State of the 3PL Union 2023

Each year in late June, we get the State of Logistics Report from CSCMP, which I summarize under the banner of "The State of the Logistics Union."

Every year in early fall we get the annual "3PL Study," released at the CSCMP conference. And so it was again this year with the 2023 study, now in its amazing 27th year, all under the leadership of my friend Dr. John Langley of Penn State.

So this week you get my summary of the 3PL report (we read more so you can read less), which I might as well title the "State of the 3PL union," as it really is a fine compendium of many data points from the logistics service provider sector - though with some substantial changes in this year's report.

| GILMORE SAYS: |

WHAT DO YOU SAY?'

This year, again 94% of shippers believe 3PL IT capabilities are a very important factor in success, while only 54% are satisfied with those capabilities, down from 58% last year.

Send us your

Feedback here

|

This theme for 2023: "Back-to-Basics."

The consistent Langley's leadership has lately been pared with somewhat changing sponsor mix. This year's report was sponsored for the second year by consulting and technology firm NTT Data and long-time sponsor Penske Logistics. Without the sponsors the report wouldn't happen, so they are worthy of some public recognition.

Since I knew I could get a copy of the report later I didn't attend the CSCMP Edge conference presentation on the study, but it is usually very well attended. The interest in logistics outsourcing obviously remains high, and nothing pulls the current dynamics together like this study.

I will note that last year the pdf report was marred by having very fuzzy charts, but thankfully that glitch was gone this year.

The report is based on an email survey and focused interviews with shippers and 3PLs/4PLs on a global basis, though a majority were from North American sources, but without specific numbers for share by country. I could also not find a count for total survey respondents, which totaled 354 last year.

As I can attest from our work here at SCDigest, getting people to complete surveys is increasingly difficult.

For many years, the report has provided a set of survey data and then related discussion across a set of "special topics" that vary in number from year to year.

The survey questions and related charts have largely stayed about the same in the main section.

There are quite a few the special topics this year, and there are many pages covering each of these subjects, leading to a whopping 85-page document. The special topics, following a section on "Back to Basics," are as follows:

• Understanding the Talent Crisis

• Tapping into the Potential of Reverse Logistics

• Maturity of ESG

• Rebalancing Underway

• Continued Demand for Cold Chain

• Technology as the Differentiator

• The Driver and Maintenance Technician Shortage

There are even sub-topics and sub-sub-topics within the specialty topics, with "control towers," for example, making it in as a section (as it always does) under another sub-topic on supply chain resilience. I will try sort all this out next week.

This year, the special topics each get their own, sometimes very different survey questions and charts. Example: I believe there is a brand new question in special topics on shipper plans for rebalancing inventory levels.

I will summarize today the main general data points and insights, and visit the specialty topics next week.

For reasons not clear, the percent of shippers that said their relationships with their 3PLs generally have been successful fell to 83%, down from 90% last year. As is typical, almost all 3PLs (99%) believe their customer relationships are working.

The percent of total logistics expenditures directed to outsourcing rose a bit to 42%, after surprisingly falling to just 40% last year on average and compared to 53% the year before that. I said last year that I had a hard time believing the drop if any was really that sharp, but we now have a similar number for two years in a row.

"A likely reason for this drop in total [outsourced] logistics expenditures is a lack of full capacity in the supply chain," the report says."

There were some other anomalies in the data. The report, for example, found the percent of companies outsourcing warehousing fell from 63% last year to 43% this year.

I a m sorry but numbers like this simply do not change that much in a single year. I am wondering if it was to due changes in the mix of respondents, perhaps by country or size.

Domestic transportation management again came in as the most outsourced function, at 69 % of respondents, followed by freight forwarding at 60% and international transportation at 52%.

An interesting chart in the report shows responses from shippers and 3PLs to a series of questions relative to their relationships - and as can be seen, there are some different perceptions between the two groups.

Source: 3PL Study

As an example discrepancy, as you can see almost all 3PLs (89%) believe the percent of companies increasing outsourcing is rising, while a much lower 55% of shippers feel that way. Similarly, 92% of 3PL users say that 3PLs provide new and innovative ways to improve logistics effectiveness, versus a much lower 71% of shippers believe 3PLs are providing that value.

Another large discrepancy came on the topic of whether shippers are collaborating with other companies to achieve logistics cost and service improvements. A strong 86% of 3PLs agreed, versus just 52% of shippers. I don't believe it's even that high.

There was alignment, however, on this: 75% of 3PLs say shippers are reducing or consolidating the number of 3PLs they use, while 71% of shippers believe this is a trend.

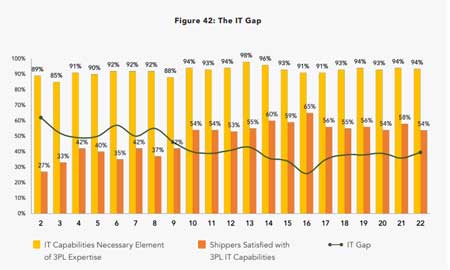

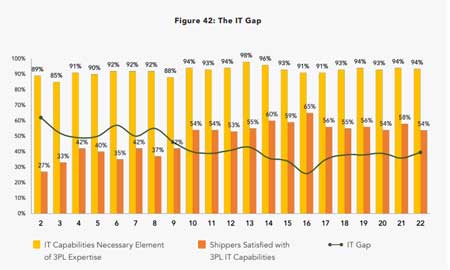

SCDigest is always interested in the dreaded "IT Gap," which the report has been following for many years. That gap refers to the percentage difference between how shippers place 3PL IT capabilities in terms importance (always very high, usually in the low 90s in terms of percentage), versus their view of actual 3PL IT capabilities, always with a much lower score.

For years the IT Gap was large but shrinking. However, for reasons that are unclear, it spiked back up six years ago and stayed there, as seen in the chart below:

This year, again 94% of shippers believe 3PL IT capabilities are a very important factor in success, while only 54% are satisfied with those capabilities, down from 58% last year.

Interestingly, the report doesn't say that gap is isn't "stuck in neutral," as it did last year, but rather "it could be that expectations are consistently increasing and evolving as new solutions are emerging and the supply chain transitions into digital."

There is probably some truth in that. My view is that some 3PLs still try to get by with aging, often home-grown technology that is simply far out of date. There is some complexity here, because if in the middle of a contract with a given shipper or multiple shippers, introducing new technology raises some issues. Even the shipper may not want to upset the apple cart.

But I also believe that many 3PLs that have deployed modern technologies often do not fully use those capabilities or cannot present them in a way most convincing to shippers.

I am out of space. The full report available for free download with registration here. It is as usual a solid effort and worth a read, but it's too long, and the report again left out the data it used to have from non-3PL users, e.g., why they don't outsource, which I found interesting.

A look at the special topics in the report next week.

Any reaction to this data from the 3PL report? Let us know your thoughts at the Feedback section below.

|