As usual, there were some interesting comments from the carriers in their earnings announcements for the quarter accompanying the financials.

Werner, for example, noted the role of asset discipline across the industry as a key to its financial performance, noting that the "generally favorable truckload freight trends are caused to a greater degree by supply side constraints limiting truckload capacity, as opposed to demand generated by economic activity."

It added that it does "not believe that industry fleet growth is occurring, as some carriers are already struggling to finance the replacement truck upgrade due to the large pricing gap between the significantly increased costs of EPA-complaint new trucks compared to the low value of record-old trucks."

In its truckload segment, for example, Hunt said its tractor count was 2,605 compared to 2,793 in 2010. Knight was basically flat, with 3,939 tractors compared to 3,912 last year, with that small growth in the fleet coming mostly from trucks managed by owner-operators, which rose from 426 to 454 in Q3.

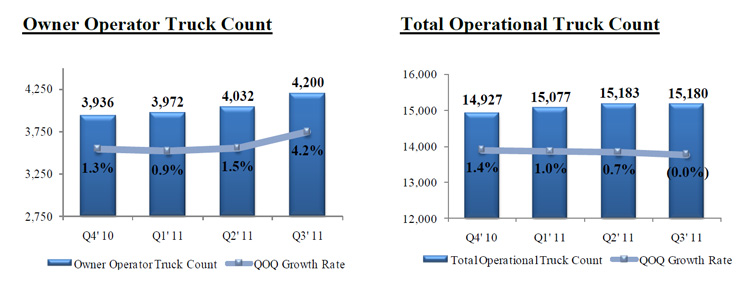

Similarly, as shown in the graphic below, Swift has seen its fleet growth be about flat over the past year even as frieght volumes recovered, while the owner-operator portion of that approximately 15,000 tractor total rose 4.2% in Q3.

Fleet Dynamics at Swift

Focus on Fuel

The carriers almost universally cited efforts to improve fuel economy in their operations.

Knight, for example, said it "continued to mitigate the effects of rising fuel expense by effectively managing our fuel miles per gallon with an intense focus on reducing idle time, managing out of route miles, and improving the driving habits of our driving associates," adding that it was also updating its fleet with more fuel efficient 2010 US EPA emission engines, installing aerodynamic devices on its tractors, and adding trailer blades on its trailers, which lead to meaningful fuel efficiency improvements.

Werner said it was able to improve its fuel miles per gallon by an impressive 4.9% in Q3 versus 2010, citing better control of truck idling; optimizing the speed, weight and specifications of its equipment; and implementing fuel enhancing equipment changes to its fleet as key elements of the improvement.

Celadon said it has "on-boarded over 2,000 new trailers with aerodynamic side skirts within the past twelve months, [so that] 27.1% of our trailer fleet is now less than one year old."

Effective rates seem to have increased about 3% in the quarter, with the generally tight capacity also enabling the carriers to shift business to more attractive and profitable accounts, driving the profit improvement.

Werner cited "contractual rate increases and a better freight mix," as the reasons behind its 3% increase in revenue per mile in the quarter. Meanwhile, JB Hunt attributed its strong growth in profits in its dedicated fleet business to its ability to "transfer assets to more profitable accounts."

Swift noted it has been able to steadily descrease the amount of empty miles it drives over the past few years, with the Q3 level of 11.5% deadhead miles down 1.2% over 2009.

Several of the carriers also cited growing concerns with driver shortages as a key issue, with Knight, for example, saying "We also feel our decentralized model, regional freight lanes, and strong utilization provides us a competitive advantage to recruit and retain experienced driving associates."

Heartland said its profit decline was in part due to challenges finding enough drivers, but noting that it "will not sacrifice safety and customer service for the sake of growing" by hiring drivers that do not meet its tough safety standards.

Next week, we'll look at LTL, rail, and parcel company results.

Any reaction to the Q3 truckload carrier results? Do you think the asset discipline will last for some time? Should improving fuel efficiencies be reflected in fuel surcharge levels? Let us know your thoughts at the Feedback button below.

|