| |

|

| |

|

|

Supply

Chain by the Numbers |

| |

|

| |

- Feb. 4, 2021

|

| |

|

| |

|

| |

|

| |

Amazon Q4 Revenue, Profits Soar; US Agricultural Exporters Searching for Containers; US Purchasing Managers Index Strong Again; Warehouse Lease Rates Headed Higher |

| |

|

| |

| |

| |

| |

$1.25

Billion |

|

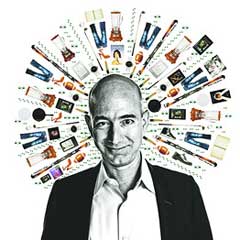

That, incredibly, was Amazon's revenue in Q4, up 43% versus 2019, as reported on the company's earnings call this week. That makes Amazon just the second company in history to see a $100+ billion revenue quarter, joining Apple, also in Q4, as announced last week. That took Amazon's full year revenue to $386 billion, up 37.6% versus 2019, as it continues to close in on Walmart, the largest company in the world by revenues. On-line sales were up 46% in the quarter, to $66.4 billion, while commissions from its 3rd party marketplace services were up a whopping 57%. Net income for the quarter was $7.2 billion, about double earnings of $3.3 billion in Q4 2019. Full year profits were $21.3 billion, up 83% from $11.6 billion last year, as Amazon is finally starting to make real money. And that strong bottom line comes after factoring in billions of dollars related to COVID-19 programs, such as in-house testing labs in its fulfillment centers. Still Amazon's AWS web services unit accounted for 52% of total operating income in Q4, though that was down from its share in Q4 2019.

|

|

|

| |

| |

|

|

|

That was the level of the US Purchasing Managers Index for January, as reported this week from the Institute for Supply Management. That was down a bit from the December reading of 60.5, but still well above the 50 mark that separates US manufacturing expansion from contraction. The January number indicates expansion in the overall economy for the eighth month in a row after contraction in March, April, and May. The New Orders Index registered 61.1, down 6.4 percentage points from the seasonally adjusted December reading of 67.5, but still comfortably above the 50 level in a bullish sign for future US manufacturing activity. Of the 18 manufacturing industries ISM tracks, 16 reported growth in January – only the Printing & Related Support Activities and the Petroleum & Coal Products sectors were negative, neither a great surprise. However, many survey respondents notied challenges with supplier deliveries, as has been widely reported recently in the business press, and others cited continued labor shortages. |

| |

| |

|

|

| |

| |

5% |

|

That is the level of rate increases for US distribution center leases warehouse operator Prologis expects in 2021, according to CFO Thomas Olinger in the company's earnings call this week. If accurate, that would be up from a 3.2% rise in rates in 2020, Prologis said, with all the growth coming in the back half of the year. Interestingly, short-term leasing was up 58% in the quarter for Prologis said, as 3PL, retail and transportation companies raced to secure space ahead of the holidays, increasingly looking for "speed and flexibility." Prologis said that overall in the US, fourth quarter net absorption of space was the highest level ever, at 100 million square feet, higher than the new supply of 90 million square feet. However, ecommerce activity made up 19.8% of new leases for Prologis in Q4, down from 37% in Q3. In potential good news for shippers, not everyone expects US DC rates to jump in 2021. Real estate firm Cushman & Wakefield, for example, recently forecast that while lease rates for US warehouse space are unlikely to decline this year, they are likely to stabilize in here in 2021. |

| |

| |

| |

| |

| |

|

|

|

| |

|

|

| |

|

![]() |

|

|

| |

|

Feedback |

|

|

|

![]()

|

No Feedback on this article yet.

|

|

![]() |

|

|

|

![]() |

|

![]() |

|

|

| |