From SCDigest's On-Target E-Magazine

Sept. 28 , 2011

Supply Chain News: A Comprehensive View of Opportunities and Risks for US Manufacturing

US Manufacturing at Inflection Point, Needs "Wake-Up" Call to Head Back in Right Direction, Report from Booz & Company Says

SCDigest Editorial Staff

After a "lost decade," US manufacturing is healthier than many believe but still at an inflection point, with its path forward hanging in the balance, say consultants from Booz & Company in a recent article in the firm's Strategy + Business magazine.

Arvind Kaushal, Thomas Mayor, and Patricia Riedl say that right now the US needs a "wake-up" call to revitalize its manufacturing sector, and that smart moves "could lead to a robust, manufacturing-driven economic future." The alternative is for manufacturing to decline much more rapidly than has been seen even in recent years.

SCDigest Says: |

|

The authors also say that labor costs are an increasingly unimportant consideration in where to locate a new factory, or expand a current one. Instead they cite these four critical factors.

|

|

What Do You Say?

|

|

|

|

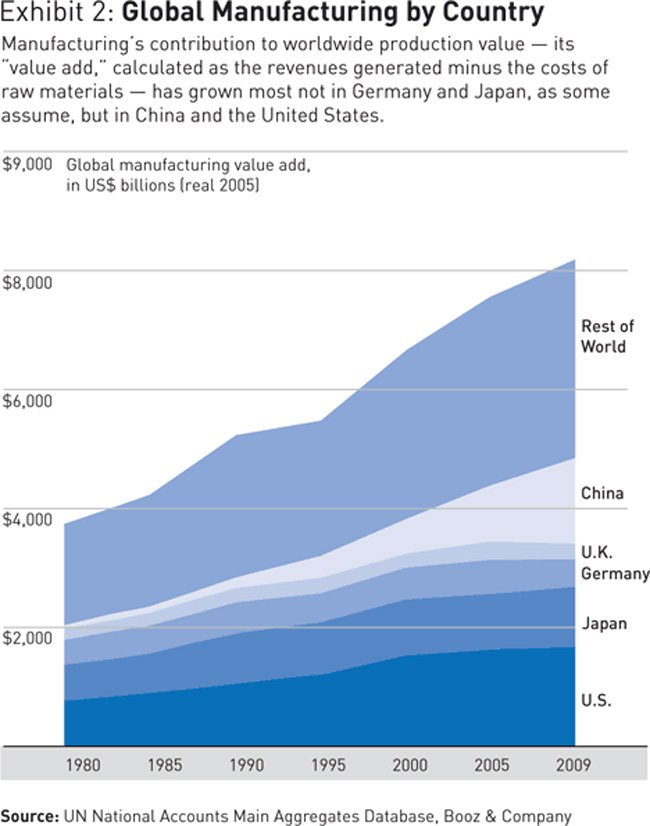

They note, however, that the trend over the last decade or so has not been good. While in the 1980s and 1990s the US saw competitiveness issues and lost plants and jobs for a few sectors such as autos and apparel, all told US production levels remained strong. Between 1980 and 2000, production jobs fell by only 0.5% annually, and the U.S. outperformed both Germany and Japan in the value of manufacturing output as a percentage of global production (see graphi below).

But things began to change dramatically about 2000. U.S. manufacturing output as a percentage of global production fell sharply, and the ratio of exports to imports, a critical sign of manufacturing viability, also fell. The number of manufacturing jobs dropped as well, by 4.3% per year.

These declines obviously coincided with the rise of China, its entry into the World Trade Organization (WTO) in 2001, and the mainstreaming of the concept of "low cost country sourcing" over the decade.

However, Booz & Company says there are important changes on the horizon. For example, In a general sense, global manufacturing is moving to more of a local/regional orientation versus a global one. Large multi-nationals are tending to move production closer to major markets. That surely means US and other Western countries may build factories in China and elsewhere to serve say Asian customers, but that the offshore approach to serving the US market may start to lose some favor.

"This type of region-oriented footprint is a clear way to provide adequate scale and volume, minimize transportation and logistics costs, increase market responsiveness and innovation, and customize products for the unique preferences of different regions and cultures," the authors say.

Source:Booz & Company

The authors also say that labor costs are an increasingly unimportant consideration in where to locate a new factory, or expand a current one. Instead they cite these four critical factors:

1. The skill level and quality of factory employees, especially for high-tech facilities.

2. The presence of high-impact clusters, in which many companies can learn from one another and innovate more readily.

3. Access to nearby countries with emerging consumer markets and lower-cost labor (for the U.S., this means building a future with Mexico).

4. A reasonably competitive regulatory and tax environment (for the U.S., this means simplifying and streamlining the current tax and regulatory structure).

(Manufacturing article continued below)

|