From SCDigest's On-Target E-Magazine

Feb. 29, 2012

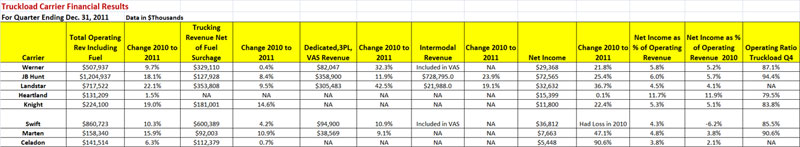

Logistics News: Truckload Carriers Again Enjoy a Solid Q4 and Full 2011, Our Exclusive Analysis Shows

Good 2011 Continues on in Q4, with Asset Discpline Remaining the Key to Higher Rates and Profits; Swift Lowers Deadheading and Adds EOBRs

SCDigest Editorial Staff

From being one the most beleaguered industries around in 2008 and 2009, truckload carriers have mostly been on a roll starting some time on 2010 and continuing on through 2011.

SCDigest Says: |

|

| Werner says it "continues to believe that favorable truckload demand trends are caused to a greater degree by supply side constraints limiting truckload capacity, as compared to growing demand generated by increased economic activity." |

|

What Do You Say?

|

|

|

|

Once again, SCDigest has analyzed the financial results and market comments released near the end of January from a number of leading publicly traded TL carriers announcing results for Q4 2011 and the full year. That analysis obviously leaves out a few large carriers such as Schneider National, which is privately held.

Next week, we'll look at LTL and rail carriers.

The story is much the same in the truckload sector for both the quarter and the full year: gradually rising freight volumes combined with strong asset discipline on the part of the carriers (in some cases caused in part by the on-going driver shortage) has led to increases in rates and the ability to be more choosy about what freight to haul, resulting in significant improvements in operating ratios and total profits.

In Q4, for example, as shown in the chart below, revenues in Q4 for the full group were up 14.8%, including fuel surcharges, which account for about one-third of that increase.

Profits were up strongly over Q4 2010 for everyone but Heartland, including a jump at Swift from a loss of $48 million to a profit of $36 million in Q4 of 2011 - quite an improvement.

Operating ratios (operating expense as a percentage of operating revenues) continued to move downward, decreasing 1-2 percentage points for virtually all carriers that provide this metric (we looked only at regular truckload carriage ratios, not dedicated services, brokerage, etc.). Most now range from about 80% to the upper 80s - a far cry from the 90+% the industry has often seen.

The carriers also in general are seeing much faster growth in their other businesses beyond pure line haul operations, such as dedicated carriage, logistics services, brokerage, etc., though we will note it is difficult to make clear comparisons because how each carrier reports this revenue is different.

View Larger Image Here

JB Hunt yet again saw incredible growth in its intermodal business, which rose about 24% to almost $729 million. It's bound to slow down sometime, but shows no signs of that fatigue yet, as Hunt said its intermodal load volume grew 17% during the quarter, compared with 13% growth in Q4 2010 (yet revenues were up even more at 24%).

That included growth in its Eastern network intermodal loads of an astounding 35%, while transcontinental growth showed a 9% improvement during the quarter.

(Transportation Management Article Continued Below)

|