|

February 20, 2015 - Supply Chain Flagship Newsletter |

|

| FEATURED SPONSOR: PROMAT 2015 |

||

|

||

|

||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

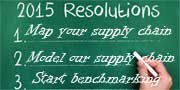

Map your Extended Supply Chain: Our collective supply chain eyes were opened in 2011 as a result of the earthquake/tsunami in Japan, and then severe flooding in Thailand that decimated key suppliers in the high-tech sector. Both events exposed risk, often further back in the supply chain, that companies did not realize existed - for example a dual sourcing strategy made irrelevant when both suppliers were in the same heavily damaged regions of Japan or Thailand. The head of procurement for Toyota and its vaunted supply chain said: "Our assumption that we had a total grip on our supply chain proved to be an illusion," in one of the great supply chain quotes of all-time. He also suggested I might have emphasized the increasingly important global trade management requirements (and penalties) and how they have become core supply chain competencies that must be mastered. The result: a multi-year Toyota effort to map its full extended supply chain, down to the tier 3 and 4 level. Such a project can be a huge effort, but once complete is much easier to maintain than compile initially. Such an effort will not only expose unknown risks but lead to better overall understanding of your supply chain and - if done right - can be used for other insights, such as demand sensing, as contract manufacturer Flextronics does with its upstream, indirect suppliers. It may be time for you to start such a project tis year. I firmly believe companies doing this have a significant competitive advantage over those which do not, and that the ROI from a small team of full-time network analysts - maybe even just a single person - is very high. Yet most won't still yet make the investment. In a complex dynamic world, with oil prices falling by 50% in a matter of months, the US dollar rapidly gaining strength, lots of complexity and more, a model of how your supply chain works that can be used to answer questions and make optimal decisions is no longer a luxury. I recommend you start building your model in 2015. Develop a Talent Strategy: Do you really have a plan for finding and developing supply chain talent? A few leaders do - but not many. A few years ago, Pepsico took a look at this - and wasn't happy with what it found. Succession planning was poor, usually just at the very top levels, and it turned out often the same person was slotted as the successor for a whole bunch of positions. There was no real development plan to get current managers the additional skills they needed to move up the ladder. Start Benchmarking: In general, we do far too little benchmarking in the supply chain. I am referring not just to maybe participating in some survey or service that allows you to compare your results (sort of) with those of others, but meeting with companies to see how they do things, and swap and compare ideas and practices.

So pick up the phone and set up a visit time with some company say 50 miles or less from your place of business. For most, there will be many such opportunities. If you have to go a little further, it will still be worth the effort. You should resolve to do this at least twice a year - and offer to reciprocate the service for others as well. After a few years of doing this important but not urgent task, I almost guarantee you will have learned some valuable insights and ideas. The only real barrier is inertia. Review Your Technology Portfolio: Do you know exactly what software you have where? Do you have any "shelfware," meaning software you paid for but never implemented, either in total or at certain locations? Do you have options in your contracts with existing vendors for additional products that you have never exercised? All these are issues for many companies, especially global ones, who often have all kinds of different software and contracts across the world. Let 2015 be the year you get on top of all of this - do a complete supply chain technology portfolio assessment. You may just find you own some things you didn't realize. It may be possible to convert an option for a traditional solution into a newer-Cloud-based version. And on a related note, it's almost always a good idea to have existing software vendors send in an expert to see how you could get more out of what you have now. Smart companies do this regularly - but most unfortunately do not. Paint a Vision for becoming Demand-Driven: In the early 2000s Procter & Gamble came up with the "consumer-driven supply chain" concept, which the then AMR Research morphed into its demand-driven supply networks. Rightly or wrongly, it has always had a sort of consumer goods focused orientation, generally involving use of POS data to "pull" the rest of the supply chain. But I think even many consumer goods companies aren't quite sure what demand-driven really means or what it takes to get there - and becoming demand-driven certainly applies to many more than companies in just that sector. Let 2015 be the year you a least start the process of mapping out what a demand-driven supply chain really means to your industry and your specific company. I don't think many companies have actually documented that end state vision. That effort may just crystallize a road map of where your supply chain should be headed over the next 3-5 years. Start Lunch Time Education Meetings: I know a few companies - Campbell Soup used to be one of them and maybe still is - that hold weekly or monthly Friday "brown bag" lunch days focused on education. Could be an internal team member presenting insight into their area of operation. Maybe someone from finance comes in and explains cash flow. Some have commented to me that sometimes watch SCDigest videos of interest and then talk about what they saw. Whatever it is, I think this is a great idea for team building and knowledge gaining. People in supply chain are so busy these days they often just can't keep up with developments outside their immediate work responsibilities. A well-led brown bag Fridays program can really pay off at no real cost - think about launching one in 2015. I am out of space, but think those are a pretty good list of supply chain resolutions for 2015. Pick a few off and run with it. Any reaction to Gilmore recommended supply chain resolutions for 2015? What would you add? Let us know your thoughts at the Feedback button or section below. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

YOUR FEEDBACK

We received several emails from last week's column on "Supply Chain Predictions 2015 from the Analyst Community, some of which we publish below.

Feedback on Supply Chain Predictions 2015 from the Analyst Community:

I agree with Gartner's prediction that companies will get more disciplined about demand planning which will likely lead to the creation of more chartered demand planning organizations. Best practice companies have had such organizations for year but more companies are starting to realize that they need a longer horizon demand plan.

John Bermudez Infor |

||

| More on Supply Chain Predictions 2015 from the Analyst Community: | ||

Good article. In the past year, I have done webinars, blog posts, and presentation on a "Demand Management" organization and that companies need a Chief Demand Management Officer. Traditional S&OP or IBP processes have been constrained by politics and lack of day to day analytics. That's changing with Web 3.0 and the development of new tools As always, you are providing great insights to the supply chain community.

Richard J Sherman

|

||

Fantastic job summarizing predictions from these analysysts. I know how hard it is to do what you do wit things like this, and you make it look easy. Will 50% of supply chain executives be gone by 2018? Could be - executive turnover is rising at every position, and that has to include supply chain. But I do agree the future supply chain leader will be much different from today's model, and that many current CSCO's will not be able to adjust. How many will see the need to do make those adjustments - and how many will not really be able t look in the mirror and seen the reality of what needs to change? Dennis Wilson Huntington, AL

|

SUPPLY CHAIN TRIVIA ANSWER

Q: What is UPS's average price to move a parcel via ground in the US?

A: $7.53 for 2014 - the average for overnight shipments is $20.13, by the way. Businesses get much better rates than consumers.

| © SupplyChainDigest™ 2003-2015. All Rights Reserved. SupplyChainDigest PO Box 714 Springboro, Ohio 45066 |

POWERED BY: XDIMENSION

|

Ok, if you're Kroger then Publix is unlikely to welcome you in with open benchmarking arms, but you would be surprised how open most companies will be to the idea. And there can be great value in seeing how companies in almost any sector do certain things. For example, how a chemicals company does sales & operations planning might certainly provide some insight to a consumer goods company. It used to be the firms from all sorts of sectors trouped up to Maine to see how LL Bean handled individual piece picking in its DC. Maybe they still do.

Ok, if you're Kroger then Publix is unlikely to welcome you in with open benchmarking arms, but you would be surprised how open most companies will be to the idea. And there can be great value in seeing how companies in almost any sector do certain things. For example, how a chemicals company does sales & operations planning might certainly provide some insight to a consumer goods company. It used to be the firms from all sorts of sectors trouped up to Maine to see how LL Bean handled individual piece picking in its DC. Maybe they still do.