From SCDigest's On-Target E-Magazine

Jan. 19 , 2011

Logistics News: Will Carriers and Shippers Really Come Together to Solve the Driver Shortage

The Problems are Known, but Solution will Require Higher Pay, Increased Rates, and Changes to Shipping/Receiving Practices that Improve Driver Lifestyles

SCDigest Editorial Staff

As long been discussed, a shortage of over-the-road truck drivers is both a long-term and immediate problem within the logistics industry, adding to capacity tightness in many markets right now, and ultimately leading to rising costs for carriers and shippers over time.

But is the industry really willing to do something about it, or will competitive conditions continue to cause driver pay levels and lifestyles to be near the bottom of the employment barrel, perpetuating the problem even as it impacts US and individual company supply chain performance.

SCDigest Says: |

|

| Hodgen said that estimates are that to recruit needed drivers, wages will have to rise by as much as 30% by 2014. |

|

What Do You Say?

|

|

|

|

Estimates vary, but nearly everyone agrees there is a driver shortage in the US. FTR Associates has estimated there will be a shortage of about 180,000 in 2012, and transportation economist Noel Perry has said that could rise to as much as 350,000 over the next couple of years, rivaling the extreme shortages of the 2005 era, a period that saw severe capacity issues for many shippers.

On a recent webinar on the topic, put on by Bulk Transport magazine but really applicable to the broader US trucking industry, John Conley, president of the National Tank Truck Association, said that it is time the entire industry starts thinking about what he called "driver sustainability."

"Truck drivers are the lifeblood of our industry. They are critical human resources in the same way that clean air and water are environmental resources," he said, adding that the industry for too long has not really thought that way.

There are many disturbing trends. The overall driver population continues to age, with some 1 in 6 now over age 55, and many more nearing that mark. The career is simply not drawing in younger workers, for both pay and lifestyle reasons.

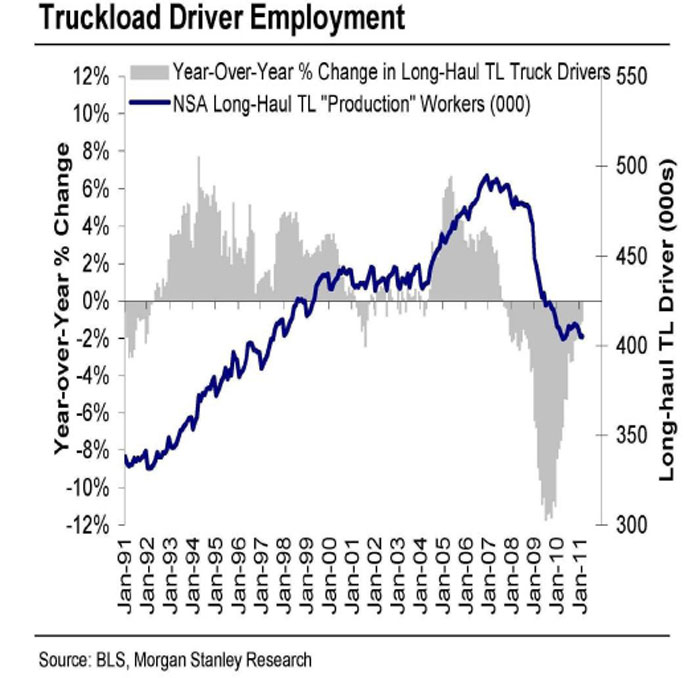

Conley showed an interesting chart illustrating how after peaking in 2007, the number of long haul truck drivers has fallen about 18%. While much of that is due to the recession, the fact that there is a large driver shortage right now shows that the economy is not the only reason for the drop.

And after declining during the heart of the recession (mostly because most trucking companies greatly reduced hiring of new drivers who have the greatest dropout rates), driver turnover levels are on the rise again, averaging about 75% annually, according to estimates from the American Trucking Associations.

"The quantity and quality of drivers appears to be declining," Conley said.

Greg Hodgen, president of Groendyke Transportation, later added that that only 8.5-10% of applicants Groendyke considers will meet the company's first level qualification. That also leads to higher costs for recruitment and training, which now average at least $7500.00 for each new driver the company hires.

Hodgen said that studies estimate that average over-the-road driver wages averaged about $48,000 per year in 2011, a number that in real terms hasn't budged and has even fallen of late from levels in the 1980s. The overall range of wages is between $35,000 and $75,000, and Hodgen added that the gap from the top quartile to the bottom quartile is increasing in terms of compensation per mile. Compensation for the top quartile was 16 cents more per mile than the bottom quartile, versus the historical average of just 10 cents, he noted, and the gap continues to increase. That naturally drives those at the bottom back out of the industry.

(Transportation Management Article Continued Below)

|