From SCDigest's On-Target E-Magazine

June 6 , 2011

Supply Chain News: New Study from Boston Consulting Finds China Manufacturing Cost Advantage Over US to Disappear by 2015

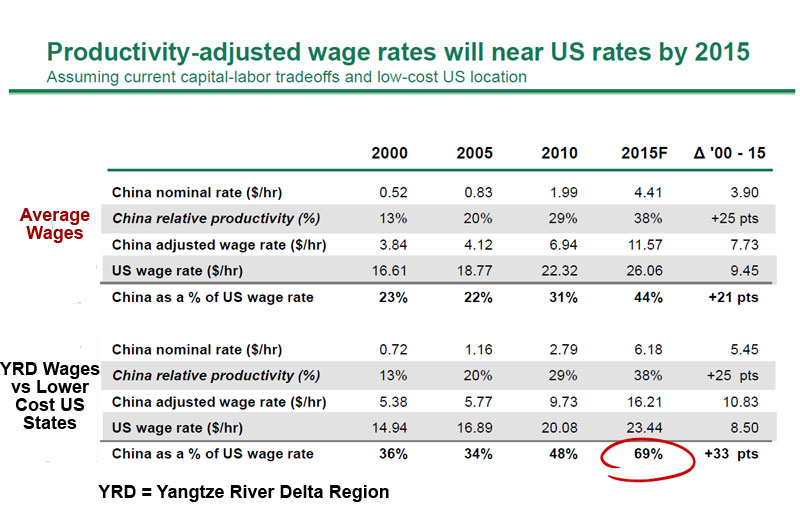

China Labor Costs Alone will Rise to 69% of US Costs in Some Regions before Logistics, Duties, Inventory and Other Costs; A US Manufacturing Renaissance?

SCDigest Editorial Staff

New analysis from the Boston Consulting Group (BCG) suggests that the move offshore to China by US companies in search of lower labor costs may slow significantly over the next few years and even reverse course, as rising wages in China will make it more costly as the US in four years, when productivity differences are factored in.

SCDigest Says: |

|

| For domestic markets and exports from the US to Europe and other parts of the world, the dynamics really are changing. |

|

What Do You Say?

|

|

|

|

In fact, BCG says that the US is likely to see a "manufacturing renaissance" as the wage gap with China shrinks and certain US states become some of the cheapest locations for manufacturing in the developed world.

Europe will not be so fortunate, and continue to lose manufacturing to more cost effective Chinese sources due to higher labor costs there than in the US.

Both high absolute wages and a rising value of the Yuan currency are behind the changes, BCG says.

"With Chinese wages rising at about 17% per year and the value of the Yuan continuing to increase, the gap between US and Chinese wages is narrowing rapidly," BCG says. "Meanwhile, flexible work rules and a host of government incentives are making many states—including Mississippi, South Carolina, and Alabama—increasingly competitive as low-cost bases for supplying the US market."

Data provided by BCG to the media show BCG predicts labor costs in the US will only grow about 3% in the period from 2010 to 2015, to just over $26.00 per hour on average, while wages in China will increase between 15 and 20% each year.

China's manufacturing productivity is growing, but with expectations for about 10% worker productivity growth in China over the next five years, it will not be nearly enough to keep pace with wage increases there, making China relatively less competitive.

At the same time, BCG notes that the US labor market is marked by increasingly flexible work forces, especially in some regions, and supported by capital investments that are driving productivity up.

China's cost advantage versus the most competitive manufacturing regions in the US will fall to just 10-15% by 2015 before transportation, duties, inventory and other costs, the report says, often giving the total cost advantage to US factories.

As shown in the chart below, BCG believes China's effective wage rates, including productivity factors, will rise to 44% of overall US costs by 2015 - and increase of 21 percentage points (and almost a 100% increase) since the 2000 comparison of just 23% of US costs then.

Source: Boston Consulting Group

But in the most competitive regions of the US, such as several Southern states, China's effective production costs will rise to 69% of US wage rates, an increase of 33 percentage points since 2000.

(Manufacturing article continued below)

|