From SCDigest's On-Target E-Magazine

Jan. 25 , 2012

Logistics News: Carrier CEOs Says Driver Pay Must Rise to over $60,000 - but will Shippers Come Along?

Would Represent about a 30% Increase over Current Pay, and Likely Raise Rates by 11%

SCDigest Editorial Staff

There is a growing sense of urgency about a current shortage of over-the-road truck drivers, with deep concern that the problem is likely to get much worse over the next few years, causing a capacity crisis in the industry not for shortage of tractors or trailers but the drivers needed to move them.

SCDigest Says: |

|

| Shippers could then expect freight rates to also rise by about 11% based on the increased driver wages alone, before any other cost factors. |

|

What Do You Say?

|

|

|

|

As we reported last week, the analysts at FTR Associates, a transportation related research firm, have estimated the driver shortage in 2012 will be about 180,000, with several pundits, such as transportation economist Noel Perry, saying that could rise to as high as 350,000 over the next few years. That would be similar to levels seen in the 2005 era, when the driver shortage played a strong role in the extreme capacity crunch that drove rates much higher and caused much shipper angst for nearly two years.

Now, the latest quarterly report from Transport Capital Partners, based on a survey of CEOs and other executives at truckload carriers, finds a strong majority of those executives believes average driver wages must rise substantially to retain an acceptable level within the industry and to attract more new drivers into the pool.

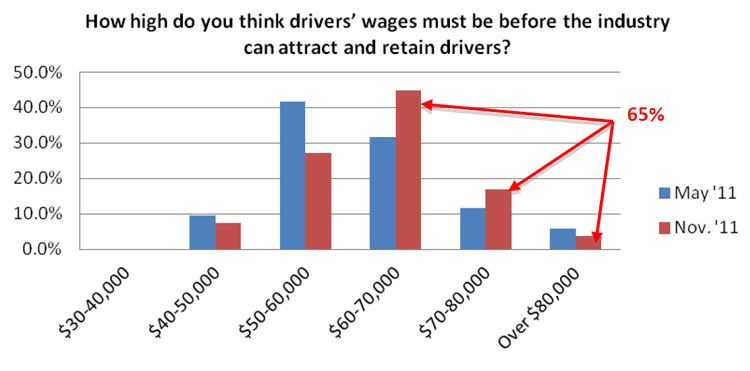

According to the just released Q4 2011 survey, 65% of the trucking executives surveyed said that wages must rise to more than $60,000 annually to attract and retain drivers. That's versus averages wages of about $48,000 in 2011, according to US Bureau of Labor statistics.

That 65% is up from 49% in the Q2 survey, meaning there has been a significant jump in just six months, as evidence continues to mount based on surveys and studies such as this one and the carriers' own experience trying to hire drivers that a real problem is emerging.

As shown in the figure below, a sizable percentage of trucking executives believes the wage level needed to go even higher to provide a sustainable level of drivers in the industry. A little less than one-third of those surveyed believe the wage rate needs to go above $70,000 annually to meet the industry's needs for drivers.

Survey of Trucking Company Executives

Source: Transport Capital Partners

(Transportation Management Article Continued Below)

|