From SCDigest's On-Target e-Magazine

Sept. 8 , 2011

Supply Chain News: Can Commodity Prices Continue to Soar Amidst Weak Economic News?

Some Predict Prices for Metals, Agricultural Goods Headed for Big Fall, but Others Note China Keeps Buying, Food Demand Outstrips Supply

SDigest Editorial Staff

IFinancial market watchers have been noting an unusual phenomenon: given economic weakness across the globe, banking and financial turmoil in Europe, fears of a "double dip" recession in the US and Europe, and a dropping stock market, the prices of most commodities are still surging, with many near historically high levels.

In general, both stock and commodities prices move roughly in tandem, especially relative to economic data, where a slowdown in growth generally sends both stock commodity prices headed south.

SCDigest Says: |

|

So who is right, those that see a big disconnect between economic conditions and rising commodity prices, expecting a big crash fairly soon, or those say a variety of factors will keep pushing prices higher?

|

|

What Do You Say?

|

|

|

|

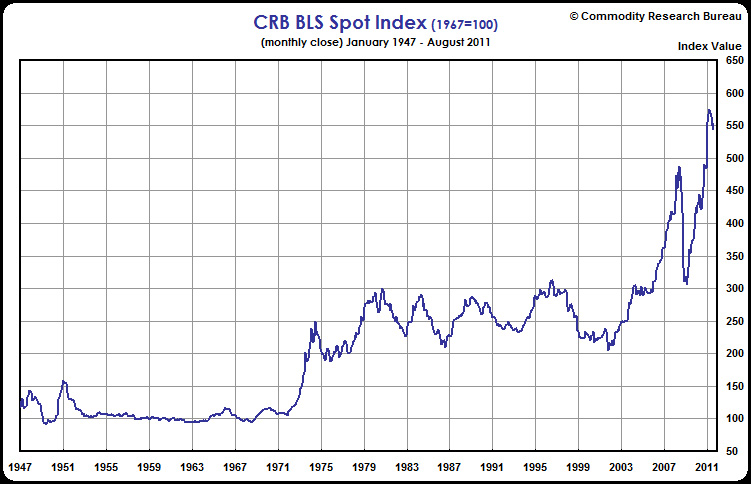

But not so right now, with stocks reacting negatively to the worrisome economic news, while commodity prices for the most part keep jugging along, with slight signs of modest weakness recently, but in general remaining in an upward trend (see graphic below).

Global food prices in July hit the highest levels ever recorded, for example, with staples such as wheat and sugar a third more expensive than they were a year ago, and some categories up even more. Company after company continues to cite rising inputs costs as a key factor challenging their bottom lines.

"Never before have we seen commodity prices so high when prospects for global growth appeared to be so weak," wrote Daniel Dicker of theStreet.com last week. He notes that many economists claim we are already in another recession, and that recessionary conditions are almost never accompanied by screaming commodity prices, as we are seeing now.

How can this be? A couple of potential answers. One is that as global stock markets struggle, many investors are putting their money into commodities instead of stocks, not only pushing commodity prices up for companies, but becoming something of a self-fulfilling prophecy, as additional investors keep coming into commodities, creating more demand that continues to send prices higher.

In a similar vein, many as usual are pointing to the role of "speculators" as driving up commodity prices far beyond where they would be based on "fundamentals" alone, or basic supply and demand.

Earlier this year, a report from the Bank of Japan noted that "the increasing share of investors who are less concerned about the fundamentals of each commodity has diluted the link between the return on commodities included in the major indices and supply-demand fundamentals. Given such evidence, the "financialization: of commodities has caused commodity prices to diverge from the level explained by fundamentals."

That's a mouthful that in the end says that speculators are having an increasingly important role in how commodities are priced, and supply and demand less so.

The CRB Index of a Basket of Various Commities Shows the Steep Rise in Prices

Since the Bottom of the Recession

As an example of that, Dicker notes that right now, prices for many commodities such as copper, corn and others, are more expensive in the short term than they are priced for futures contract four months out. That's in part a sign of the role of short term speculation, and also a condition that in the past has been associated with sharp drops in commodity prices down the road.

In Dicker's view, "the prices we are seeing in these commodities are overextended and destined to crash." That may be bad for speculators and producers but good for companies procuring these commodities directly or indirectly. A coming major drop in most commodity prices would of course also impact corporate procurement strategies, causing them to be more hesitant to lock in prices through contracts now if a sharp drop is around the corner.

(Sourcing and Procurement Article Continues Below) |