From SCDigest's On-Target E-Magazine

Nov. 23, 2011

Logistics News: Slowly, Warehouse Space Overcapacity is Turning, and Rates Heading Upward

New Report from Grubb & Ellis Says Empty Space from Recession Nearly Absorbed; A Return to Spec Building by Developers at Last?

Cliff Holste, Materials Handling Editor

The financial crisis and recession delivered a powerful blow to distribution center developers and owners, as demand plummeted and many companies consolidated existing facilities into fewer buildings.

Developers building on "spec" came to a literal halt, and rates naturally fell sharply, making it a buyer's market for companies looking for new space or to renegotiate existing leases.

SCDigest Says: |

|

| "Speculative new construction will be the story of 2012," the report says, after two years of literally no new spec construction in the US. |

|

What Do You Say?

|

|

|

|

But despite the wobbly economic recovery in the US ever since, the market is quietly recovering, and will soon have absorbed all of the millions of square feet of space left idle during the recession, a new market analysis from real estate company Grubb & Ellis recently found.

It says that in total, 153 million square feet was vacated over a six-quarter period starting in late 2008, of which 132 million has been reabsorbed over the subsequent six quarters. That includes general industrial and "incubator" type space, in addition to DCs and warehouse space, which represents the strong majority of the total.

Grubb & Ellis notes that "Given the severity of the decline, the current recovery is progressing slightly ahead of the one that followed the 2001 recession."

The report states that the remaining unabsorbed space from the start of the recession should be absorbed by the end of Q4.

Given that rebalancing of supply and demand, it should be no surprise that rates appear to be heading up. The report says that following three consecutive quarters of flat readings, overall asking net rents increased an annualized 0.6% during the quarter. This means that "The bottom has been formed and rent increases will accelerate in 2012," Grub b & Ellis says.

Even though new supply of space increased by 53% from the second quarter, that 5.3 million square feet of total national deliveries ranks as the fifth lowest quarterly total on record.

The report says demand is strong in most markets, with Q3 net absorption positive (meaning more space was leased/rented than delivered to the market) in 34 of the 49 metro regions Grubb & Ellis tracks.

The report says that with the exception of Atlanta, where demand slowed markedly in Q3, all other national distribution markets saw strong demand, especially for large blocks of distribution space. Chicago led the way with 2.5 million square feet absorbed, followed by Dallas/Fort Worth with 2.3 million square feet and Northern/Central New Jersey with 2 million square feet. Phoenix, which historically acted as a local distribution market, has been attracting retailers from California, resulting in quarterly net absorption of 1.7 million square feet.

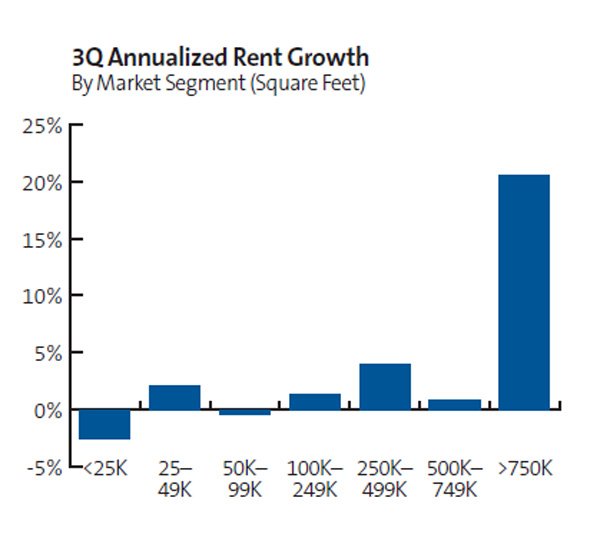

Interestingly, the report says that demand for space and upward rent/lease price pressures are greatest at the largest end of the space segment . As seen in the chart below, DC space over 750,000 square feet saw by far the largest increase in demand, growing at about a 20% rate, while demand for all other space categories was in the low single digits or slightly negative during the period. In practice, this means that of the relatively few new DCs that were built on contract, the vast majority were for very large facilities.

Market Demand by Facility Size in Q3

Source: Grubb & Ellis

(Distribution/Materials Handling Story Continues Below

) |