| |

|

| |

|

|

Supply

Chain by the Numbers |

| |

|

| |

- March 24, 2022

|

| |

|

| |

|

| |

|

| |

War Expected to Lower Global, US GDP; Trucking Firm Gives Big Bump to Driver Pay; US Manufacturers Plan Lots of New Workers, as Wages Jump; Amazon Share of eCommerce Sales Keeps Growing |

| |

|

| |

| |

| |

| |

3.3% |

|

| That is the revised forecast for 2022 global GDP growth released this week from the economists at S&P Global Market Intelligence. That’s down from their forecasts of 4.1% growth for the year in February, mostly due to the impact of the Ukraine-Russia war. The forecast for US growth this year was also reduced, also to 3.3% but from 3.7% previously. However both these forecasts seem pretty bullish, versus others predicting looming recessions globally or in the US, as the war exacerbates other worrisome trends like surging inflation. Speaking of which, S&P Global Market Intelligence also predicts global consumer price inflation will rise from 3.9% in 2021 to aa very high 6.4% in 2022, the highest rate since 1995 – with many negative impacts sure to be felt from that. |

|

|

| |

| |

|

|

|

| That’s by how much US manufacturers on average plan increase their number of workers in the next 12 months, just shy of the record for projected new worker hiring of 3.8% seen last September. That according to the just released quarterly survey from the National Association of Manufacturers (NAM). It’s not clear where all those projected new employees are going come from though. The US has had more than 800,000 job postings in manufacturing for the past five months. That demand for workers versus limited supply is sending wages higher. The NAM survey found respondents also anticipate employee wages rising over the next year by 3.9% on average, the fastest pace in the survey’s history, which dates to the fourth quarter of 1997. |

| |

| |

|

|

|

| |

| |

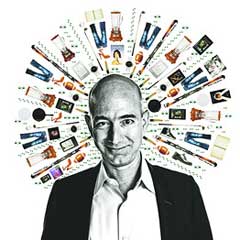

56.7% |

|

That was Amazon’s share of US on-line retail purchases in 2021, new data from PYMNTS shows, according to the web site this week. This reflects “the company’s tightening grip on ecommerce sales and a continuation of the stair step market share advance it has made over the past twenty years,” PYMNTS observed. Amazon doubled its share of domestic retail ecommerce last year from 28.1% in 2014. PYMNTS says Walmart’s US share was a much lower 6.2% in 2021. To calculate Amazon and Walmart’s respective share of overall and on-line retail sales, PYMNTS uses a gross merchandise value method, which backs out things like revenue from Amazon Web Services but includes the full dollar value of everything sold, even when an item is sold and fulfilled for a third party for a 10-15% selling commission. We’ll note Walmart to date has relatively little of that “marketplace” business while Amazon’s has huge third party platform, padding its sales revenue over Walmart using this calculation approach. |

| |

| |

| |

| |

| |

|

|

|

| |

|

|

| |

|

![]() |

|

|

| |

|

Feedback |

|

|

|

![]()

|

No Feedback on this article yet.

|

|

![]() |

|

|

|

![]() |

|

![]() |

|

|

| |