| |

|

| |

|

|

Supply

Chain by the Numbers |

| |

|

| |

- Sept. 5, 2024

|

| |

|

| |

|

| |

|

| |

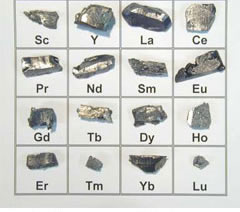

China's Rare Earth Metals Strategy. US Manufacturing Contracts again in August. New Sail Powered Cargo Ship Takes Off. Dock Workers ready for Strike, Union Chief Says |

| |

| |

| |

| h |

| $25,000 |

|

| That is about the cost per metric ton for a mineral called antimony, essential today for making batteries, solar panels, brake pads and nuclear weapons. That is up from more like $12,000 at the start of the year. What is going on? Last month, China, which dominates mining and production of antinomy and most other “rare earth” metals and minerals, announced the implementation of export licenses on antimony, with the new measures going into effect on September 15. Other restrictions on the export of the rare earth metals are being developed, as China believes it has found a counter weapon against the tariffs being assessed on imports on many Chinese goods entering the US and Europe. Alternatives to China for antimony are few. China controls about double the global mining share versus number 2 provider Tajikistan. The US has not mined any commercial antimony since 1997. |

| |

| |

| |

|

|

|

| |

| |

|

|

|

That was the level of the US Purchasing Managers Index (PMI) for August, as released Tuesday by the Institute for Supply Management (ISM). That score is again below the key 50 mark that separates US manufacturing expansion from contraction, but was up a bit from the July score. What’s more, the US PMI had previously been in contraction territory for 16 straight months until it poked its head into expansion in March with a score of 50.3, but that has now been followed by five more months of contraction. Meanwhile, the New Order Index, saw a score of a weak 44.6, 2.8 percentage points lower than the 47.4 level reached in July, in a negative sign for future US manufacturing activity. |

|

|

|

.

| |

| |

100% |

|

| That’s the percentage of East and Gulf Cost longshoremen that would back a strike if union demands are not met, International Longshoremen’s Association president Harold Daggett said in August, adding in a video released by the ILA Wednesday that “The ILA most definitely will hit the streets on Oct. 1 if we don’t get the kind of contract we deserve. ... Mark my words, we’ll shut them down.” The contract between the union, representing about 47,000 dock workers across multiple ports and terminals and the United States Maritime Alliance, which represents port management, expires Sept. 30. Delegates representing chapters of the ILA were meeting on Wednesday and Thursday this week to discuss a proposed contract with the union’s wage scale committee. Speaking in the same video, executive vice president Dennis Daggett added, “We’re at an impasse ... we are very, very far apart” on a new contract. Wages and automation to no surprise are emerging as the key issues in the talks. |

| |

| |

| |

| |

| |

|

|

|

|

| |

|

|

| |

|

![]() |

|

|

| |

|

Feedback |

|

|

|

![]()

|

No Feedback on this article yet.

|

|

![]() |

|

|

|

![]() |

|

![]() |

|

|

| |