The world moves awfully fast.

A few weeks ago, I wrote a column on Rethinking China, which basically argued this: that the US and other developed economies were basically shooting themselves in the foot with regard to their relationships with China.

Meaning, that while China is rightly seen as rising rapidly, soon to overtake the US as the largest economy in a few years by the International Monetary Fund (IMF) and others, that ascent has almost totally been paid for by the same developed economies that now seem to be in relative if not absolute decline.

| GILMORE SAYS: |

"Last week, the respected consultants at Boston Consulting Group released a report predicting that by 2015 - just four years - all-in costs to produce and deliver goods from China to the US will be on par with making the goods in the US."

WHAT DO YOU SAY?

Send us your

feedback here

|

China's economic growth has simply come from the huge trade surpluses it has piled up with most of the rest of the world - more than $2 trillion in trade surplus with the US since 1999, for example. 50% or so of China's GPG growth is coming from government spending on infrastructure, which is only possible because of those trade surpluses. Pundits come back marveling at impressive Chinese ports and highway projects, while US infrastructure keeps getting C or D grades from the Civil Engineers society, but a lot could have been here with that $2 trillion too, and the same is true for many other countries.

China can also make big investments in natural resources in South America, Africa and elsewhere, to its long-term strategic advantage, because of those huge surpluses and foreign currency reserves.

Lawrence Summers, Harvard university Professor and former high level government official under Presidents Clinton and Obama, recently said that "When someone writes the history of our time 50 or 100 years from now...It will be about how the world adjusted to the movement of the theater of history towards China." But again I say, because Western nations handed it the money to make the move.

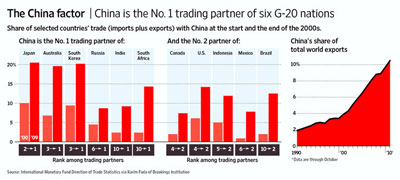

China has in just a few years dramatically changed trading relationships the world over. The chart below shows how China has rapidly moved to being the number 1 or 2 trading partner of an incredible number countries, and how its share of global exports has climbed 500% from 1990 to 2010, now enjoying over 10% world market share.

View Full Size Image

The impact is dramatic everywhere. For example, as the Brazilian economy matured, it was planning to become more of a global force in manufacturing. Now, 80% of Brazil's exports to China are agricultural or mineral/oil products, while it imports an increasing percentage of the manufactured goods it consumes from its new largest trading partner. Brazil, Australia, Canada and others mature and developing economies are sending oil, ore and other commodities to China and getting back finished goods.

So what turns out to be good for any individual company - lower costs from outsourcing to Chinese manufacturers - is in total bad for the country (I think). And supply chain is at the heart of that, since we lead the charge to find lowest total costs sources, and manage the complexity of making it happen.

So, that mostly summarizes my part 1. In part 2, I was going to ponder a bit on what to do about it, and still will, but in just the past few weeks has come some interesting news.

Many have commented that the rise of China in manufacturing has been different than say the threat Japan appeared to pose to the US in the 1980s (and much touted itself, by the way). First, it was Japanese companies directly that posed the challenge, supported by its "industrial policy" the West lacked, and Japan's network of closely linked companies.

China, on the other hand, was fueled not so much by Chinese companies directly, but by Western companies hiring the Chinese to do the work - labor arbitrage. Many compounded the situation giving up much technological know-how to their emerging Chinese competitors through carelessness, short term thinking, or government coercion, but the results were the same regardless.

Other noted that the ease of going global today made it possible for China to exploit its advantages in ways other up and comer were never able to do in the past. Chinese intense "cost engineering" was also a potential mortal threat to many Western manufacturers.

Two weeks ago, however, William Fung, CEO of Hong Kong-based trading giant Li & Fung, said we will see some dramatic changes in China over the next five years, and he is someone who really ought to know.

He predicts that Chinese wages will rise 80% over the next five years - a dramatic jump. Ironically, China's turn to a major economy with double digit GDP growth has been perhaps the key factor in rising global commodity and food prices. Inflation is running about 5% there. The Chinese government needs therefore to keep wages rising to keep up with this inflation, or risk civil unrest.

Then last week, the respected consultants at Boston Consulting Group released a report predicting that by 2015 - just four years - all-in costs to produce and deliver goods from China to the US will be on par with making the goods in the US.

BCG says that by that time, Chinese labor costs will have rising from about 9% of the US average today to about 17%. That, plus a falling value of the US dollar versus the Yuan and other factors we will soon reach "a point of indifference between producing in the U.S. and producing in China," says the company's Hal Sirkin. (We will do a more in-depth review of this report in next week's On-Target newsletter.)

Interestingly, BCG says this will not be true for European countries, where wages are higher in the developed countries and workers are less mobile. BCG sees a lot more US-made cars being exported back to Europe for this reason (note to self: be ready for more labor strife coming to Europe over next few years.)

So just when we reach the point where both right (e.g., Donald Trump, Paul Craig Roberts) and left seemed to have come to level of agreement that the current trajectory must be changed, are internal developments in China going to make it something of a moot point, just as Japan's supposed world dominance in the 1980s soon faded from view?

I say no, or at best, just partially. While the wage impact will change the dynamic to a degree, people overestimate the role of blue collar wages, missing that lower Chinese overhead is at least as big a factor in the total Chinese cost advantage. China has been intentionally giving up on low value goods anyways, which it long ago recognized were headed to Vietnam and elsewhere at some point, and has been focusing on higher value goods for several years.

Paul Craig Roberts, a well-respected former Reagan administration official, told me a few weeks ago that "Globalism is an act of national economic suicide," as it has been practiced to date. I am not sure I would go that far, but it is very hard to argue it has worked in our favor (or in Europe and Japan and frankly most countries besides China).

Roberts told me he had endorsed Ralph Gomory's solution, "which is to tax US corporations according to where value is added to their product. If they add value in China with Chinese labor, a high tax rate. If in the US with US labor, a low tax rate."

Would the cure be worse than the disease? We will explore that in a few weeks.

What is your reaction to Gilmore's Rething China Part 2? Do you agree with Fung and BCG that this situation will largely take care of itself? Or is that an overly optimistic prediction? Would a tax on value add be a smart approach - or worse than the disease? Let us know your thoughts at the Feedback button below.

|