|

March 8, 2012 - Supply Chain Newsletter |

|

This Week In SCDigest

FEATURED SPONSOR: RedPrairie |

Report Available For Download: |

Supply Chain Metric Strategies and the 50 Percent Problem Since I do not see massive turnover in the supply chain ranks, I assume most companies/managers are in fact hitting their targets fairly consistently. Yet, there are a lot of companies overall that are underperforming in the supply chain versus their competition, and study after study has shown a large (and in many cases growing) gap between top and bottom performers.

My logical conclusion therefore was that either those companies are: That column generated quite a bit of excellent feedback, enough so that if we get a few more good responses today (hint, hint) I can probably put a "Readers Respond" column together on this, one of my favorite things ever, since it means I don't have to work too hard that week.

Now, clever readers may have seen that this whole line of thinking is just another side of what I have called the "50 Percent Problem." What is that, you ask?

It is the absolute fact that a strong majority of companies and managers almost always think that there performance is better than average, when in fact by definition half must be below average.

I noticed this first when I was back doing real work for a living, and company after company I was trying to help sell something to or offering my advice and counsel would invariably say something like "We may not be the very best in [put your area/metric here], but we are probably in the top 20%." Almost every time.

There were two exceptions. One is when a new executive took over, and he or she might talk about all the problems they were inheriting, and what needed to be fixed. Come back a year later, and they will have been miraculously solved.

The other was when a company was angling for funding for new supply chain technology, and naturally enough the argument goes we can't compete without, and implicitly or explicitly fesses up a bit when showing where they are now versus where they can get to with the improved software or hardware.

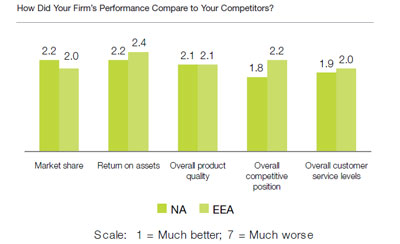

That somewhat anecdotal evidence has since been support more quantitatively many, many times since then, based on how companies respond to various studies. Below is an example I used on this topic in 2009. This data came from the well known Trends and Issues in Transportation and Logistics study presented each year at the CSCMP conference. You will note the mean/average response from companies rating themselves against the competition across all four of these categories, on a scale of 1-7, is right around 2.0; whereas, in fact, the mean ought to be around 3.5. If it was 3.2 or something, I would say fine, but from a statistical perspective (and this report had 800+ survey respondents), average scores near 2.0 are simply totally out of whack. Like the parents of the children in Garrison Keillor’s Lake Woebegone, everyone believes they are well above average. I have seen many other studies showing the same type of result time after time. And how can this be? The natural and maybe unavoidable tendency we almost all have of thinking we are better than we are in our personal and business lives is surely at work. But could it also be that we think we are performing better than average because, going back to the initial point above, that we are consistently hitting our goals and objectives? Maybe so. If there was a way to actually get at goals and KPI targets across companies, I suspect that it would look much like a bell curve. And the KPI curve naturally enough becomes the performance curve as well, does it not?

Another Perspective

My thoughts on metrics targets being set too low as a key factor in the supply chain performance differences between companies came upon me a couple of months ago, and somewhere along the line I bounced the idea off my friend Dr. Jim Tompkins, CEO of Tompkins International. He largely agreed with me, but as usual had his own unique perspective on this. He said companies can come at metrics from three levels:

