|

February 21, 2014 - Supply Chain Flagship Newsletter |

|

| THIS WEEK'S SPONSOR: MHI |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A Look at Supply Chain Planning in 2014

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GILMORE SAYS: |

"After all these years, 45% of respondents still said their tools can't model all the processes well enough, followed by the 44% who said they were not well using all the capabilities their technology had to offer." WHAT DO YOU SAY? |

Third, and certainly related to the first two, companies understand the future is tightly integrated planning and execution, to the point where as I have said many times in the past, tactical planning and execution will (and indeed are in many situations) start to look more like one process than separate steps (see Spanish clothing manufacturer/retailer Zara).

So with that brief backdrop, this column will summarize a benchmark survey and research report in supply chain planning we published towards the end of 2013 - this is literally the first open First Thoughts spot I have had since the report was published.

I can without a doubt say this is the finest research work we have done yet. It is I believe the most detailed study on planning I remember ever seeing, based in part on survey responses from about 400 supply chain professionals (from many great companies). It is produced it in an inforgraphic-type style that makes all the data very easy to get through. I promise you will enjoy it.

You can download the report here: 2014 Supply Chain Planning Benchmark Report

As usual, we'll offer a few highlights in this column. For starters, we could say it has been about 25 years since the start of we might officially call the supply chain planning era. Of course, companies have been doing some forms of planning forever, but I guess I am linking the beginning of this period with the arrival of modern supply chain planning software.

However you date it, we've been at it a long time, and you'd think most companies would feel pretty good about their planning capabilities by now.

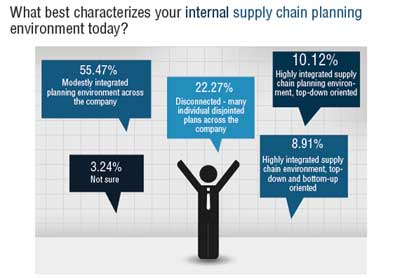

Think again. As the chart below shows, more than 22% - in in five - of companies still say said there planning processes are largely "disconnected."

Just under 9% have reached what today we might call the top levels of performance, characterized by highly integrated processes, and both a top-down and bottoms-up approach to planning. My question: is it that so many companies really are behind in their supply chain planning efforts and results, or that the bar just keeps being raised higher? A little of both I think.

I liked this chart and data points a lot, relative to how companies feel they are performing via supply chain tradeoff curves - such as the balance between inventory and customer service. It is quite fair to say that the only way to really make supply chain improvement is to "shift the curve" - be able to both reduce inventories and improve service over given period, or whatever the tradeoff area is..

Here's what companies told us relative to that question.

Just 13% or so feel they have been able to significantly shift their curves in recent years. My perception is that for leaders, it is a stair-step type journey - they are able to shift their supply chain performance curve in some area, then they plateau at that level for some period before making another advance. Most interesting of all in this data is that 25% just don't know - that's a big number. Do we need some better or easier way to measure this?

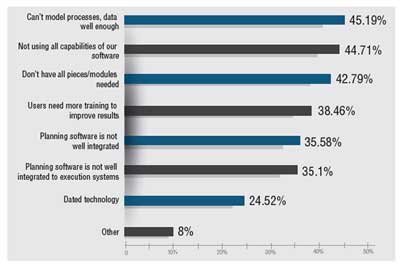

Finally, what do companies see as the biggest challenges in their current supply chain planning software environments? As shown below, after all these years, 45% of respondents still said their tools can't model all the processes well enough, followed by the 44% who said they were not well using all the capabilities their technology had to offer. I bet in reality it is an even higher percentage than that. 42% of companies said they were still missing important pieces of technology, such as Inventory Optimization software.

I am not going to have room for the chart, but in great summary, the data showed that the high tech and consumer goods sectors had to best performing planning processes, while chemicals and retail said they were the most disconnected.

There is so much more - this is very good. Please take a look: 2014 Supply Chain Planning Benchmark Report

What is your reaction to this benchmark data on supply chain planning? Let us know your thoughts at the Feedback button or section below.

| View Web/Printable Version of this Page |

|

|

|

YOUR FEEDBACK

Our friend David Schneider, who has made predictions for us before, was not that wild about our guru predictions published last week, and his email serves as our feedback of the week.

