Always anticipated, yesterday saw the release of the annual State of Logistics report at the National Press Club in Washington DC.

Each year in June, the report (now sponsored in part by the CSCMP) aggregates a variety of data to provide an overview of the prior year’s logistics activity and spend.

The very appropriate report title for this 2010 effort: The Great Freight Recession.

Yesterday, we put out a quick video summarizing key elements of the report, and received a number of nice comments on it – that 10-minute video can be found here: State of Logistics Report 2010 Instant Review and Comment.

Today, I will provide a bit more of the details and add some commentary.

Before I do that, just a bit of history: this is the 21st such report, an effort started in the late 1980s by the late Bob Delaney and sponsored by his company at the time, Cass Logistics (now Cass Information Systems). Somewhere along the way, CSCMP took over the sponsorship, and in the late 1990s Rosalyn Wilson, who has a long career in the logistics industry and is now at consulting firm Delcan, began to support Delaney in his efforts. Upon his passing, Wilson took on the challenge alone, largely keeping the existing methodology.

Gilmore Says:

|

|

"My prediction: Logistics costs as percent of GDP will be about 8% next year."

What do you say? |

|

Send us

your Feedback here |

|

This year’s report was for the first time sponsored by Penske Logistics, which filmed the event and has plans to leverage that video in a number of ways, including film of the executive panel that discussed the report at the press meeting.

The report should also be available soon, if not already, at the CSCMP web site, though only free for members. Cost for non-members is $385.00, though the reality is that if you want a copy, it’s not all that hard to find some way to get hold of one.

The report tracks total logistics costs/spend in the US, which incorporates three main components:

- Inventory Carrying Cost, including warehousing costs

- Transportation (representing some 62% of total logistics costs, as measured by this report, of which trucking is the vast majority at 78% of total transport costs)

- Logistics administration (IT costs and such)

It was indeed The Great Freight Recession in 2009, and though most of us are familiar with the story and even many of the details, it was good as always to have it put all in one place. In total, logistics costs in 2009 were equal to about $1.1 trillion – that’s a drop of $244 billion (or 18.2) over 2008. Over 2008-09, total logistics costs dropped about $300 billion.

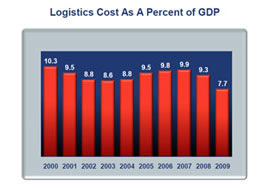

That left logistics costs as a percent of GDP at a mere 7.7% - the lowest share of GPD in the 21 years of the report. And this after logistics costs had indeed risen by some 50% over the five years prior to the start of the recession in 2008. (See graphic below). That 7.7% is against 9.7% of GDP in 2008, and 9.9% in 2007.

See Full Size Image

This is truly an astounding change of direction, and one that is most likely a once in a lifetime type occurrence. Of course, at one level if you are a shipper that may have been good news, as transportation costs plummeted, but since it was the direct reflection of a terrible economy, that happiness was surely muted. The real fortunate ones, it now occurs to me, were the lucky few, such as many private label manufacturers, who both saw strong volumes in the downturn and enjoyed the rock bottom rates.

How did we get here?

- Inventory carrying costs: down 14.1% as a result of lower total inventories (-4%) and lower carrying costs (-10%) due mostly to lower interest rates.

- Transportation costs: down 20.2%, as spend in nearly every mode was down about 20% or more. It was no surprise a combination of both lower volumes shipped and lower rates and fuel surcharges, as diesel prices plummeted. For example, trucking costs were down more than 20% though tonnage was down a much less 12.5%.

Of course, many US carriers were said in 2009 to be taking freight at or below their costs to operate the truck (ditto for many ocean carriers). What occurs to me is that those operating private fleets wouldn’t have seen their costs decline by nearly as much as those using all common carriers, as it is unlikely they started cutting driver and mechanize wages, etc. (even if they likely did lay a number of them off). Something to consider.

Some other important data points from the report from my view:

- The trucking industry lost some 2000 firms in 2009, amid predictions for another 2000 failing this year. That was 12.5% of total capacity lost in 2009.

- Heavy truck utilization currently is still at only about 75%, so don’t expect many carriers to be buying more trucks any time soon.

- The report included an interesting graphic that showed how late the US was this time to pare inventories versus the last major recession in 2001 (see Supply Chain Graphic of the Week nearby). One likely cause: the growth of offshoring since then, with much longer supply chains and often the need to place orders months in advance.

- Rail carriers idled some 500,000 cars by mid-2009, a level which fell just barely to 450,000 idled cars by the end of the year. That represented some 32% and 28% of their car totals, respectively, an incredibly high percentage versus the normal 2-3% that are idle during normal economic times.

- Thousands of locomotives were also parked, leading in total to some $43 billion in assets sitting idle. What is ironic, as I noted in the video, is that the rail industry historically has had among the worst average returns on invested capital of any sector. Not long after that began to turn around prior to the recession, they find they have billions in unproductive assets (though some of this was pushed off to the leasing companies).

- About 25% of existing total ocean shipping capacity was idled in 2009 – but since ships ordered in prior years kept coming, that didn’t help rebalance capacity very much. As a result, rates fell precipitously, and the ocean carriers did everything they could to cut costs, including so call “slow steaming” to save bunker fuel. And that impacted service dramatically – the report notes a study by Drewry Shipping Consultants that found only 53% of 1600 voyages in tracked in Q4 2009 arrived on time.

- In the area of 3PLs/brokerage/freight forwarding, the domestic transportation management segment was off 14.7% in 2009, while the international segment fell 25.2% and dedicated contract carriage declined 15.2%.

The question of course is what lies ahead, and the report ends on a cautiously optimistic note in terms of the overall economy, even if that does translate into higher costs for shippers. Manufacturing has rebounded by any number of measures. Ocean rates have clearly been heading much higher, while Global Port Tracker has forecast that TEUs will be up 25 percent for the first half of the year. Idle rail cars are now down to 23% of the total, indicating rail volumes are rising.

My prediction: Logistics costs as percent of GDP will be about 8% next year.

Two mild critiques of this always fine effort: I wish the report would more specifically factor in changes in the product versus the services economy. With services in general growing more rapidly than product/manufacturing, and I believe having fallen less in the recession, it may in fact somewhat under represent the relative change in logistics costs for product companies.

Second, in many prior years, there was some additional theme beyond the raw numbers (“infrastructure challenges” come to mind) that offered some additional interesting commentary. That was gone this year as I believe it was last year as well, maybe because the theme simply was the Great Freight Recession, or maybe there just isn’t time or bandwidth to include it these days. But it added a lot to the report, in my opinion.

That’s our take – would love your Feedback.

What’s your perspective on this year’s State of Logistics Report? Any numbers surprise you? Will we ever see a year like 2009 again? Whar are your predictions for logistics costs as percent of GDP in 2010? Let us know your thoughts at the Feedback button below.

Web Page/Printable Version of Column

|