From SCDigest's On-Target E-Magazine

Sept. 11, 2012

Logistics News: Nearly All Freight Modes in Balance Right Now, Stifel Nicolaus Says, but Future May be Troubling for Shippers

Logistics as Percent of US GDP could Soar, John Larkin Says; Driver Shortage, Changing Carrier Strategies, New Regulations and More Could Hit Shippers over next 2-3 Years

SCDigest Editorial Staff

As usual, the transportation sector analysts from Stifel, Nicolaus & Company did a great job refreshing the understanding of their clients and many others on the state of transportation during last week's annual "Shaking the Sand Out of the Sneakers" teleconference detailing key logistics themes and trends.

The material from Stifel Nicolaus, as with other Wall Street analysts in the space, is really meant in the end to be of value to individuals, investment funds, and others interested in making investments in the sector, but nevertheless always contains insights valuable to shippers and transportation service providers.

SCDigest Says: |

|

| All told, "We could see 5, 10 maybe even as much as 15% reduction in capacity in the industry," over the next few years, Larkin said. |

|

What Do You Say?

|

|

|

|

Analysts John Larkin, Dave Ross and Michael J. Baudendistel delivered a comprehensive overview of conditions in the industry across modes, in general painting a picture that says supply and demand are roughly in balance at the moment across the truckload, LTL and rail sectors, but that there are some looming issues that could move that balance in the trucking industry's favor over the next few years.

Larkin began with an overview of the economy, which is critical to the amount of freight moved and hence the capacity equation.

He said we are in a flat, slow growth mode in the US, which is likely to continue. The natural tendency to grow faster than the 1-2% levels seen in recent quarters coming out of recession is dampened by a variety of factors, including the seemingly never ending financial woes in Europe, more tension on the Middle East, a slowing Chinese economy, high unemployment and low levels of labor participation in the US, and worries over the looming "fiscal cliff" approaching at year's end.

He noted that while retail sales numbers in general have looked reasonably strong, when backing out sales of gasoline and indexing for population growth and inflation, retail sales in the US are right now just at levels seen in 1998 - hardly bullish for freight. Retail sales are still down 8.6% today from their adjusted peak seen all the way back in 2006, even though the number is up substantially more than the bottom in Q4 2008.

Larkin also showed a chart that indicated sales growth at 10 of the largest US retailers was just 1.6% in Q2 - which exactly mirrored inflation, meaning real growth was flat.

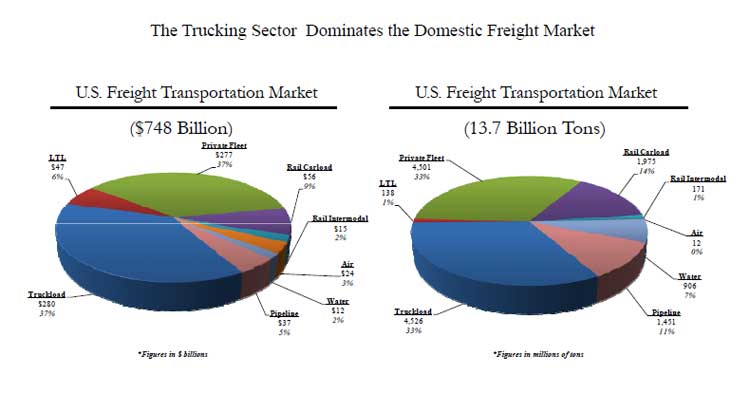

He then presented some data to just level-set the audience in terms of the US freight transportation market.

As can be seen in the chart below, the US freight market represents nearly $750 billion in annual spend, the vast majority of which is a combination of common truckload carriers and private fleets. The same basic pattern holds true with respect to tonnage moved, although in that view the LTL sector shrinks (obviously indicating LTL is a pretty expensive way to move freight). Rail and intermodal still represent just a small share of the market, though growing more rapidly than the others.

Source: ATA, Stifel Nicolaus

While a balance in supply and demand characterizes most modes right now, Larkin said several factors may upset that equation. Notable are regulations such as CSA 2010, which is knocking many drivers out of the market for safety record reasons. New hours of service rules are compounding the driver challenge by reducing driver productivity. The cost of new trucks continues to rise due to both regulations and increased commodity costs.

All told, "We could see 5, 10 maybe even as much as 15% reduction in capacity in the industry," over the next few years, Larkin said.

(Transportation Management Article Continued Below)

|