|

So, here we go again: Rising oil prices and especially rising gasoline prices (which appear to have risen more rapidly than the oil late) are now headline news in the general media again. We are feeling (again) some real pain at the pump, whether your filling up with regular gas or diesel.

Gilmore Says: |

Right now, there is a House bill in progress, known as the Natural Gas Act (H.R. 1380), that would offer subsidies to both nat gas truck purchasers and filling station developers to take the plunge. Right now, there is a House bill in progress, known as the Natural Gas Act (H.R. 1380), that would offer subsidies to both nat gas truck purchasers and filling station developers to take the plunge.

Click Here to See

Reader Feedback |

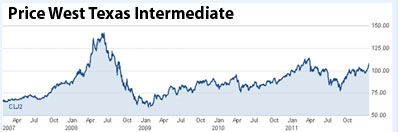

Oil prices are on the rise again, at the end of Thursday reaching over $108 for West Texas Intermediate and more than $124 for Brent Crude. Those are the highest levels since April 2011 (then $117 or so for WTI), which in turn were the highest levels since the surge to almost $150 per barrel for WTI in July 2008 (see chart below).

View Full Size Chart

As I wrote in April, we have simply become used to the once greatly feared $100 per barrel level. The mental shock for business and consumers is long gone, and both groups have reduced consumption where they can and are more prepared for this cost higher structure.

So, the question now is whether we'll settle here for awhile, then pull back a bit, keeping everything sane. Or whether this time, as in 2008, we just keep going higher. Some are predicting $5 gasoline by summer, but that seems crazy to me, barring an Israeli attack on Iran nuclear capabilities, which is certainly within the realm of the possible.

But regardless, we can bet with certainty that if oil and gas/diesel prices spike like that, it won't last long, because the hit to the economy will soon drive demand way back down, and prices will tumble again. That said, this $90-100.00 range seems like the new "higher low."

But here is the real thing: After some minor initial doubts, I am absolutely now convinced we can get out of this mess for good with a fairly simple and absolutely doable solution: Rapid adoption of natural gas-based trucks, and likely after that nat gas-based cars.

The idea of focusing on using natural gas to power freight trucks was by no means originated by famous oil man T. Boone Pickens, but his "Pickens Plan" for dramatically changing the US energy situation first released in 2008 brought the potential to the forefront. That plan called for sort of equal measures of government subsidies to spur a change from diesel fuel powered Class 8 tractors (and others) to new ones that use natural gas, and programs to drive electricity production from massive wind turbine farms from Texas through the upper Midwest.

I am still quite dubious on the windmills part of this solution, but am now totally sold on the nat gas trucks. Let's look at some facts:

-- The US has a lot of natural gas. An already abundant supply has been dramatically increased of late and moving higher from new development techniques (i.e., fracking) and the related opening of huge new potential shale-based fields, such as the huge Marcellus shale deposits in New York, Pennsylvania and Ohio.

In 2010, analysts from the respected IHS research organization said that "new natural gas plays[shale] have increased the resource base by more than 1,100 trillion cubic feet. This is an order of magnitude larger than the proved reserves recognized by the US Energy Information Administration (EIA) only two years ago."

And these reserves keep coming. We have enough natural gas to last for hundreds of years.

-- There are only two real issues with converting the nation's trucking fleet to natural gas usage: (1) the additional cost truck manufacturers (and hence carriers and private fleets) would bear to buy engines that run on natural gas; (2) A chicken and egg thing between the rollout of nat gas trucks and filling stations that can provide the fuel they need to keep moving.

When Pickens rolled out his plan in 2008, the difference in tractor costs between diesel and nat gas was about $65,000,which he wanted to return to companies buying natural gas tractors as a tax credit.

Today, the premium for a nat gas truck is just $35,000 - and falling. It probably can't get below $10-15,000 or so due to some differences in the fuel delivery system, but at that delta it becomes almost irrelevant given the benefits.

-- Right now, natural gas is very cheap. In November, the estimate was that the equivalent difference for operating a Class 8 truck on natural gas versus diesel fuel was a savings of at least $1.50 per equivalent gallon. That conveniently enough would deliver about a one year payback for the extra $35,000 cost for the natural gas engines ($1.50 per gallon times the 20,000 gallons the average truck uses per year). Since then, nat gas prices are about the same, while diesel prices have obviously risen.

-- Natural gas reduces equivalent greenhouse gas emissions by about 30%.

-- About one-third of oil use in the US is for diesel used in freight movement.

The delivery system issue is being addressed. A company called Clean Energy Holdings, for example, is rapidly building out a filling station infrastructure, planning to build a 150 new filling stations in 2012 - almost one every other day. That total will be roughly split between "highway" stations and others going into airports, trash truck companies, and other private fleet niches. That's on top of the 70 stations the company said it had at the end of 2011.

Some of those highway stations are or will be built to support trucking firms or private fleets. For example, if a manufacturer runs its trucks between a plant and various DCs, Clean Energy might provide filling stations to support that milk run. This is how these programs could start. Chicken and egg. When you start to reach some level of critical mass, it really takes off.

Right now, there is a House bill in progress, known as the Natural Gas Act (H.R. 1380), that would offer subsidies to both nat gas truck purchasers and filling station developers to take the plunge. It's just this simple: if this bill makes it into law, we will seeing an explosion of investments in trucks and stations.

To me, it's clear. The solution is here. And it is going to happen, I am absolutely convinced, barring some near suicidal barriers put on the move to natural gas trucks based on totally misplaced environmental concerns or some tsunami of oil industry money and pressure. The only question is how fast. Why not now?

Shippers, get behind the Natural Gas Act. We will reduce logistics costs, wild oil prices swings, the level of US (and Europe) oil imports and trade deficits, and realize many other benefits.

Is this not a no brainer?

Do you agree a rapid move to natural gas trucks could benefit the supply chain, the economy, and more? What are reasons you see for not making this move right now? Let us know your thoughts at the Feedback button below. |