From SCDigest's On-Target E-Magazine

Sept. 19, 2012

Logistics News: Truckload Driver Turnover Exceeds 100,000 for First Time in Four Years, Fanning Fears Over Looming Driver Shortage

Is the Big Crunch Really Coming Soon?

SCDigest Editorial Staff

The American Trucking Associations quarterly analysis of truck driver turnover was released last week, and showed the metric among large truckload carriers (those with revenues over $30 million) exceeded the 100% level for the first time in more than four years.

SCDigest Says: |

|

| In their second quarter earnings calls, a number of large public truckload carriers sounded warnings on the growing shortage of drivers - as they have been doing for a number of consecutive quarters.. |

|

What Do You Say?

|

|

|

|

AThe turnover rate in TL of 106% was the highest level since the fourth quarter of 2007, and the first time the metric has been over 100% since the first quarter of 2008. The measure was 88% in Q1, and as low as just 50% in Q3 of 2010.

The news isn't as bad as some media outlets have been reporting, in which it was noted that this is the equivalent of a carrier turning over its entire driver pool in a single year.

The reality is that the vast majority of the turnover comes from new hires who decide they don't want to drive a truck for a living. When the failure rate of those new drivers is high, it can send the overall turnover rate soaring even if most long term drivers remain on the job.

The news is nonetheless worrisome given many recent predictions that the US trucking industry could face a huge driver shortage over the next two to three years, playing havoc with capacity and rates in the industry.

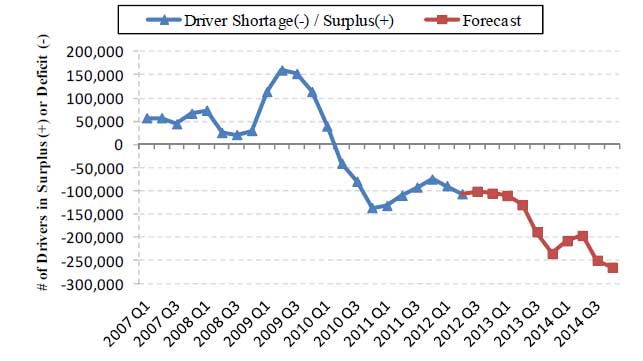

As recently as 2010, there was a driver surplus is the US, although a small one, as shown in the chart below from FTR Associates.

Now, there is a shortage of some 100,000 drivers, with the likely potential that the shortage will reach 250,000 by the end of 2014. That would put the shortage at about the same levels seen in 2005, when there were substantial capacity issues in the industry.

In their second quarter earnings calls, a number of large public truckload carriers sounded warnings on the growing shortage of drivers - as they have been doing for a number of consecutive quarters.

US Driver Shortage Expected to Become Severe

Source: FTR Associates

(Transportation Management Article Continued Below)

|