From SCDigest's On-Target E-Magazine

- Aug. 22, 2012

Logistics News: Beleaguered LTL Carriers Finally Getting Healthy, as Q2 Rates Continue Recent Increases

All Five Carriers We Track Have Operating Ratios Under 100% for First Time in Many Quarters; Old Dominion Continues to Expand, Take Share

SCDigest Editorial Staff

It's time once again for our quarterly review of the earnings reports and conference calls of major carriers.

Over the last couple of weeks, we reported on the strong results from public truckload carriers, which you can find here: Truckload Carriers Once Again Post Generally Solid Q2 Results, as Asset Discipline Continues to Pay Off, and the rail carriers, which can be found here: Rail Carriers Enjoy Solid Q2 Results Despite Collapse of Coal Shipments.

This week, we end our Q2 reviews with the less-than-truckload carriers.

With the exception of Old Dominion, the LTL sector has struggled mightily in recent years (longer than that, many would argue), with YRC Worldwide having a near death experience in 2009 to 2011, and most other LTL providers losing money over the same period. The LTL sector continues to be highly fragmented, giving an edge to shippers in terms of supply and demand balance, which drives down rates.

However, the carriers have been working on networking efficiences and other improvements to reduce costs and improve yields, and the last few quarters have seen the carriers get back some level of pricing power, with contactual rate increases in the 4-5% range each period year over year.

As a result, as a group in Q2 among the five publicly traded LTL carriers we track, all but YRC Worldwide made a net profit, and YRC itself made $15.5 million in operating income. That's the first time that has happened at YRC (with the exception of one quarter that was impacted by an unusual financial transaction) since Q3 of 2008.

All five carriers also had operating ratios (operating expense divided by operating revnues) of under 100% - the first time that has happened in quite a long time.

Still, overall profitability is still weak across the sector, and far below the truckload and rail sectors generally.

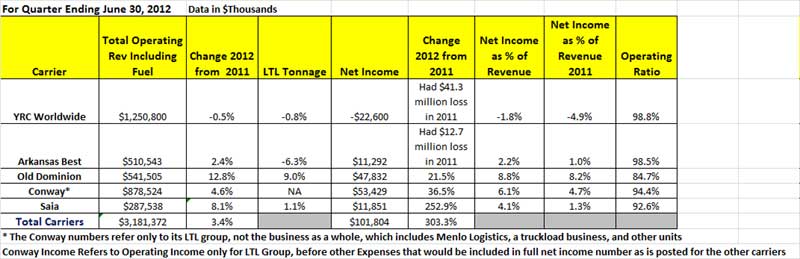

LTL Carrier Results Q2 2012

See Larger Image

Of course, Old Dominion continues to blow away the field with its performance, sporting an 84.7% operating ratio that compares with the results of the better run truckload carriers, and continued gains in market share, with tonnage up another 9% in Q2, versus flat or negative changes in tonnage hauled by the other carriers.

Saia saw both revenue and profits soar in Q2, though tonnage was up just 1.1%.

Arkansas Best/ABF managed to return profitability after a number of quarters of losses, but keeps losing a lot of tonnage in recent quarters, which was acknowledged but not really explained in its Q2 earning release.

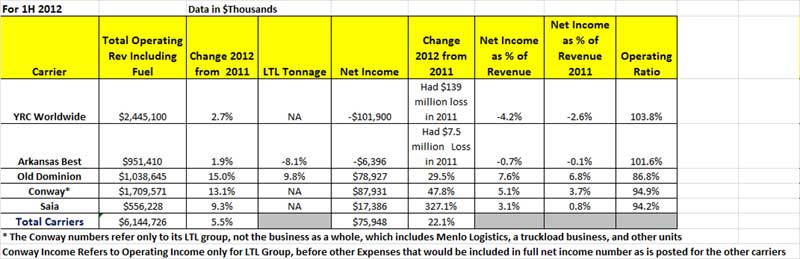

The results for the full half of 2012 are not as strong as Q2, with the usual exception of Old Dominion, meaning things got much better in Q2 for the group versus Q1, which itself marked improved results over previous periods for most of the group.

LTL Carrier Results 1H 2012

See Larger Image

(Transportation Management Article Continued Below)

|