|

Strategic versus tactical supply chain investments and initiatives – where does your company stand?

It’s an interesting question, and one subject to some vagaries of definition. One company’s “strategic initiative” might seem like a mere tactical response to someone else.

I bring this up because again this year research firm Gartner has partnered with SCDigest to do a short, but impactful survey of our readership on supply chain priorities and technology. Your chance to participate will be coming along next week, and I ask that you please take the 10 minutes or so it will take to complete the survey. The effort will be led by capable Gartner analysts Chad Eschinger and Dwight Klappich.

With the current economic climate, it will be interesting to see the results this year. Last year, we were in pretty good overall economic times, although the supply chain itself was being buffeted by soaring fuel and commodity costs, among other pressures. Even then, the current focus was primarily on the tactical, according to the research, with plans for most strategic initiatives and investments said to be coming 2-3 years down the road. The question of course is: will you ever get there?

| Gilmore Says: |

What is really interesting is that when the survey asked what individual respondents personally thought should be the company’s supply chain priority between now and end of year 2010, a more strategic focus emerged. What is really interesting is that when the survey asked what individual respondents personally thought should be the company’s supply chain priority between now and end of year 2010, a more strategic focus emerged.

Click Here to See

Reader Feedback |

So for example, 17% of last year’s respondents picked “Reduce operating costs” as the top current supply chain priority among a long list of choices, versus 11% who selected “Drive business growth.” Looking forward, however, those positions were reverse: 16% selected “Drive business growth” as the top priority their supply chains would have in 2010, versus 9% that selected “Reduce operating costs.”

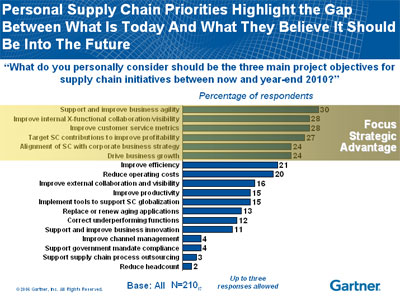

Those questions were oriented around the company’s plans and actions. What is really interesting is that when the survey asked what individual respondents personally thought should be the company’s supply chain priority between now and end of year 2010, a more strategic focus emerged. As shown in the chart below, such goals as “Support and improve business agility,” “Improve cross functional collaboration,” and “Improve customer service metrics” were at the top. (You can click on this graphic for a full sized image/printable.)

“Improved efficiency” and “Reduce operating costs,” were ranked only at 6 and 7, respectively, in this personal priority list. So, what individuals think the company should be doing with its supply chain aren’t matching what the company is doing, it appears.

Here were some other interesting highlights from the report, published earlier this year:

- 18% of respondents said supply chain excellence was the main source of company differentiation in their markets; 22% said SCM was a necessary but not a differentiating function, and 60% said SCM was one of several differentiating functions. That sounds about right to me, across industries.

- Interestingly, the survey asked respondents how aggressive their companies were with regard to supply chain technology. 9% said their companies often favored new and riskier technology; 56% said they generally adopted maturing technologies that still had some risk but at manageable levels; 35% said they preferred only mature, proven technologies.

- The three biggest barriers to achieving SCM goals were: (1) lack of cross functional collaboration/visibility; (2) forecast accuracy levels, and (3) supply chain network complexity.

- In terms of 2008 priorities, the bottom two responses were “improving external collaboration and visibility,” and “support and improve business innovation.” That surprises me. Thought they would be higher.

- Respondents were looking for investment and improvement in supply chain technology support. The average response to “Our supply chain technology portfolio needs increased investment over the next 2-3 years” was 5.81 on a scale of 1-7, with 7 being “totally agree.” Conversely, the lowest score on a series of such choices was “Our supply chain applications/technology are/is flexible enough to adapt to market change in a timely fashion.”

- But probably consistent with the tactical/strategic divide, just 14% of respondents in this year’s numbers said they expected current investment in SCM technology to increase a lot, versus 39% who believed those investments would increase a lot by 2010. Wishful thinking?

Some key takeaways? Eschinger and Klappich noted the disconnect between the fact that the most respondents identified SCM as a source of differentiation, while very few currently had the support of business innovation or agility as a top SCM priority. But again, I’ll note that individually, respondents thought more attention should be paid to strategic SCM.

Although not in the data I have, Eschinger and Klappich also said there were pretty large disconnects between operations and IT personnel when it came to supply chain priorities and perceptions. This gap continues to persist in study after study, and I am not sure why we can’t ever seem to close it.

I’ll also say that I think some of this is an “Urgent” versus “Important but not Urgent” scenario, using the timeless Steven Covey framework. Cutting short-term costs is usually urgent. More strategic initiatives often get pushed out of the way.

The survey is being revised for 2008 based on learnings from last year. Again, please take a few minutes to respond – you’ll receive some free Gartner research for the effort. We’ll summarize this year’s results I hope in Q1 of next year.

Are you surprised there were big differences between what individuals thought should be the top supply chain priorities and what they thought those of their companies would be? Is the strategic/tactical divide an “Urgent” versus “Important but not Urgent” scenario? Anything in these results surprise you? Let us know your thoughts at the Feedback button below. |