From SCDigest's On-Target E-Magazine

March 1 , 2011

Logistics News: Distribution Center Space Still Largely a Buyer's Market in 2011, New Report Says, though Rates Slowly Inching Up from 2009 Nadirs

Rates to Rise on Average just 1.6% over Next Two Years, Grubb & Ellis Report Says; Chart of Current Rates by Market

SCDigest Editorial Staff

Commercial real estate in general and distribution/warehouse space specifically have just barely climbed off the mat from the lows seen in the depths of the recession in 2009, but the forecast is for much stronger absorption and rates growth heading into 2012 that will modestly increase what shippers pay for space.

So say the real estate professionals at Grubb & Ellis, in their recent report on commercial real estate trends for 2011.

The overall logistics vacancy rate will fall to about 11.5 percent by year end from 12.8 percent at the end of last year and 13.8 percent at the end of 2009, the report said.

SCDigest Says: |

|

| Current DC rates range from from $8.30 on Long Island to just $2.33 per square foot in Memphis.

|

|

What Do You Say?

|

|

|

|

One of the striking pieces of data in the report is how little industrial and distribution space was built during 2009-10.

For example, in 2009 the net "absoption" was a negative 150,000 square feet in the US, meaning companies abandoned that much space in aggregate as they rapidly left existing buildings, consolidated facilities, and dramatically reduced inventories and hence the need for storage space.

In 2010, with a lukewarm economic recovery, net absorption for the year totaled 20 million square feet, a sign that some level of demand had returned, but compare that to what was happening in the 2005 to 2007 period of economic expansion, when annual absorption ranged from 172 to 192 million square feet per year.

There was only some 7 million square feet of new space added in 2010, versus some 150 million square feet in 2007.

However, activity certainly picked up towards the end of the year in 2010, with 15.9 million square feet of space leased or acquired by shippers during Q4.

Supply will remain constrained, with less than 7 million square feet of new logistics buildings under construction. "Additional projects will be announced during the year, but 2011 will be the year with the least amount of new deliveries on record," the report said, as developers simply stopped new projects during the recession. Supply will remain constrained, with less than 7 million square feet of new logistics buildings under construction. "Additional projects will be announced during the year, but 2011 will be the year with the least amount of new deliveries on record," the report said, as developers simply stopped new projects during the recession.

"The wild card in the coming expansion cycle will be fuel prices. When prices spiked in 2008, logistics companies and shippers were moving down the path toward more and smaller distribution centers in order to maximize the use of fuel-efficient rail and minimize trucking costs," the report says.

As a result of the fuel cost impact, emerging distribution hubs such as Phoenix and Kansas City saw DC space demand increase substantially prior to the recession.

However, the downturn and the decline in energy prices put a hold on this strategy. But with energy prices obviously spiking again, Grubb & Ellis expects demand to return for smaller distribution facilities across a larger number of secondary markets.

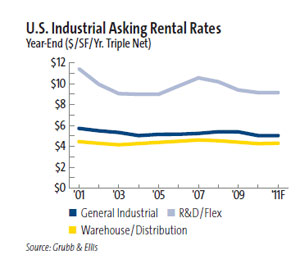

Overall, however, warehouse and DC rates in the US have remained relatively flat since 2001, as shown in the graph nearby.

Grubb & Ellis expects the several year trend of demand patterns shifting as a result of the Panama Canal expansion that will open in 2014 to continue, putting some increasing rate pressure for space in Gulf and East Coast port areas that can ultimately handle the larger ships coming through the Canal.

(Distribution/Materials Handling Story Continues Below)

|