SCDigest Editorial Staff

| SCDigest Says: |

With the financial crisis, those letters of credit have been extremely hard to come by. When that happens, global commerce slows to a crawl, further reducing demand for ships and containers. With the financial crisis, those letters of credit have been extremely hard to come by. When that happens, global commerce slows to a crawl, further reducing demand for ships and containers.

Click Here to See Reader Feedback |

As we reported recently in Supply Chain Digest, ocean shipping rates have been in a free fall since the start of the financial crisis, in some cases dropping to the variable cost the carriers have moving the ship. (See Financial Crisis Hits Ocean Shipping Too, as Rates Plummet.)

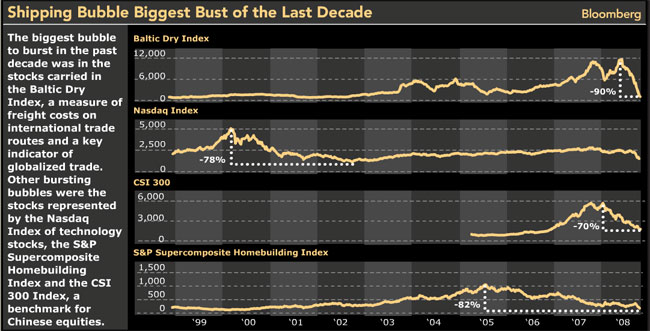

Now, some are calling the rise and fall of ocean shipping rates another “bubble,” and maybe the biggest bubble of them all, even more than housing, oil, and other areas that rose fast and fell even harder over the past several years.

As shown in the graphic below from the Bloomberg news service, the Baltic Dry Index (BDI), which is used to measure the basic cost to ship various commodities across the globe, as of last week had dropped an amazing 90% from its peak levels reached this summer.

Is the index somehow not reflective of real changes in shipping rates? No, it appears that in this market, spot rates really have plummeted to these sorts of levels from their peaks.

Writing in London’s Financial Times, John Dizard found that “Ships really are that cheap. As one broker told me: “I just chartered a Handymax to go to the US Gulf from India for $1,000 a day. So the BDI really is pretty accurate.” A Handymax vessel would typically displace about 40,000 deadweight tons. You would notice it if it dropped anchor near your dock. The cash operating costs are at least $1,500 to $2,000 per day. On top of that, figure another couple of thousand dollars a day for the capital costs.”

How could this be?

Part of it is obviously general economic contraction, and the laws of supply and demand coming into play after several years of the ocean carriers adding tremendous capacity chasing what appeared to be never ending growth in global trade.

But there is something else going on as well. Global trade hinges hugely on the availability of letters of credit, in which one financial institution agrees that it will accept the credit risk of an individual importer or exporter, for a fee.

Source:Bloomberg News

(Global Supply Chain and Logistics Article - Continued Below) |