|

September 27, 2012 - Supply Chain Newsletter |

|

FEATURED SPONSOR - CPS Advisors |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

Where do We Stand in Supply Chain Execution Tech?

|

| GILMORE SAYS: |

"Companies have a vision for a much more integrated approach to SCE in the not too distant future." WHAT DO YOU SAY? |

That is kind of interesting at several levels. First, the term never really much caught on with actual companies. SCE tended to be more used by the analysts, software vendors, consultants, etc. than practitioners.

Yet, if not SCE, then what? "Advanced Planning Systems" (APS) or just supply chain planning is of course widely used in companies, so it does seem we need some companion term for the execution side of the supply chain house.

Some companies might refer to "integrated logistics" or just logistics software, but I think the fact that some more general term for these applications as a whole is largely lacking is indicative of the fairly fragmented way that most companies have cobbled together those solutions. It occurs to me that there is sort of a natural flow of how planning has to work (demand plan, supply plan, inventory deployment, etc.), leading to a sort of holistic view of the software needed to support those processes.

But it just hasn't really gelled that way on the execution side. So since the best we have is Supply Chain Execution, we are going to stick with that here. And that in fact was part of the title of our just completed report on Supply Chain Execution Technology 2012, a benchmark study by our Chief Supply Chain Officer (CSCO) Insights research arm we hope to repeat each year, with a few improvements already in mind for 2013. You can download a copy here: 2012 Supply Chain Execution Technology Benchmark Report (please note technology consulting firm Cognizant funded the research, so the report is on its site - very simple form to download).

This week, I am just going to summarize a few of the highlights, including a small number of the many charts in the report, based on survey data from more than 300 respondents (thank you).

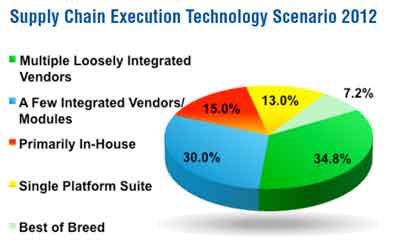

First, in support of my contention that most companies tend to have very fragmented SCE technology portfolios, consider the following, which asked respondents to describe their current technology scenarios:

As can be seen, just 13% say they have a single platform suite.

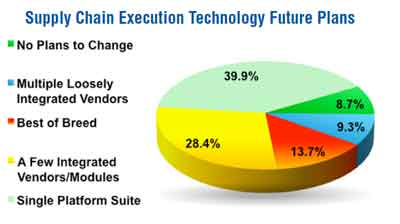

But companies have a vision for a much more integrated approach in the not too distant future. When we asked respondents where they hope to be over the next few years, a very different picture emerges, as shown below:

As can be seen, now nearly 40% say they plan to adopt a more unified, single vendor platform suite. Will they get there? That is another question of course, but you can see the intent. More on this "platform" concept in a few paragraphs.

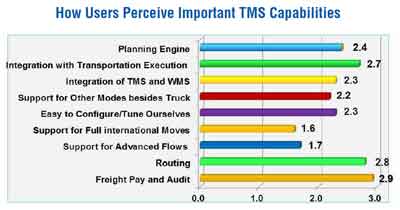

We also took a deep dive in several areas. For example, we asked respondents to rate the capabilities of their current TMS on a scale of 1 to 5 (1 being the lowest, 5 the highest) across a number of specific functionalities. I don't actually ever remember someone doing this before.

The results are shown below.

In general, the overall satisfaction is mediocre. Just a few categories made it over the mid-point of 2.5, with "freight pay and audit" and "routing" leading the way (two pretty basic functions), while "support for full international moves" and "support for advanced flows" such as cross docking and intermodal had the lowest rankings. Anyone that knows the TMS market should not be surprised by that result.

We also did the same sort of thing for WMS in the report.

One key trend among several we call out in the report is this SCE platform trend. First, not only have a number of vendors really started to get this right (i.e., deep integration across the suites), but companies are increasingly thinking about how building such a platform can drive real benefits in terms of flexibility down the road.

Please take a look at the Full Report. There is quite a bit of good stuff in it.

Do you like or use the term Supply Chain Execution? If not, what's the alternative? Do you think we will see more companies truly adopt integrated SCE platforms? Let us know your thoughts at the Feedback button below.

![]()

| View Web/Printable Version of this Page |

|

|

|

YOUR FEEDBACK

We received a few goods letter on our recent First Thoughts column on The Coming Era of Perfect Logistics.

That includes our Feedback of the Week from David Schneider, who says Perfect Logistics is a nice theory, but maybe not much more than that. Gilmore says he will answer that claim, as well as some others, very soon.

Feedback of the Week: On Perfect Logistics

Perfect Logistics across the entire Supply Chain is a "nominal concept," a place that exists in name only. The place does not exist. It is a state of mind, like seeking nirvana, where the journey to enlightenment will still be highly rewarding for those to embark on it. The examples in your article, and where Perfect Logistics will come the closest, is in tightly controlled links. When the process crosses entity lines, between businesses, the concept of perfection will be subject to the financial, technological and cognitive resources of each of the links. Some links will be very strong, others not. The variability of performance will be directly related to the level of commitment to perfection a player's management team makes. Finally, Perfect Logistics runs into the immutable brick wall of the Law of Diminishing Returns. We can get near perfect, but the price is quite high. There is always a point that the cost to get that last degree of perfection is beyond the resources of the component companies. Costs may drop and new technology developed, but imperfect man will still be involved in the equation. Every time you make something foolproof, a new and improved fool arrives. And all of us get to go to work to solve the new and improved problems. David K. Schneider |

||

More on Perfect Logistics:Would you define perfect logistics by the logistics decisions and execution that were taken based on information available at a point of time? Colin Pereira |

||

I think you have extremely well articulated a sense many of us in supply chain are starting to sense, but which we haven't yet given much voice to. Andrew Helferidge |

SUPPLY CHAIN TRIVIA ANSWER

Q:What percent of US GDP is generated by exports?

A: About 12%. China's figure is about 39%, while Germany has a remarkable 50% of its GDP from exports.

| © SupplyChainDigest™ 2003-2012. All Rights Reserved. SupplyChainDigest PO Box 714 Springboro, Ohio 45066 |

POWERED BY: XDIMENSION

|