From SCDigest's On-Target E-Magazine

- Oct. 9, 2012 -

Logistics News: Our Review of the Annual Third Party Logistics Study

Those Planning More Outsourcing Almost Triple Percent Favoring Taking More Work Back in House; 3PL IT Gap Continues

SCDigest Editorial Staff

As always the annual third-party logistics (3PL) study was released last week at the annual CSCMP conference in Atlanta, an effort led for the 17th consecutive year by Dr. John Langley of Penn State University, with support from Capgemini, Panalpina, eyefortransport, and Korn/Ferry International.

SCDigest Says: |

|

| The report notes that "It's possible that 3PLs are not fully informing shippers about their IT capabilities. However, it is more likely that shippers are seeing what they have and finding it lacking." |

|

What Do You Say?

|

|

|

|

The dataset grew this year to more than 2000 responses from shippers (both 3PL users and non-users) and 3PLs, with the data being collected earlier this year. We summarize key findings below.

The 3PL industry had a robust year globally in 2011, with total revenues up 13.7% to $616 billion from $541 billion in 2010. In North America, growth was slower at 7.2%, while spending on 3PLs soared 43% in Latin America, according to numbers cited in the report compiled by Armstrong & Associates.

The study data supports anecdotal evidence that use of outsourcing for logistics is increasing, with 65% of shipper respondents saying they are increasing their level of existing outsourcing (about the same as the past two years of the study), versus just 22% saying they are bringing more logistics activities back in house. What is interesting is that 3PLs themselves see higher levels of insourcing, with 37% saying they are seeing more shippers bring work back internally.

Again supporting anecdotal evidence, the survey also found 58% of shippers globally are trying to reduce and consolidate the number of 3PLs they use. A specific figure for North America was not broken out.

In general, satisfaction on both sides of the relationship is high, with 86% of shippers and 94% of 3PLs saying that their outsourced relationships are generally satisfactory, though we might note that "generally satisfied" does not imply shippers and/or 3PLs don't see a lot of room for improvement.

We will note that also a the conference, the general manager of the Dell Outlet business unit was finding great stress in a traditional 3PL arrangement, eventually moving to a "vest outsourcing" approach and achieving big results. That story soon on these page.

Along the same lines, just 63% of 3PLs are satisfied with the openness, transparency and communications in their relationships with shippers, versus 71% of shippers who feel that way.

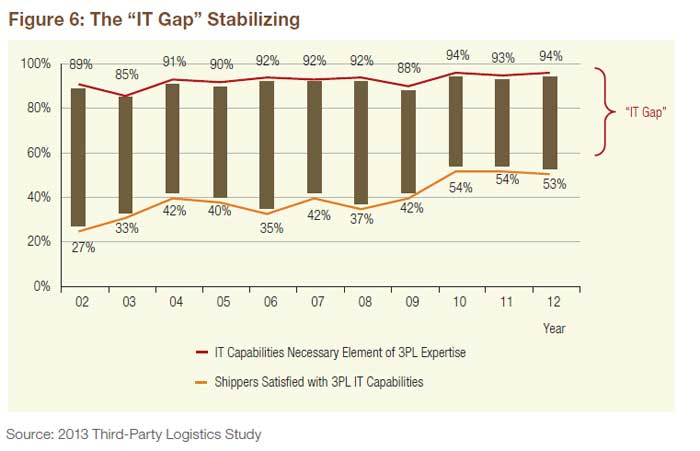

And shipper satisfaction with the technology capabilities with of 3PLs is still somewhat wanting, with three straight years of satisfaction levels of just about 53%, though that is a big jump from levels seen in 2009 and before. (See graphic below.)

Source: 3PL Study 2013

This despite the fact that many 3PLs have made significant investments in technology in recent years, and certainly among the larger providers often if not usually have access to the same sorts of leading commercial packages as have been deployed by shippers.

So why the gap? That is not clear. The report notes that "It's possible that 3PLs are not fully informing shippers about their IT capabilities. However, it is more likely that shippers are seeing what they have and finding it lacking."

(Distribution/Materials Handling Story Continues Below

)

|