From SCDigest's On-Target E-Magazine

April 25, 2012

Supply Chain News: New Study from Boston Consulting Group Says 50% of Large US Manufacturers will or Are Considering Returning at Least Some Production Back to the US

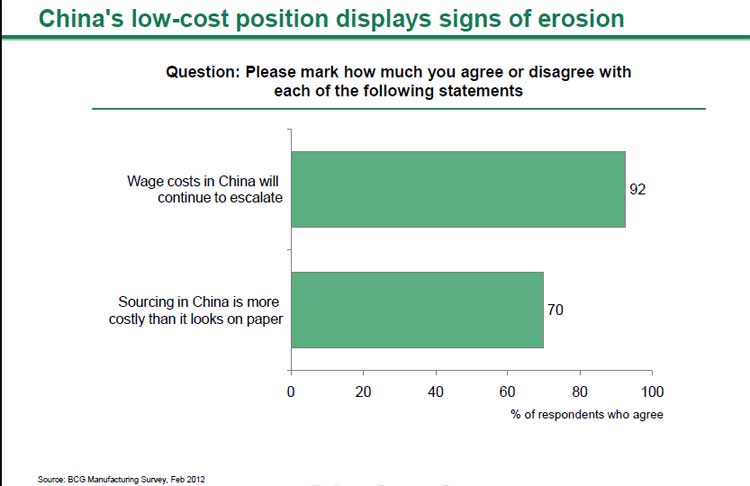

Mid-Sized Manufacturers are Somewhat Less Likely to Consider Reshoring; Strong Majority of Respondents Agree Costs from China Are Over Initial Estimates

SCDigest Editorial Staff

Last year, Boston Consulting Group released research showing that rising wages in Eastern China would lead to near parity with the least expensive regions of the US in terms of manufacturing costs by 2015. (See New Study from Boston Consulting Finds China Manufacturing Cost Advantage Over US to Disappear by 2015.)

SCDigest Says: |

|

70% believe that sourcing from China in the end winds up being more expensive than it looks on paper†when the initial cost estimates are performed.

|

|

What Do You Say?

|

|

|

|

The firm also predicted that improved US competitiveness and rising costs in China will put the US in a strong position to add 2 million to 3 million jobs in a range of industries and an estimated $100 billion in annual output by the end of the decade.

In an extension of that 2011 research, BCG has released a new study showing there is significant interest among many large US manufacturers in moving production back to the US.

The new report is based on a survey of just over 100 large and mid-sized manufacturers with sales of at least $1 billion annually. The surveys were conducted in February.

The headline news from the research is that a significant percentage of the companies surveyed – 37% - say that they plan to or are actively considering bringing back production from China to the US.

That trend is even stronger among the largest manufacturers (sales of $10 million or more), where the research found almost 50% of respondent companies gave the same response. However, among companies with $1-10 billion in sales, just 30% said they were or are considering “reshoring.â€

Manufacturers also seem to agree that cost conditions are becoming more unfavorable in China. As shown in the chart below, a full 90% of respondents say they expect wages in China to continue to rise, while another 70% believe that sourcing from China in the end winds up being more expensive than it “looks on paper†when the initial cost estimates are performed.

Results from a group of industry sectors BCG believes are at a “tipping point,†meaning they could either build additional strength in US manufacturing or see more and more production go offshore, were mixed. Those industries include sectors such as transportation goods, appliances and electrical equipment, furniture, plastic and rubber products, machinery, fabricated metal products, and computers and electronics.

Source: Boston Consulting Group

(Manufacturing article continued below) |