Wulfraat Says: |

|

| How will Amazon's loyal customers perceive these shipping changes if they no longer receive the premium quality of service that is the bedrock of UPS and FedEx, where online shipment tracking and reliable and dependable service is the norm? |

|

What Do You Say?

|

|

|

|

In 2015, many companies in North America will be paying more for ground freight as UPS and FedEx start charging on the basis of dimensional weight. Will this revenue increase be enough to offset the volume loss being caused by the new Amazon sortation network and by e-retailers shifting volume to other local service providers for same day delivery?

Perhaps the best way to answer this question is to study the impact that the Amazon Sortation Network will have since Amazon has the largest share of the online retail market at approximately 20%.

Shipware Systems Corp, a parcel consultancy firm, estimates that UPS will experience a $380 Million increase in revenue in 2015 due to their move towards dimensional weight pricing. Similarly, Kevin Sterling, a BB&T Capital Markets analyst, estimates that FedEx will experience a $180 Million operating income increase. If these numbers are accurate then the question becomes whether or not UPS and FedEx will experience a similar drop-off in revenue as Amazon begins to shift volume away to The Postal Service and other service providers?

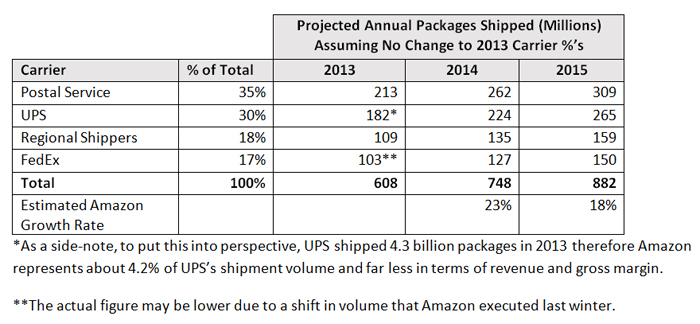

Sanford C. Bernstein & Co. analysts estimate that Amazon shipped about 608 million U.S. packages in 2013 with the breakdown by carrier as shown in the % of Total Column in the table below.

Depending on who you believe, the latest sales revenue projections on the street suggest that Amazon will grow top-line revenue by 23% in 2014 and let us say that Amazon’s 2015 revenue growth is more conservative at 18%. Based on these assumptions, and no change to the status quo in terms of the percentages shipped by carrier, Amazon’s shipping volume projections out to 2015 areas follows:

Previous Columns by

Marc Wulfraat |

|

|

The average cost per parcel shipment by carrier is known only to Amazon so some assumptions are required at this point. As per the Wall Street Journal (which sourced shipping-industry analysts), Amazon typically pays between about $2 and $8 to ship each package, with the cheapest option being through the Postal Service, and the most expensive being via UPS or FedEx.

If 80% of the small packages shipped are less than 5 pounds (as per the Amazon Drone hype), then the weighted average parcel shipment cost will tend to be on the lower end of this scale. Let us say for the sake of this discussion that the average parcel costs $5 to ship with UPS or FedEx. We may be off on this but we’ll use this figure as a starting point and see where it takes us.

1. If we divide the projected $380 Million UPS revenue increase in 2015 by $5 then this works out to 76 Million packages. In other words, Amazon would have to shift 76 Million packages away from UPS next year for their dimensional weight price increase to be revenue-neutral. This represents about 29% of the projected 2015 UPS volume under the status quo.

2. Similarly, the projected $180 Million FedEx revenue increase in 2015 divided by $5 works out to 36 Million packages. In other words, Amazon would have to shift 36 Million packages away from FedEx next year for the FedEx dimensional weight price increase to be revenue-neutral. This represents about 23% of the projected 2015 FedEx volume under the status quo.

Now Amazon is building out a sortation network to shift volume away from UPS and FedEx but Rome was not built in a day and it will take time for these pieces to fall into place. Amazon has indicated that 15 sortation facilities will be up and running by the end of 2014 and it is highly probable that we will see close to 40 of these facilities eventually positioned nearest to highly populated metropolitan cities across North America sometime by 2015-2016.

With these figures as the backdrop, is it feasible that Amazon will shift a total of 112 Million packages away from UPS and FedEx within the next 12 months? If this happened then the impact would be revenue-neutral for UPS and FedEx. This implies that 12.7% of Amazon's projected 2015 shipment volume would move away from UPS and FedEx to the Postal Service and/or to smaller regional service providers.

While this is all subject to debate and conjecture, our assessment is that there is a high probability of this volume shift happening quickly as Amazon aggressively moves to gain control over their shipping network and cost structure. Clearly the dimensional weight pricing increases from UPS and FedEx are a defensive measure designed to offset the threat of revenue loss not only from Amazon, but also from other retailers that will increasingly be shipping from stores with local service providers like Shoprunner, Instacart, Deliv, LaserShip, OnTrac and many others.

The real question in my mind is how will Amazon's loyal customers perceive these shipping changes if they no longer receive the premium quality of service that is the bedrock of UPS and FedEx, where online shipment tracking and reliable and dependable service is the norm. Amazon customers, particularly Prime customers, are tickled pink with their current shipping arrangements and it will be interesting to see if this love affair continues into 2015 and beyond.

Agree or disagree with our expert columnist? Send Feedback Below.

|