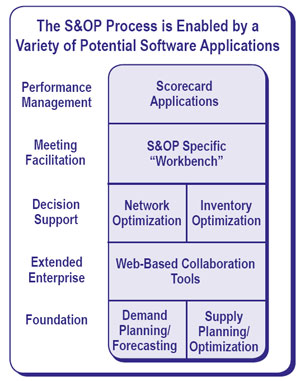

Following upon support for demand planning, tools that optimize supply planning then also become a critical foundation of S&OP. Without such tools, it is a much more difficult task to really understand how the supply organization can deliver against the demand plan – and to well understand the constraints that need either to be resolved or considered in revising the baseline forecast.

Effective S&OP processes are almost always based on a solid foundation of demand and supply planning technology.

Collaboration Tools Collaboration Tools

Most companies agree that achieving consistent input on demand from sales, channels and customers is critical to a highly effective S&OP process. Technology can make a significant difference in achieving that goal.

Many supply chain software vendors now offer web-based applications that provide strong support for collaborative forecasting processes. This can range from relatively simple tools that are very easy to deploy and use to those that provide technology support for rigorous processes such as Collaborative Planning, Forecasting and Replenishment (CPFR).

In some cases, these capabilities may be built into the demand planning application, in others it will be a separate model. In either case, companies should look for the same type of flexible workflow capabilities that are part of most of today’s better demand planning tools. Regardless, “collaboration” internally and externally is a different process, and so supporting tools should be evaluated in that light.

Network and Inventory Optimization Software

Because S&OP is heavily strategic in nature, and because of the increasing need for dynamic, flexible supply chain networks, a small but rapidly growing number of companies are finding significant value in incorporating input from supply chain network planning and optimization tools as a critical component of the process.

Network planning tools provide tremendous value in allowing companies under different forecasts scenarios to understand such issues as:

- What its supply chain network design would or should look like?

- For the given forecast, what actions should be taken to improve the supply chain performance?

- What would be the trade offs between cost and customer service?

- How the plan would impact overall supply chain costs and hence profitability?

- How to optimally plan new product introductions and end-of-line strategies?

Supply chain leaders such as Dell and Frito-Lay have been aggressive in using output from supply chain network planning tools as part of the S&OP process.

An increasing number of companies are also more explicitly bringing inventory decisions into the S&OP process (SIOP). This in turn is leading more companies to also use the related category of multi-echelon inventory optimization applications to support S&OP.

The fundamental question to be answered: What are the right inventory targets for multi-tier supply networks based on supply and demand variability?

While taking the step of more specifically including inventory as part of the planning processes will inherently improve inventory decisions, the scale of this analysis for large companies is daunting. Inventory optimization technologies are proving valuable in this effort for many organizations.

Workbenches and Analytics

The S&OP process requires understanding and balancing of a wide variety of inputs and trade-offs.

To do this effectively requires participants both in the “pre-S&OP” meeting and executives in the final S&OP meeting to be able to easily visualize this information, and understand the impact of various alternatives.

In the end, every company uses an S&OP “workbench” of some type. Some use a tool created internally using spreadsheets. Spreadsheet-based tools have many well-known challenges, from data synchronization issues to either having too little data or being too large and complex for decision-makers to navigate.

As you would expect, an increasing number of supply chain software companies have also develop package workbenches that are meant to specifically support S&OP processes and analysis.

These workbenches typically provide the following types of capabilities:

- A consolidated view of all pertinent data for each forecasted item (sales, forecasts, inventory, run rates, etc.)

- The ability to easily consolidate date from multiple sources

- Support for constrained versus unconstrained supply and demand plans

- Flexibility to easily look at the data over a variety of time buckets (monthly, quarterly, annually, etc.)

- A strong visualization component

- The ability to perform scenario analysis (e.g., what is the impact if sales from the new product cannibalize sales of an existing product more than we expect?), and analyze the impact of risks and opportunities

- Support various strategies around new product introductions and end-of-life decisions

- Analysis of profitability by channel and customer

- Robust ability to support financial projections, including the impact on the bottom line and key financial metrics such as cash flow and return on capital

These are just a few of the key features – these workbenches can often provide very deep and granular levels of functionality. What is important to consider in looking at the tools is to understand how they will be used at different stages of the process. Support for very detailed analysis may be required for the pre-S&OP process, whereas a very different set of visualization and analytic tools are needed for the executives participating in the final S&OP meeting.

Summary

Technology can’t deliver S&OP, but evidence and case studies indicate it is hard to reach successful levels of S&OP without the right software tools.

The reality is there will almost always be multiple software applications and vendors involved in the process: ERP, production systems, supply and demand planning, logistics systems, etc. There may be a few companies that have it all from one single vendor, but not many.

The key then becomes to really assess where your company is in its S&OP maturity, its ultimate objectives for the process (world-class or just “good enough”), and its current technology stack. S&OP initiatives are often the catalyst for companies to invest in solid demand and supply planning tools as a foundation to the process.

Finding the right tool to consolidate data from multiple sources and to truly power - not hinder - analysis and decision-making becomes critical. The good news is that the ability of these workbench tools to integrate data from multiple sources is getting better and better.

Thinking through the technology part of the equation early is strongly recommended. Generating executive support for S&OP, only to find the company does not have the right tools to support the process as it is adopted, can set the initiative back for a long period. On the other hand, deploying technology too quickly or aggressively can get in the way of developing the right process and functional involvement.

In the S&OP area especially, creating detailed “to be processes,” and piloting those processes with key stakeholders, will help identify the information and technology support required for the process to work effectively. Talk to current customers of supply chain software vendors to see what tools they are using to support the process, and just as importantly how they are using them.

Remember also, however, that no one will get the technology support exactly right from the start. It’s important to set the expectations with executives that this will be a learning process for the organization, and it will take time to fully understand all the data and analysis that will be required.

How important do you think technology is to effective S&OP? What are the most important capabilities? Where do the tools still need work? Let us know your thoughts at the Feedback button below.

|