From SCDigest's On-Target E-Magazine

- Nov. 27, 2012

Logistics News: Q3 LTL and Rail Carrier Results and Trends

YRC Seems to have Really Righted Its Financial Ship; Rail Carriers Sure Not Sharing Efficiency Gains with Shippers

SCDigest Editorial Staff

It's time once again for our quarterly review of the earnings reports and conference calls of major carriers, based on Q3 earnings calls that have just wrapped up.

Two weeks ago, we reported on truckload carriers. (See Logistics News: Q3 More Challenging for Truckload Carriers as Freight Volumes Slow.)

SCDigest Says: |

|

| None of the four rail carriers seems much interested (surprise) in sharing those gains in efficiency with shippers. |

|

What Do You Say?

|

|

|

|

This week, we look at the earnings, comments and trends among both less-than-truckload (LTL) and rail carriers.

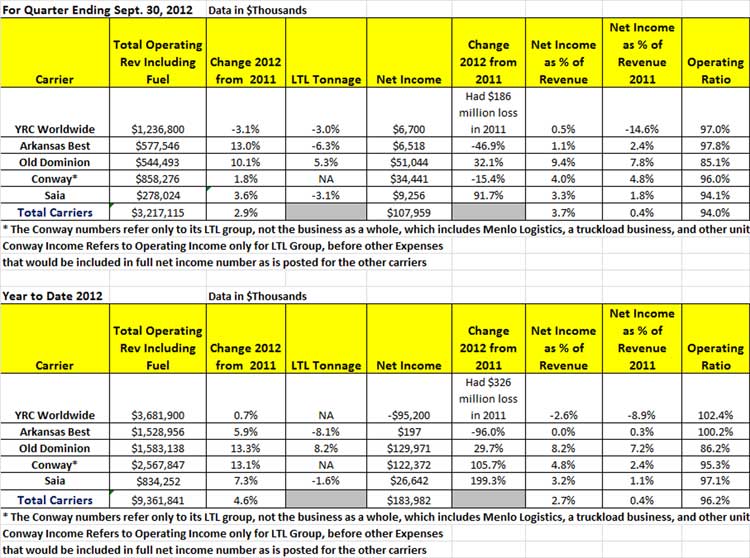

Below, we provide tables of third quarter and year-to-date results for our group of five large public LTL carriers. We also summarize some of the key or interesting points made by company executives during those earnings calls or press releases.

The biggest news is probably that YRC Worldwide does legitimately appear to be actually pulling out of its multiyear financial swoon, which came close several times to putting the company out of business.

YRC, the country's largest LTL provider, had a positive net income of $6.7 million in Q3. That may not sound like much on more than $1.2 billion in revenue, but is a whole lot better than the $186 million loss in had in Q3 2011, and marks the second straight quarter YRC has managed a profit from operations.

It certainly appears that the threat of a complete bankruptcy has greatly receded for now.

Operating ratios for our group (operating expense divided by operating revenues) continue to come down, with none of the five carriers we track showing ORs above 100% (a rarity in recent years).

Of course, Old Dominion keeps trucking along, with a OR of 85.1 for the quarter, about nine percentage points below its closest rival Saia. It also grew its tonnage another 5.3% in the quarter, and 8.2% so far this year, as Old Dominion continues to gain share, open new terminals, and deliver exceptional financial performance in a sector known for its tough economics.

Old Dominion's profits were up 32% in Q3.

The full year to date results are largely the same, as shown in the second chart below, but note that the operating ratios in Q3 are better than they are for the full year, indicating in part, as several of the carriers noted, a continued improvement in the rate environment. You will also find a link to full size image for easier reading provided below these charts.

LTL Carrier Q3 and YTD Results

Source: Supply Chain Digest

See Full Size Image

A selection of some of the interesting or noteworthy comments provided by each company in its earning release is provided below.

YRC Worldwide

In Q3, there continued to be big gap in financial performance between the company's national and regional freight groups. The national group had an OR of just under 100, at 99.7%, versus a solid 93.5% for its group of more regional LTL carriers, meaning that segment is far more profitable.

The company cited on-going pricing discipline as a key factor in its financial turnaround.

Indicative of a solid pricing, both national and regional groups saw revenue per hundredweight and revenue per shipment up 2.9 to 3.6%.

Old Dominion

Company's operating ratio improved to 85.1% for the third quarter of 2012 from 86.2% for the third quarter of 2011, with a similar improvement for the year to date.

Old Dominion said it is in a virtuous cycle right now, as it continues "to win market share and increase the density within our service center network, which allows us to produce strong profitable growth."

The company said that "In the third quarter, we maintained our on-time delivery percentage at 99% and improved our cargo claims ratio to 0.45%, a seven basis point improvement as compared to the third quarter of 2011. We believe these metrics lead the LTL industry."

The company opened four new service centers in the third quarter: Orange, CA; Pensacola, FL; Duluth, MN; and Parkersburg, WV. That brings its total centers in operation to 219 at the end of the quarter.

Arkansas Best/ABF Freight Systems

As with many carriers in the truckload sector, the company seems to see big opportunities outside its core LTL business, noting that "at our emerging non-asset-based companies, we are encouraged by the continuation of strong revenue and improving profitability trends in the midst of a tenuous economy."

For example, the company's brokerage revenue was up 63% in Q3.

Company said that currently "Industry pricing is stable and rational," certainly often not the case until fairly recently. It added that "ABF’s recent yield improvement reflects positive retention of the late June general rate increase and better price levels on contractual agreements that renewed during the quarter," and that it has"added new, profitable customer relationships and remains focused on improving existing account pricing and managing its resources to available freight levels."

However, a looming union contract battle is a threat.

"For some time now, we have remained diligent in our efforts to address ABF’s high cost structure. This includes numerous internal activities associated with the March 2013 expiration of ABF’s union labor contract," said CEO Judy McReynolds.

The company has tried to sue the Teamsters over concessions the union awarded to YRC that Arkansas Best says put it at a competitive disadvantage, but has lost those actions in the courts so far.

Saia

After noting its high levels of customer service, CEO Rick O'Dell said "We remain committed to receiving fair compensation from all the shippers who value Saia's service quality."

During Q3, Saia acquired Robart Transportation, and its subsidiary. Those companies, now rebranded as Saia TL Plus and Saia Logistics Services, will offer shippers truckload, expedited and full service logistics solutions.

(Transportation Management Article Continued Below)

|