From SCDigest's On-Target E-Magazine

March 24, 2011

Supply Chain News: US Manufacturing - is the Glass Half Full or Half Empty?

US Manufacturing Continues to Grow in Absolute Terms, but Most See Manufacturing Sector in Decline; Productivity Gains or Offshoring?

SCDigest Editorial Staff

Where does US manufacturing stand right now? It depends on your perspective, and who you ask.

For now, America remains the world's largest manufacturing, producing more 20% of the world's manufactured goods, according to a new report issued this month by the United Nations Industrial Development Organization (UNIDO).

In 2009, the most recent full year for which international data are available, US manufacturing output was valued at $2.155 trillion (including mining and utilities). That figure is more than 45% higher than China's 2009 output - though how you calculate those numbers is a subject of some debate.

SCDigest Says: |

|

| According to the Bureau of Labor Statistics, American factories are producing 57% more output by value today than they did in 1987, but they are doing so with 33% fewer workers today. |

|

What Do You Say?

|

|

|

|

Regardless, it is clear that US manufacturing output is far from shrinking in absolute terms. The US is producing more than twice the output in constant dollars today than it did during the 1970s, for example. Even though manufacturing represents only about one-third of the total economy, US manufacturing would rank today as the sixth largest economy in the world, just behind France and ahead of the United Kingdom, Italy and Brazil.

Right now, manufacturing is the hottest sector of the US economy. Manufacturing output was up 9% in 2010 over the admittedly dismal levels of 2009. That trend is continuing in 2011. The ISM Purchasing Managers index rose for a seventh straight month in February to 61.4%, matching its highest reading since 1983 (in this index, any score over 50 indicates manufacturing growth).

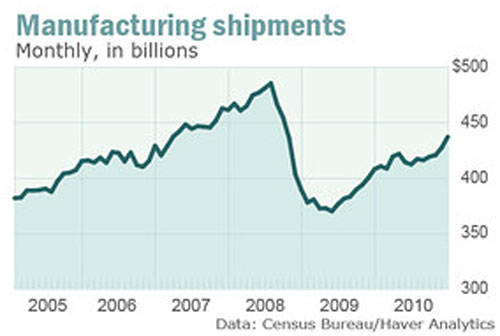

Despite much discussion about the "death" of US manufacturing, US industrial production was rising steadily until the recession, took a big drop in 2008-09, and then has started back to its normal upward progress as the recession ended, as shown in the graphic below.

That is the "glass half full" view. In relative terms, however, much evidence says US manufacturing is losing ground, perhaps inevitably given global demographics. The National Organization for Manufacturers (NAM) has argued that the US share of global production has remained steady at just over 20% in the past decade, and that there are questions about how China's output is calculated, overstating its production levels.

Still, most believe that the global share of manufacturing from developing economies in general and China in particular is rising. The UNIDO report notes that "Leading developing economies such as Brazil, China and India showed strong performance in economic growth in 2010. MVA [manufacturing value-added] of all three countries grew by more than 10% in 2010," though that was not much above the US growth rate of 9%.

Thanks to the high growth rates achieved by all developing countries, their share in world manufacturing output has reached 32% in 2010 compared to 20% 10 years ago, according to UNIDO. However, that gain in share may be coming at the expense of other countries even more so than the US, though the impact has been felt in American for sure as well.

US Manufacturing Continues to Grow in Absolute Terms

Additionally, most believe it is inevitable that China will overtake the US in industrial production at some point, perhaps as early as the next few years, according to researchers at IHS Global Insights. NAM disputes this prediction, and says if it occurs it will not be until after 2020.

(Manufacturing article continued below)

|