From SCDigest's On-Target E-Magazine

Feb. 8, 2011

Logistics News: Fourth Quarter and Full Year Quite Good for Rail Carriers, but LTL Sector Continues to Struggle

Core Rates up 5.5% in Q4, Union Pacific Says; LTL Carriers Still Struggle to Make a Buck - is this Good or Bad for Shippers?

SCDigest Editorial Staff

By most measures, the US has certainly started to see recovery in the economy, which has led to modest increases in freight volumes as a whole, though the path to both economic and freight recovery has been rocky.

The improvement in freight volumes, in turn, has led to improvement in rates, revenues and profits for most sectors of the transportation market, as the 2010 numbers that have come in for the fourth quarter of 2010 continue to show. Last week, for example, we took a look at the Q4 and full year 2010 results from the truckload industry, which showed in general (See Q4, All of 2010 Much Better for Truckload Carriers, but Data Show Divergent Performance.)

This week, as promised, we do a similar review and summary for two other transport sectors: rail carriers and the less-than-truckload (LTL) segment.

SCDigest Says: |

|

| Rail carriers had strong profitability, up 30-69% for the quarter across the group, and similar increases for the full year. |

|

What Do You Say?

|

|

|

|

Before getting to that data, SCDigest notes that it was interesting to compare the financial reports across the three sectors we have reviewed. Clearly, the truckload segment offers by far the most detailed management commentary relative to results, strategies and projections. The rail and LTL carriers say little or nothing in those areas, so that unlike as we did last week for the truckload numbers, we cannot provide snippets of similar interesting comments for the rail and LTL executives, as they didn't offer any.

Rail Carriers Bounce Back Strong

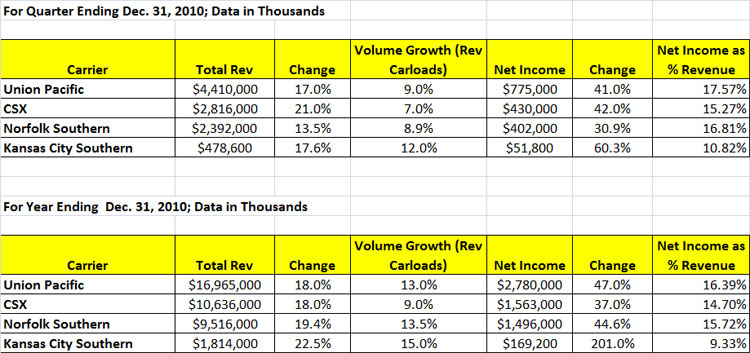

The rail carriers held up best of the three sectors during the global recession and freight "depression," in large part because of continued pricing power, but were still able to rack up impressive results for Q4 and all of 2010, as shown in the chart below.

Q4 rail revenues of the publicly traded carriers, which now exclude Burlington Northern since it was acquired by Warren Buffet's Berkshire Hathaway Corp. last year, went much higher, from 13.5% on the low end from Norfolk Southern to a 21% gain at CSX. For the full year, revenues were up at least 18% for all four US major publicly traded rail carriers.

Rail volumes not surprisingly were strong up for both the quarter and the year, rising between 7 and 12% in Q4 depending on the carrier and 9 to 15% for the year. In both cases, that was substantially below the equivalent gains in revenues, indicating the rail carriers were able to substantially increases rates throughout 2010, even allowing for some impact from increase fuel surcharge revenues.

Union Pacific, for example, said in its earnings call that "core pricing" for Q4 was up 5.5%.

That in turn led to the carriers to strong profitability, up 30-69% for the quarter across the group, and similar increases for the full year.

Source: SCDigest Analysis

Equally impressive is the rail carriers' net income as a percent of total revenue, which in general was in the mid-teens for both the quarter and the year.

(Transportation Management Article Continued Below)

|