As just one example of how this ties together, Guinipero and Carter cite a case study of one company that first used such a tool to look at all bids across all suppliers for a particular set of products. It then filtered the results to only look at those suppliers with a 97% or greater service level.

By “comparing this solution with the first solution, the sourcing team could clearly see the increased cost of only using suppliers with superior service records,” Guinipero and Carter write. “This additional cost would be compared with the cost of holding additional inventory if the lower-cost suppliers with inferior service records were used.”

Where is the Sweet Spot?

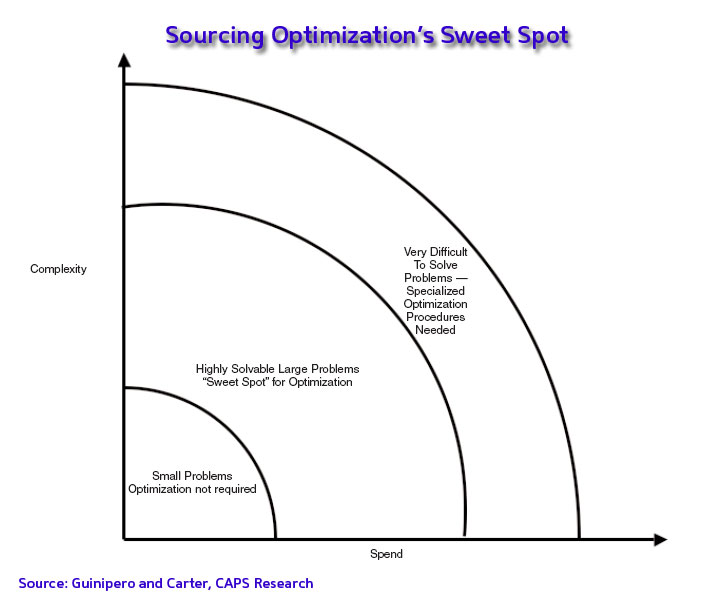

Not all products/services are well suited for sourcing optimization.

Some categories are, of course, simply too small/simple for the effort or return from using a sourcing optimization tool and process.

At the other end of the spectrum are very, very large and complex buys, for which the optimization software likely will have to be customized to meet the buying requirements - and even then may not be able to identify a true optimal and/or feasible solution. Guinipero and Carter say, however, that even in this case, the tool may still be useful for analytic support.

The real sweet spot are those products and buys in the middle, where there is enough spend and complexity that the analysis and optimization can really deliver savings, but where the level of complexity is modest enough that the process can be managed with the tools “out of the box.” (See graphic below.)

There is a tremendous amount of detail in the full report about the requirements for sourcing optimization success, the process models used, and a wealth of other data.

A few key points stand out:

- By its nature, use of sourcing optimization tools and processes will tend to drive a greater level of procurement centralization in a company;

- This move often represents a dramatic change for procurement managers – much attention needs to be paid to training and change management issues (the report offers a number of smart suggestions in this area);

- That is equally true for suppliers, many of whom may never have gone through such a process; often, the supplier issue centers around the sheer volume of data they are required to provide;

- Including non-price attributes in the bidding processes is not easy, but can be done by “monetizing” some attributes, such as quality.

Guinipero and Carter note that “While the application of optimization in supply management is still in its infancy, early adopters of the technology envision ever-increasing use.”

They foresee two complementary paths: (1) ever more user-friendly and simple to set-up versions that will lead to broader use within an organization; (2) increasing advances in underlying capabilities that expand the number of products and the level of complexity where such tools can be used effectively.

Do you have experience with sourcing optimization technology outside of transportation? How well does it work, and what are the best applications? What are the downsides and limitations, if any? Let us know your thoughts at the Feedback button below.

|