|

Is it Deja Vu all over again?

They said a huge percentage of people always remembered where they were when they heard that president John F. Kennedy had been shot. It may be a poor comparison, but from my conversations, I think a lot of people have some moment associated with the dramatic rise in oil and gas prices in the summer of 2008 that also sticks with them.

We happened to take an easy coast family vacation at the end of July that year that came exactly at the peak of prices, which of course saw oil reach almost $150.00 per barrel, and gas and diesel prices soar well over $4.00 per gallon. We had a three-hour in a rented minivan from the airport to where we headed, and found the gas prices in the east were 10-15 cents more than the outrageous levels we were paying in Ohio. That first fill-up of the large minivan tank, knowing how much more money in total was going to be spent that week, was painful.

We have friends with Suburbans and Tahoes who said at the time they were only filling those 25-gallon tanks halfway either because of the credit card limits at the pump or because they just couldn't bear to see the huge number from a complete fill up.

Today, oil is at something like $103 per barrel. Industry sources are saying that the retail prices of gas and diesel for whatever reason haven't really caught up yet with that rise, and we can expect big prices moves soon.

A little history is in order. It is hard to believe now, but oil prices started to become a concern in 2005 and 2006 when they rose from roughly the $40-50 per barrel range into the $70s. This caused much angst, accelerated the nearly decade long rise in US logistics costs as a percent of GDP, and had many companies here and around the world complaining about the growing costs of transportation and input costs.

Then, in 2007 Goldman Sachs analysts said we were heading for $100 per barrel oil. At the time, it seemed as if the sky was falling. Many thought the global economy would come to crashing halt, there would be blood on the streets, etc.

We got close to $100 for several months at the end 2007, finally moving above $100 early in 2008, after which the price kept rising to the July peak. There were new predictions for $200 per barrel oil. During those times, anything - some pipeline had to be shut off in Nigeria for a few days - seemed to send prices strongly upward. Many were blaming oil "speculators" bidding on oil futures from the pits at the mercantile exchanges for the price surge. To this day, despite much reading, I still can't figure out if the speculators really play a bad role is this or not.

But starting in August, we then saw oil prices rapidly falling under its own weight and the recession that was already in full swing (even if we didn't know it), then collapsing with the financial crisis to under $40 per barrel in March of 2009. Of course, diesel prices moved in almost lock step, and it is quite interesting to see those patterns, which we have handily made our Supply Chain Graphic of the Week: A Short History of Diesel Prices.

Oil prices swung 5% or more in either direction an amazing 38 days in 2008.

So here were are in 2011, and we are back to $100. It's news, but not the same level of news at is was just a few years ago. Why is that? Is it because we have been there, and found it really wasn't quite as big a disaster as we thought it would be? Or that $100 just seems not all that high when we know we can get to $147?

The equally important question is where do we go from here. A government official yesterday predicted we will drop back a bit for the rest of the year, then march to $100 or so again sometime in 2012.

But of course this is at best a guess. The recent rise is in large measure due to developments in the Middle East. Does anyone have a good crystal ball as to how things are going to play out there over the next year or two? It is a vast unknown, but as expert oil industry analyst Steven Schork told me last year, "We know we can get to at least $147 per barrel, since we been there before."

There are other wild cards. Since still today oil is sold globally in US dollars, its price is highly correlated to the value of the US dollar. When the dollar falls versus other major currencies, oil prices go up. With the US budget deficit and "quantitative easing," many believe the dollar will continue to lose value (though potentially in a race with the Euro to the bottom). If that happens, oil will rise further, and concerns about this is in large part why China and Russia are pushing to end the dollar as the currency standard for oil transaction.

We seem to have a real economic recovery happening, if still modest, in much of the developed world, and the developing economies have already roared back. Demand is going up.

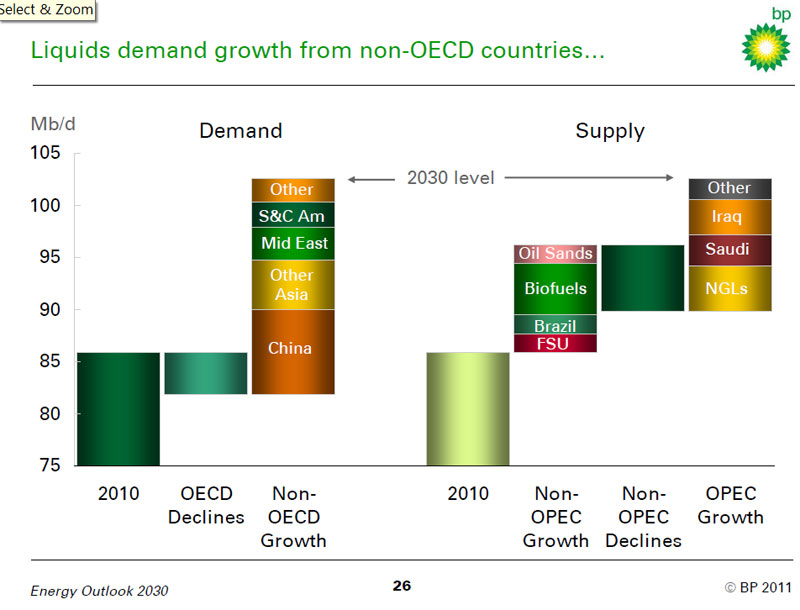

One of the most fascinating things I have read in the past year is the just released BP Global Energy Outlook 2030, which we recently reviewed on our thegreensupplychain.com web site. It is a highly researched and analytic view of where energy markets and consumption are headed. It predicts total growth in consumption in oil from about 85 million barrels per day currently to about 102mbd by 2030. That includes about a 3 million barrel decline in demand from developed economies, but strong growth from China, India and elsewhere.

As shown in the chart below, BP believes world supply will be able to keep up, with biofuels and tar sands oil playing an increasingly important role. The report doesn't really address the "peak oil" theory, but I will just quickly say that if it is at all accurate, that could mean much higher prices even if there is supply to meet demand, because getting each barrel becomes relatively more costly.

So, my quick summary: I think we are going higher, and could easily see $120 oil before long. Logistics managers really need to be looking at their budgets and discussing the potential scenarios with executives. Relook at your strategies and policies on fuel surcharges. I am not an expert on hedging, and it could be dangerous at these levels if prices drop back down, but I would at least consider the cost/benefits.

We will hear more and more companies in 2011 citing rising oil prices as pressuring profits, as Nike recently has. Logistics costs and pressures once again move to center stage - both good and bad for those of us in the business. "Green supply chain strategies" get re-invigorated not for green reasons but due to these cost pressure.

And maybe rising prices push us to trucks and then cars that are powered by natural gas - abundant in the US, clean, and cheap, to largely get us out of this mess.

Why do you think we seem to have less concern now over $100 oil than we did a few years ago? Which way do you think we they will head from here? Could natural gas vehicles solve much of the problem? Let us know your thoughts at the Feedback button below.

|