|

One of the most bothersome anecdotes I have heard lately was the story that a US business executive went to China last year, and met with a high level official there. Somewhere early in the meeting, the Chinese official said to the executive: "China" and pointed his thumb up, and then "US" and pointed his thumb down. (Wish I could find the reference but I can't; believe I read it in the Wall Street Journal.)

Now, that anecdote is bothersome if you live in the US (recognizing we now have thousands of readers outside the US) first because that state of affairs, to the extent it is accurate, is obviously not a happy one. But perhaps worse is the fact that we (and many other countries actually) may have simply abetted the change in the status quo.

Gilmore Says: |

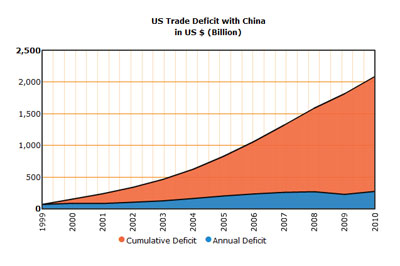

The more amazing number is the cumulative total - over that same 12-year period, the cumulative US trade deficit with China is just over $2 trillion The more amazing number is the cumulative total - over that same 12-year period, the cumulative US trade deficit with China is just over $2 trillion

Click Here to See

Reader Feedback

|

Demography may be (economic) destiny, but that axiom doesn't say anything about when that destiny will actually arrive.

I realize this will border on a political column, and some readers have been critical when I have gone a bit down this path before, but let's just ponder this: has any area of the business done more to change world and economic dynamics relative to China than the supply chain and sourcing from Chinese manufacturers?

The 22nd "First Thoughts" column I wrote for SCDigest was titled "Is Viasystems' Salvation Good or Bad for the U.S. Economy?," and discussed how this printed circuit board manufacturer almost went under in 2002, but was able to recover and even thrive basically by shutting down every Western factory it had a moving it all to China.

As I went back to take a look at that piece, I was struck by this quote: "One of Viasystems' owners is quoted as saying 'The whole U.S. electronics industry will be domiciled to China.'" You can take a look here at our early days and read this article if you care to: Is Viasystems' Salvation Good or Bad for the U.S. Economy? (Think we were OK even back then.)

The "tragedy of the commons" quickly comes to mind, a metaphor I have used only once before on these pages. What is that? A concept made famous by a man named Garrett Hardin in a 1968 article, who noted how sometimes individuals/companies independently pursuing their own self-interest can in the end deliver problems for everyone. The example was the town commons of yesteryear, where farmers could come and graze crops for free. Good for the first farmer, but over time as others joined in the commons was destroyed for all.

Is it not at least reasonable for developed economies to view offshoring like that? Good for an one company, bad for the whole?

As many know, the International Monetary Fund this week predicted that the Chinese economy may now exceed that of the US by 2016, much earlier than previously forecast. Now, many are disputing the prediction, challenging the methodology used to calculate GDP, etc., but the timing is interesting, given there seem to be growing consensus that something must change.

Whether you like him or not, it is one of the reasons Donald Trump is gaining media traction if nothing else. His "tough talk" on China may mostly bluster and self-promotion, but it is resonating nonetheless. There is one thing I have to agree with Trump on: China's advance has been largely built on the backs (and jobs) of Western nations generally, and the US in particular.

Take a look at the chart below, on the US trade deficit with China since 1999. On an annual basis, that has risen from $68.6 billion dollars to an incredible $273 billion in 2010 - a 400% increase in 12 years.

Full Size Chart

But the more amazing number is the cumulative total - over that same 12-year period, the cumulative US trade deficit with China is just over $2 trillion. The same basic pattern holds true with many if not nearly all developed economies (the story is somewhat different with commodity-rich nations such as Australia, but even in those countries there are downsides - more on that in a bit.).

Now, China's economy has been growing at or near double digit levels for a decade or so. But did you know that 50% of that growth is coming from government spending, primarily in areas of infrastructure? And how can China afford to spend like that on infrastructure? Because it has trillions of dollars in reserves accumulated by huge trade surpluses.

So, China is "thumbs up" and surpassing the US in GDP because the US and other developed nations are providing the funding. This makes sense? It is actually worse, an "unvirtuous cycle" because the government spending is increasing the Chinese domestic market much faster than it would otherwise do, making it increasingly critical for Western manufacturers - or at least "brands" - leading them to do stuff such as Nissan promising to turn over its electric car technology for the right to enter the Chinese market.

I have always considered my a "free trader," but there comes a point when you might have to compromise principle for reality. But maybe you don't have to do that. This week, I had an email exchange with Paul Craig Roberts, a well-known economist, former under-secretary of the US Treasury Dept. under Ronald Reagan, and certainly a conservative, which generally means a free trade advocate.

Here is what he says: The US does not have a "free trade" situation with China. That is when two countries each produce their own goods and trade them with each other. What the US and other developed nations have is instead a "labor arbitrage" situation - companies shifting work offshore for lower costs to send back to the home market. That is much different say from the worry about Japan 2-3 decades ago. It was Japanese companies themselves that posed the threat, not US companies moving to Japan.

Roberts ads that "It is a mistake for the US government and economists to think of the imbalance as if it were produced by Chinese companies underselling goods produced by U.S. companies in America. The imbalance is the result of U.S. companies producing their goods in China and selling them in America."

So, it ultimately comes back to the supply chain.

I am going to get a "two-fer" out of this, and write part 2 in the next few weeks. But as promised above, I will note that even in the commodity-rich countries like Australia, Brazil and even to an extent Canada, what is emerging is that while they have more favorable trade balances with China, they are reverting back to commodity-based economies, generally considered to be one a lower level of evolution than those based on manufacturing and knowledge industries.

They ship China ore and oil, and China ships back finished goods.

Is it too late to change course? Maybe. I'll discuss this and more in part 2.

What is your take on Gilmore thoughts on "Rethinking China?" Do you agree with Roberts that there is a difference between free trade and l abor arbitrage? What is the role of supply chain in all this, and do we have a 'tragedy of the commons" situation? Let us know your thoughts at the Feedback button below.

|