Accenture Research Says Recessions Separate Winners and Losers

That view is very much supported by research on what happens after recessionary periods.

The research was initially first performed following the rough 1990-91 recession, but dusted off more recently by the company to remind executives of the ultimate stakes.

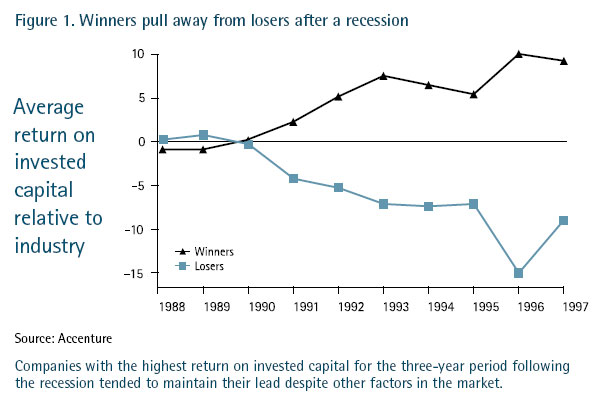

As seen in the figure below, Accenture found that in terms of one critical corporate financial metric, return on invested capital (ROIC), recessions tend to divide companies onto “winner” and “loser” tracks that maintain themselves for many years after the recession ends.

“This correlation shows that companies that pull away from the competition during a downturn have lasting advantages, not just a fragile edge,” the report notes.

What attributes and actions characterized these winning companies? Accenture notes the following, most of which, while focused at a more general business level, have direct supply chain implications or parallels. Winning companies:

Set priorities based on detailed knowledge of how the company creates value: Winning companies did not just cut costs— they cut the right costs. They diverted resources to activities that actually created value. These companies did not just make across-the-board, indiscriminant cuts that impacted service and how the company created and delivered value to themselves and their customers. That takes detailed knowledge and analysis of what really matters in terms of value creating and competitive advantage.

Leveraged information systems: The winners had better IT going into the recession, and used that or acquired new capabilities to better model the new conditions and make adjustments as the economy improved. Just as important, they actually used this intelligence to make better decisions than the losers.

Collaborated with customers to improve value propositions: The winners of the last recession reached out to customers to better understand their challenges. Gathering this information allowed the companies to create new products and services that were uniquely suited to the pressures customers were facing during the downturn.

Priced for profitability: Winners worked themselves into an advantaged cost position during good times, and then used their pricing flexibility to pick up market share in a downturn. Interestingly, winning companies walked away from bad business during the downturn – while losers did not.

The bottom line: while most companies have needed to hunker down during this deep recession, there are smart and not so smart ways of doing it – and big stakes for those who plan right for recovery.

Do you like Dr. Langley’s NASCAR analogy on how the recovery and companies will play out? Are you surprised at all by the Accenture research? What should winning companies be doing or planning now in supply chain? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |