|

October 25, 2012 - Supply Chain Newsletter |

|

FEATURED SPONSOR - LOGILITY |

|

New Whitepaper Available for Download from Logility

|

|

|

||||||||||||||||||||||||||||||||||||||||

The Shelf-Connect Supply Chain: The Report

|

|||||||||||||||||||||||||||||||||||||||||

| GILMORE SAYS: |

"The only question is how long the adoption is going to take - and how the pie is divided." WHAT DO YOU SAY? |

To get a little ahead of the story, a new research report from Chief Supply Chain Officer Insight provides some ground-breaking data showing how manufacturers and retailers are thinking about this, and where they stand in the process.

As I said in June, this value chain has seen a slew of initiatives, such as Efficient Consumer Response (ECR), Quick Response (sort of the ECR equivalent for the soft goods sector), Continuous Replenishment, Collaborative Planning, Forecasting and Replenishment (CPFR), RFID, and more.

I think I would be far from the only one who would say while each of these industry programs has delivered benefits and moved the ball down the field, there was always the feeling that the potential had not quite been truly grasped. The same problems seemed to remain.

The idea that the supply chain should driven from true consumer demand (whatever industry you are in) is of course really as old as the supply chain itself. Someone back in the late 1980s said relative to Quick Response that the supply chain will one day become so integrated and responsive that we would soon arrive at the state that when a sweater is sold in a department store in Peoria, a sheep will be shorn somewhere in New Zealand.

We haven't got quite that far yet. But a combination of improved computing power, improved software, evolution in overall supply chain thinking (especially by retailers), and a recognition that it really is in the seams between manufacturers and retailers where the next round of benefits will derive has led to what I am confident we be a real inflection point in the supply chain. For the first time, we will truly use store-level demand to drive the rest of the supply chain, all the way back to the factory schedule, finally taking a real whack out of inventories, out-of-stocks and other costs.

Lora Cecere, formerly of AMR Research and now at her own research firm, recently said at the Logility user conference that "she hasn't seen one company effectively use point of sale data."

I am not sure we don't have a single example (see Scotts Miracle-Gro case study in the report, for example), but the overall observation is well taken. The truly "demand-driven" supply chain has been very slow to evolve, even as store-level POS data has been widely available now for some time. It has also taken most retailers quite a while to really embrace supply chain thinking, with company's such as Lowes finally starting to adopt time-phased order planning processes the way manufacturing companies have done for years, and their own versions of Sales and Operations Planning.

In the report, CSCO Insights obtained survey responses from about 300 manufacturers and retailers, looking at a variety of issues relative to a "shelf connected" supply chain. The full report can be downloaded here: Building the Supply Chain from the Shelf Back.

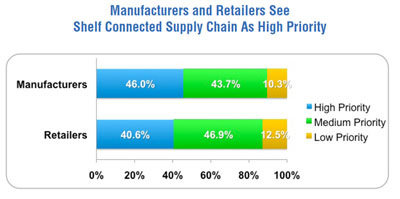

Clearly, the interest is high. As shown in the chart below, 46% of manufacturers and 40.6% of retailers view achievement of a shelf-connected supply chain as a high priority, while just 10.3% and 12.5%, respectively, see it as a low priority.

Ok, there seems to be consensus on the importance of shelf-connected thinking, but what sort of progress have manufacturers and retailers made?

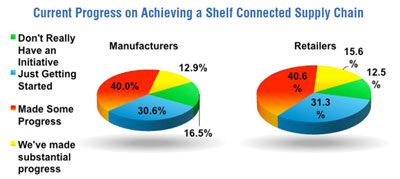

Understandably at this early stage, very few manufacturers (12.9%) and retailers (15.6%) say they have "made substantial progress" on building these capabilities (see chart below).

Meanwhile, 47.1% of manufacturers and 43.8% of retailers are either just getting started or really don't have an initiative yet. The obvious conclusion: there are vast differences in progress on what I think will be a game-changing opportunity among manufacturers and retailers.

I think it is important that manufacturers and retailers really evaluate their status versus the competition and develop a plan to "catch up" as appropriate. Even if the decision is to go slow, it is important that this be a formal decision made by weighing all the factors, not a default choice driven primarily by inertia, as is so often the case.

I wish I could fit a few more of the excellent charts from the report in here, but I am out of space.

Interestingly, for example, manufacturers see the biggest barrier to making the shelf-connected supply chain work as being a lack of confidence that retailers will be willing to share the resulting benefits fairly.

That's notable to me because at a meeting of JDA's Software Demand Optimization Council last May, some retailers were saying that as they started to share those time-phased order plans, they expected to begin seeing some lower prices from the manufacturers as that data helped them reduce production and inventory costs. So far, they said, it wasn't happening.

So there are always issues, especially in this value chain. But these capabilities trust me are going to dramatically remake how the consumer goods to retail value chain operates. The technology barriers have fallen.

The only question is how long the adoption is going to take - and how the pie is divided. Report here.

Do you believe the "shelf-connected" supply chain era is near? Why or why not? Is it an important initiative in your company? (We'd love to talk.) Let us know your thoughts at the Feedback section below.

![]()

| View Web/Printable Version of this Page |

|

|

|

YOUR FEEDBACK

We received a few more emails in after last week's follow up First Thought column on Perfect Logistics - Really?

That includes our Feedback of the Week from Steve Murray, who says we should keep marching to the Perfect Logistics beat.

Feedback of the Week: On Perfect Logistics

Thanks for taking the lead (and a few arrows) on this Dan. OK, we can all agree that "Perfect" is not easy, and in some cases may not even be worth the effort & cost required. But should that stop us from trying to achieve perfection to a level that is practical? Isn't that why we do Continuous Improvement projects? What about Lean Kaizen and Six Sigma? The mantra has always been "it's not a destination, it's a journey"). And when we get close we frequently find that the destination shifts due to product or customer requirements, business strategy, etc. Focusing on logistics - does anyone ever expect to achieve perfect "Perfect Orders"? If the answer is no should we give up this valuable metric? I think we should have an agreed upon metric set for "Perfect Logistics" and a single comprehensive metric similar to the "Perfect Order Index". Something which includes selected measures across the supply chain from supplier to consumer. It should ignore numbers that are unique to specific industries as these would preclude our ability to benchmark institutions. Steve Murray

|

||

More on Perfect Logistics:Certainly there are going to be skeptics out there about perfect logistics, but it takes a lot of courage on your part to lay out the gauntlet and be a visionary on behalf of the industry.

Good Job! Don Dovgin

|

||

You know, you are really starting to have me convinced. I think we are going to to start looking more at this vision in my company's logistics operations - but I can't let our customers starting thinking that's how it is going to be yet! Arnie Leesman |

SUPPLY CHAIN TRIVIA ANSWER

Q: The value of the goods carried by UPS and FexEx is equal to about what percent of overall US GDP?

A: About 6%.

| © SupplyChainDigest™ 2003-2012. All Rights Reserved. SupplyChainDigest PO Box 714 Springboro, Ohio 45066 |

POWERED BY: XDIMENSION

|