From SCDigest's On-Target E-Magazine

- Aug. 15, 2012

Logistics News: Rail Carriers Enjoy Solid Q2 Results Despite Collapse of Coal Shipments

Modest Total Volume Growth Offset for Most By Strong Core Pricing Gains, Improved Productivity

SCDigest Editorial Staff

It's time once again for our quarterly review of the earnings reports and conference calls of major carriers.

Last week, we reported on the strong results from public truckload carriers, which you can find here: Truckload Carriers Once Again Post Generally Solid Q2 Results, as Asset Discipline Continues to Pay Off.

This week, we tackle the rails, followed finally next week by less-than-truckload carriers.

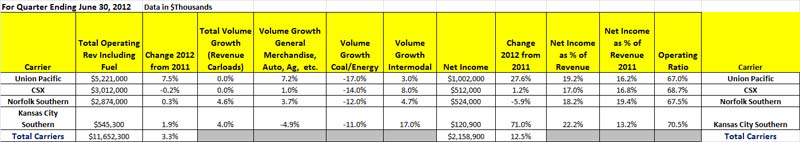

As shown in the table below, Q2 was generally good for the four public major rail carriers (with Burlington Northern now part of Berkshire Hathaway).

See Larger Image

All of the carriers battled a huge collapse in coal-related shipments, down 11-17% in the quarter across the four carriers. But that was somewhat offset by generally strong gains in intermodal and general merchandise rail car traffic.

The net result was that car loads were flat for CSX and Union Pacific, while up about 4% at Norfolk Southern and Kansas City Southern.

In aggregate, total revenues were up just 3.3%, while net income was up a total of 12.5%. However, that profit growth was spread unevenly, with CSX seeing profits rise just 1.2% for the quarter, while Norfolk Southern saw a drop of 5.9%, caused primarily by a one-time gain in Q2 of 2011.

Meanwhile, UP profit soared 27.6% percent, while Kansas City Southern net income rose even more, by 71%.

In general, the carriers said once again pricing was up 4-5%, and several offered guidance that this would remain the range for the rest of 2012, as the rail carriers continue to retain pricing power.

Operating ratios (operating expense divided by operating revenues) continue to improve, ranging from 67-70.5% in the quarter, and seem to decline continuously through a combination of price hikes and a now relentless focus on productivity. This puts the rail carriers' OR substantially better than even the best truckload carriers, driving profits.

(Transportation Management Article Continued Below)

|