SCDigest

Editorial Staff

| SCDigest Says: |

The supplier should be a critical, strategic supplier, and truly need the financial assistance. The supplier should be a critical, strategic supplier, and truly need the financial assistance.

|

In these challenging times, a growing number of companies across industry sectors are concerned about the health of their suppliers.

A growing number of companies are looking at various financing options, ranging from loans, purchasing raw materials on behalf of suppliers, and shortening payment terms. (See If Suppliers are Struggling Financially, What Should Procurement Organizations Do?)

But in which suppliers should a company consider making such investments?

It goes without saying that the supplier should be a critical, strategic supplier, and truly need the financial assistance. But do procurement organizations have that analysis at the ready and updated as times and conditions change?

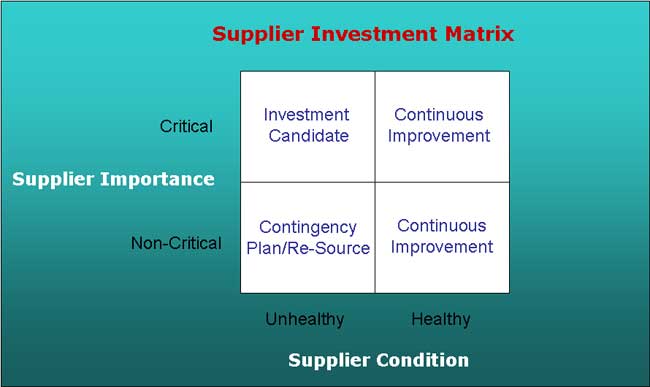

The graphic below is a simple matrix that can be used to segment suppliers based on their strategic level and current operational and financial health.

In normal times, the “Health of the Supplier” evaluation can refer not only to financial health, but also other attributes, such as reliability, process excellence, and quality. A critical supplier could have problems with these basic operational issues that make it “Unhealthy.”

(Sourcing

and Procurement Article - Continued Below)

|