Watson Says... |

|

| ...accounting costs can fail you if you are looking to maximize your overall profit. Instead, the value of the assets depends on how you use them. |

|

What do you say? |

|

| Click here to send us your comments |

|

|

|

One of the examples shows that accounting costs can fail you if you are looking to maximize your overall profit. Instead, the value of the assets depends on how you use them. (This, by the way, is very similar to the lessons from Eli Goldratt’s The Goal where they realize the value of better using the time at the bottleneck to increase profitability.)

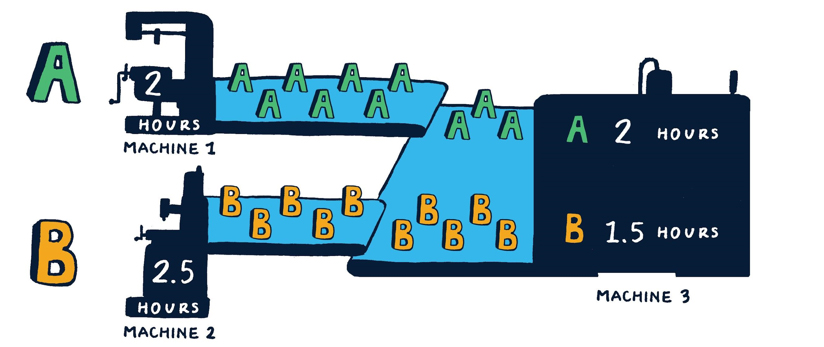

In this example, we have a simple factory that makes 2 products, A and B. The products each go through two different steps. Product A goes to Machine 1 (M1) first and then Machine 3 (M3). Product B goes through Machine 2 (M2) first and then on to M3. The diagram below shows the the routings and shows that both products need a total of four hours of processing time.

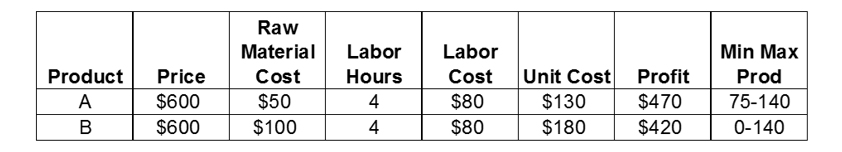

The table below shows the price the items are sold for, how much raw materials go into each, how much labor goes into each and the accounting profit of each product. The last column shows some monthly market constraints. No matter what, you can only sell 140 of A or B per month. And, for A, you have a minimum contractual requirement to make at least 75 per month. We are assuming 336 hours of time per month.

When you look at this data from an accounting viewpoint, it is very clear that Product A is more profitable ($470 vs $420). So, a natural plan would be to make as much A as possible and use remaining time to make B.

So, the plan that optimizes based on accounting data leads to producing 140 of A and 37 of B. This leads to a gross profit of $81,340.

However, if you better use the bottleneck asset-- Machine 3, you can come up with a plan to make 75 of A and 124 of B. This leads to a gross profit of $87,330 (a 7% increase). In this simple problem, you can find the solution by trial and error, but for larger problems linear programming can be used to find the solution.

What is the Intuition Behind this Solution?

If you look at the bottleneck resource, you notice that A takes longer on M3 than B. So, in this problem, if you look at profit per hour on the bottleneck A’s comes out at $235 ($470/2) and B at $280 ($420/1.5). You can then see that using M3 to make more B is a strategy that better uses the bottleneck and leads to more profit for the company.

Final Thoughts

In this simple solution, the profit per hour at the bottleneck is a good measure. However, for more complicated problems, linear programming is a key way to find solutions that best use the resources you have.

Any reaction to this Expert Insight column? Send below.

Your Comments/Feedback

|

|

Erik Lopezmalo

Sr. Operations Research Analys, Land O' Lakes |

Posted on: Mar, 10 2017 |

|

| Great article. This is a simple problem that exemplifies an optimal business decision that I've found hard to convey to stakeholders because it is not intuitive. The bottleneck measure question I usually use for them to understand is what product to make with the last unit of capacity (time/tons, etc) in your bottleneck asset. Cheers! |

|

|