In support of my overall argument, Tompkins told me that the process often works like this: transportation costs are going up at Acme Inc. Directives to reduce transportation costs are issued. The director of transportation suggests and agrees to goals in some area that seem directly related to transportation costs that he or she is highly confident can be obtained and which will seem to indicate that real improvement has been made. The point is that maybe these targets should have been in place at the beginning. And that focusing on some specific measures may actually cause problems in other areas or not really get the company where it wants to go. Tompkins says it is critical that KPIs should "get the right focus on "the big things,” and that too often, supply chain KPI’s tend to look only a "the small things." "For example, a DC Manager gets given the goal of shipping 98% or all orders on time. The on time definition in the company is if the orders are in by 4PM they must go the same day," Tompkins said. "The DC Manager accomplishes the goal of 98% but the customer expectation is not the same day shipment and the way the DC Manager accomplishes the goal is by working 20% more overtime than budget. The result is the DC Manager gets a bonus for achieving their KPI, but the company does not hit budget. Etc." He says there are hundreds of examples of these types of broken KPI’s, and that it is the norm to see multiple, conflicting objectives. "We must guide organizations towards profitable growth and not towards some myopic view of short sighted KPIs," Tompkins added. So that is another view, and it's hard to argue that conflicting goals and KPIs could be at the root of the issue too. But I'll still argue the 50 percent problem is alive and well, and that companies need to do more benchmarking to better understand where their targets should really be set. |

|

||||||||||||||||||||||||||||||||||||

Upcoming Videocast:

The Real Deal in WMS Selection

Seven Smart Moves to Enhance Your Success in Getting the System and Results that are Right for You

Featuring John Pearce, Founding Partner & Principal, StoneCross Group; Steve Hopper, Founding Partner & Principal, StoneCross Group; and Joel Stachowski, Strategic Sales Executive, Infor Global Solutions

New On Demand Videocast:

Operations Rules for Driving

Business Value & Growth

Part 1: Mitigating Business Risks from the Known-Unknown to the Unknown-Unknown

Featuring Prof. David Simchi-Levi, Professor of Engineering Systems, MIT

who unveiled the Innovative New Supply Chain Risk Exposure Index

New On Demand Videocast:

Managing Risk in a

Multi-Tier Supply Chain

Look Beyond Tier One Suppliers to Lower Risk, Optimize Costs, and Enhance Resiliency

Featuring Tom Linton, SVP and CPO at Flextronics; Thomas Choi, Professor of Supply Chain Management at Arizona State University, School of Business; and Rich Becks, General Manager, High Technology at E2open

We received a number of letters on our piece saying that use of natural gas engines for both cars but especially trucking could substantially reduce the cost and variability of oil, gas and diesel (See Higher Oil and Diesel Prices - the Answer is Here.) We published a few of them this week, including our Feedback of the Week from Dr. John Hansen of the Supply Chain Management Institute, who says there may be some issues with our theory. More next week. Feedback of the Week: On Natural Gas Engines:

|

||

I suppose it's always easy to raise niggling objections to great ideas, but the key issue I recall from my days working in automotive air, fuel and emissions was the significant lack of consistency of natural gas as a product. This meant basically that vehicles had to be calibrated for their local supply; not a big problem for local buses or the private fleets mentioned in the article, but problematic for interstate commerce. John D. Hanson, Ph.D.

|

||

More on Natural Gas Engines:

|

||

Nat Gas Pricing is low now and diesel very high - opposite ends of the spectrum. Edward Blickstein

|

||

There is no match between the resources and consumption of natural gas that US has with Pakistan but this seems to be a dangerous path. In Pakistan, have a good network of CNG (Compressed Natural Gas) stations here in Pakistan and about 60% of transportation shifted on to CNG only to know that the natural gas is not sufficient. Since the CNG was a lucrative business and cheaper than petrol / diesel there was huge growth but now what we hear is that CNG stations will be closed for three days a week because natural gas for industrial and residential use is not enough. CNG station owners are going through tough times as government has asked them to open only three days a week, vehicle owners are also suffering as they have to run on petrol/diesel 3 days due unavailability of CNG and if its available there is long queue and wait to get your car filled up. Using of natural gas in transportation must be planned out properly to avoid demand/supply problems in near future. Syed Bokhari

|

||

SUPPLY CHAIN TRIVIA ANSWER

Q: How many of the top five US exports to China can you name?

A: 1. Soybeans; 2. Aircraft; 3. New and used cars; 4. Semiconductors; 5. Copper.

| © SupplyChainDigest™ 2003-2012. All Rights Reserved. SupplyChainDigest PO Box 714 Springboro, Ohio 45066 |

POWERED BY: XDIMENSION |