Benchmarking ASN Performance in Retail

Compliance Networks has again sponsored research by Auburn University's Brian Gibson on the state of Advanced Ship Notices (ASNs) from vendors in the retail supply chain. The report, soon to be released, takes a fresh look at the topic after previous research by Gibson in 2010.

Here is a preview of some of the findings:

Supply Chain Digest Says... |

|

| There were many stories of the CEOs of vendors turning irate when they saw their company's low score on the display when making a call on Circuit City. |

|

|

|

Tied to serialized, case-level bar codes (or RFID), ASNs can

have a big impact on supply chain performance. It can enable

improvements in receiving productivity in a distribution center

of as much as 40%, for example.

ASNs also provide forward visibility to incoming shipments that allow for pre-planning inventory allocations. That can be at a store-level through fulfillment at a given DC, but increasingly in an Omnichannel world those allocations for offshore goods can be made as merchandise arrives at US ports.

Visit the Retail Vendor Performance Management home page to learn more

and subscribe to the monthly newsletter.

As will everything these days, Omnichannel is in fact raising the stakes in getting ubiquitous, highly accurate ASNs.

One retailer told Gibson for the study that "It's critical that you have high levels of in-store inventory accuracy. Ship-from-store order allocation is driven by whether or not I think the inventory is in the store. If it's not, we negatively impact the guest."

More details coming soon, but this year's study found that about 28% of retailers had ASN compliance with over 95% of their vendors. Another 24% had 90-95% vendor compliance, with 20% seeing 80-89% of vendors on ASNs, and finally about another 28% had less than 80% of vendors ASN compliant.

Interestingly, 18.5% of retailers audit 100% of their inbound vendor shipments for ASN accuracy.

More on this soon as the full report is released.

Circuit City Tries Another Comeback

Retail veteran Ronny Shmoel and a partner plan to revive the Circuit City retail brand for the third time, with plans for 50-100 store openings in the next year, probably starting in Dallas. Circuit City closed all its stores in 2009 after filing for bankruptcy

But the stores will be scaled down from the large electronics outlets for which Circuit City was once known, with reduced footprint physical stores selling smaller gadgets, such as gaming accessories, printers, and tablets. Shmoel believes millennial consumers will actually take the time to visit a brick-and-mortar store to quickly grab a small device.

Beyond the general interest of this retail news, we mention it because in its last incarnation Circuit City was known for displaying the performance grades of its suppliers in the lobby of its headquarters building at the time in Richmond, VA.

There were many stories of the CEOs of vendors turning irate when they saw their company's low score on the display when making a call on Circuit City.

We're not aware of any other retailer employing this tactic, but it is surely one way of putting pressure on vendors to up their supply chain performance.

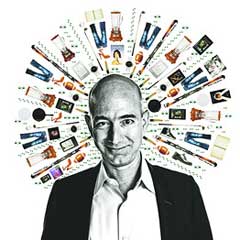

Keeping Up with Amazon

Marc Wulfraat, president of consulting firm MWPVL International, has become perhaps the industry's foremost expert on Amazon.com's logistics strategies. In a recent column for SCDigest, he noted that "Last year Amazon quietly rolled out no less than 43 smaller urban facilities (Prime Now Hubs & Fresh Delivery Stations) in the United States with the goal to enable delivery to your doorstep in 60 minutes or less."

He added, "This is just the tip of the iceberg as the company is only getting started on its national quick response assault Amazon's main weakness is that it doesn't have any stores for people to shop at but they are quickly working on eliminating this barrier."

Wulfraat estimates that in 2016-2017 Amazon will open 7.2 million square feet of new fulfillment center space in the U.S. alone. He also notes that "Amazon is now heavily investing in transportation, ultimately in our opinion, to enable complete independence from UPS and FedEx," including, it appears, building air freight capabilities out of the old DHL hub in Wilmington, OH. Wulfraat estimates that in 2016-2017 Amazon will open 7.2 million square feet of new fulfillment center space in the U.S. alone. He also notes that "Amazon is now heavily investing in transportation, ultimately in our opinion, to enable complete independence from UPS and FedEx," including, it appears, building air freight capabilities out of the old DHL hub in Wilmington, OH.

He says other retailers should stop and think about the implications of this because they are big.

"Any Amazon customer placing an order for any SKU that is not available within the closest fulfillment center can now have their order picked, packed and shipped from any of the other 63 US fulfillment centers in the Amazon network and can receive delivery of that SKU within 24-48 hours," Wulffraat wrote. "Amazon will simply move packages onto planes for shipment to the Wilmington sortation center where they will be sorted by fulfillment center and then shipped on the same planes as they return to their home airports."

He further notes that "speed to market and quick response will increasingly emerge as a paramount competitive weapon and that this phenomenon will be most pronounced for, but not limited to companies serving customers at the retail end of the supply chain."

Surely vendor performance, and thus performance management, will be a critical aspect of success in this new fulfillment world.

Your Comments/Feedback

|