from the book:

(1) This work reinforces my opinion, while impossible to prove or measure, that Procter & Gamble is really our leader in supply chain performance. P&G has simply been central or in fact the pioneer in creating supply chain concepts and practice from the Bullwhip Effect to ECR , Continuous Replenishment, "demand driven supply networks," and more to a degree to which no one really holds a candle to the company in this regard. I don't believe anyone else really pushes the envelope in terms of continuous supply chain process improvement the way P&G does year after year, though certainly its competitors have learned some lessons and made great strides themselves over the past decade. Nevertheless, catching P&G is a formidable challenge. (1) This work reinforces my opinion, while impossible to prove or measure, that Procter & Gamble is really our leader in supply chain performance. P&G has simply been central or in fact the pioneer in creating supply chain concepts and practice from the Bullwhip Effect to ECR , Continuous Replenishment, "demand driven supply networks," and more to a degree to which no one really holds a candle to the company in this regard. I don't believe anyone else really pushes the envelope in terms of continuous supply chain process improvement the way P&G does year after year, though certainly its competitors have learned some lessons and made great strides themselves over the past decade. Nevertheless, catching P&G is a formidable challenge.

2. Despite my friend Ralph Drayer's critical role in its development at P&G (along with Peace, whom I don't know, and others), I have always had mixed feelings relative to ECR with regards to the real impact it had on the industry, which is debatable. Reading this book, however, one is hard pressed to come away without feeling that ECR simply worked magnificently at P&G (as Drayer has presented many times), and that the so-so performance improvements it resulted in overall was simply due to the failure of other companies to execute on the vision the way that P&G did.

We started hearing about "demand-driven supply networks" from AMR Research (now Gartner) in about 2004, but the concept largely came from P&G, which was executing against its "consumer-driven" supply network" (CDSN) vision in the mid-late 1990s.

That effort was directly connected to P&G's earlier work on the continuous replenishment process (CRP - sorry for all the acronyms, but it's unavoidable), which at a high level meant P&G would trigger retail shipments based on actual data about what customers were buying in stores and what product was leaving the retailer's warehouses, rather than the guesses and unpredictable ordering patterns of retail buyers that rules before then.

Continuous Replenishment is one of SCDigest's Top 10 Supply Chain Innovations of All-Time, and after some success at some smaller retailers, P&G eventually "sold" the practice to Sam Walton and WalMart, changing supply chains and indeed the world from the success that followed.

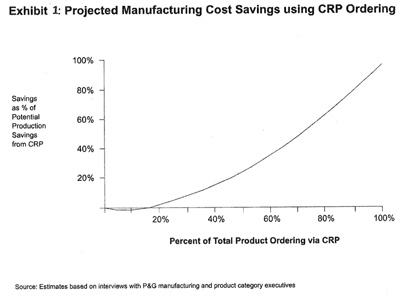

I liked this chart from the book, which shows the increasing rate of savings that are achieved (much more than linear) as the percent of business between two companies using the CPR process increases. I think this is probably true in almost every sector, not just consumer goods to retail.

View Full Size Image

Peace says that getting to CDSN status is all about designing the entire supply chain from the end customer back and "converting from three separate pipes - information, cash and products - to a continuous loop," and certainly the results of P&G's efforts here as reported were outstanding: something like $1 billion in incremental sales as it grabbed market share; nearly a 50% reduction in inventory; 20% or so lower supply chain costs, etc.

One critical element of the CDSN concept - very similar to how Dell would position its supply chain "velocity" model in the late 1990s - was that the goal from this supply chain initiative was not as much about cost savings as it was expanding P&G's markets, and that much of the savings that are in fact realized need to be ploughed back into lower prices to create a virtuous cycle of savings, market share gains, further savings based on increased scale, etc.

It's a good discussion, but I wish Peace (like many others before him) would have been a little more descriptive in how processes really change as a result, and what really makes CDSN different from more traditional approaches to the supply chain. What does it really mean to build a supply chain from the shelf back?

In support of my earlier contentions about the quality of P&G's supply chain, CDSNs - not yet truly implemented at many companies - is now at least two initiatives old at P&G. Next after CDSN success was a program around joint value creation through supply chain initiatives with its customers, involving high levels of collaboration with retailers, joint plans and strategies, and a direct sharing in the rewards of resulting initiatives.

Finally, in the past five years or so, P&G began even more formally and successfully linking its supply chain strategies and capabilities with its customer go-to-market plans, with a resulting "commercial plan" for each product area that links product strategy, marketing, finance and more with the resulting supply chain plan. Most of us do this in some form or another today, but I believe P&G is out in front in its level of sophistication here.

One key theme of this book is simply the power of supply chains to drive the business, not just keep costs low. Clearly, not all companies - and in fact likely a minority of them - really do think this way. It is a powerful platform when embraced.

A few years ago, one P&G supply chain executive told me they were working some strategies that would figuratively "make the VP of supply chain at Colgate-Palmolive want to jump out a window." Don't know if that plan has been released yet (have heard of no tragedies in Manhattan), but it is simply emblematic of the way P&G thinks. The book does an excellent job of capturing that in many dimensions.

Any reaction to Gilmore's review of The Real Wow Factor? Do you think many companies truly run their supply chains as Procter & Gamble does? Do many consumer goods companies still have a long way to go in this thinking? Are there lessons here for companies in other sectors? Let us know your thoughts at the Feedback button below.

|