Feedback of the Week: On 2014 Guru Supply Chain Predictions for 2014

The predictions are rather – well – predictable. To the esteemed swami's – I mean no disrespect. These are safe projections for trends that are already in place:

Those are safe predictions. I am, and my clients are more interested in the not so safe predictions. Come step on the wild side with me for a few moments. Alternative fuels: It is not a matter of if, but when, more fleets convert over to Natural Gas. Now that Cummings / Westport have the ISX12 G engine on the market, and Volvo with their D13-LNG engines, the question of motive power for heavy duty over the road trucks has options that work. But the engine is just one part of the puzzle. Volume will help lower the cost of the NG powered tractors, and the issue is not the engines, but the significant cost of the LNG fuel tanks and systems, and the significant weight / bulk of the CNG systems. 2014 will be the year of better understanding of the costs and the opportunities. The fuel network will develop more locations – with more focus on LNG for long haul and CNG for return to base fleets. The real question to ask: "What do you think the price of diesel will be in 2014 - 2019? It is not a one year question, but a 5 year question. If diesel remains above $3.50 at the pump, then the conversion to NG as a fuel will gain velocity. If diesel runs between $3.00 and $3.50, then the conservative players will keep burning distilled fuel, and the only fleets that convert are the ones that do it for non-financial reasons. But if diesel drops below $3.00 for any length of time, watch the bottom drop out of the desire to use NatGas as a motor fuel. Don't think that can happen? Well, just last week I saw some diesel prices along I-81 in the $3.39 region, with one truck stop pulling them in at $3.29. If more of that North Dakota Sweet ends up in the markets, courtesy of the southern sections of the Keystone pipeline, we could see where the price of diesel is low enough to retard NatGas as a major fuel. It's the Weather, Stupid!: Christmas 2013, the multiple storms of Winter 2013-14, and the Atlanta Freeze - these are reminders of how fragile we made all of our transportation / logistics systems in the past decade. Somebody sneezes on a clear summer day on the I-285 Perimeter Loop around Atlanta and stuff stops moving. Make it very cold and through some water into the mix and all hell breaks out. We want to remove the variability out of the performance of the supply chain, it only makes sense from a working capital point of view. But what happens when it really messes with the unrealistic expectations of consumers and angry news anchors? Will some ecommerce players decide to offer discounts for early shopping, perhaps free shipping if you order before December 10? Better yet, will they offer high priced guaranteed delivery for those last minute shoppers that could not make it to the store. Watch this trend: bricks and mortar retailers making solid claims that you should do your last minute shopping with them, adding in wrapping and other value add services to sweeten the deal. How about some of the larger e-tailers getting a little bit more weather savvy - hiring weather services and adjusting the shipping delivery promise based on the customer location, and the projected weather? Finally, here is my special prediction:

David K. Schneider David K Schneider & Company, LLC

|

||

| More on Guru Predictions: | ||

I love how you pull these predictons together each year and how deftly you summarize the thoughts of the different contributors. What makes it a good read is the diveristy of the perspectives and viewpoints - all good. Keep it up.

|

||

| Feedback on SCDigest Weekly Trivia Question: | ||

I liked your trivia question on the two auto ID publications in the 1990s. Automatic ID News and ID Systems are long gone, but it's nice to know they are not forgotten. My memory of Automatic ID News includes editing material from a young guest columnist named Dan Gilmore! Only a couple of us from the staffs of those magazines are still involved in the industries we covered.

John Burnell

|

||

SUPPLY CHAIN TRIVIA ANSWER

Q: What was the peak year to date in terms of US manufacturing output? Was it 2013?

A: The peak year was 2007. 2013 manufacturing production was about 3-4% below that level, climbing back from the huge drop in 2009.

| © SupplyChainDigest™ 2003-2013. All Rights Reserved. SupplyChainDigest PO Box 714 Springboro, Ohio 45066 |

POWERED BY: XDIMENSION

|