The report says that among large truckload carriers Wolfe Trahan follows, rates (revenue per loaded mile) were up on average 4.3% in Q4, a level about what is also expects for 2012, given what its prediction that shippers will face "increasingly tight, supply-driven capacity conditions."

With regard to shipper expectations, the report notes that this marks the eighth straight quarter that shippers have expected rate increases in the truckload sector to exceed those for LTL.

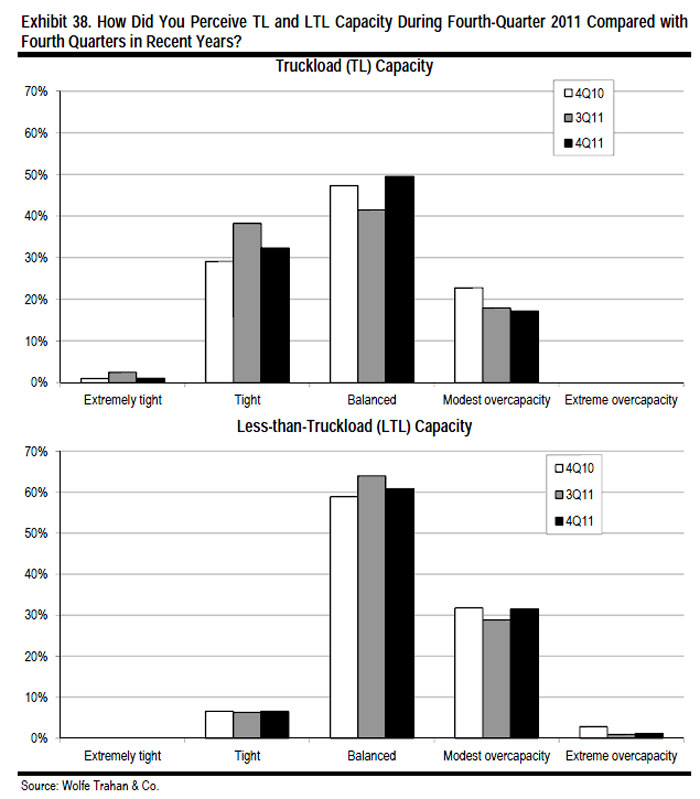

Capacity Seen as Somewhat Tight in Truckload, Balanced in LTL

Reports more generally of growing tightness in the truckload sector were modestly supported by the shipper responses, with about 31% saying they are seeing "tight" conditions, versus just over 1% seeing an "extremely tight" market, and almost 50% saying the TL market is balanced at present. The number saying the market is tight right now is down about 6 percentage points from Q3 2011, but that could be due largely to simple seasonality issues. That number is up slightly versus Q4 2010.

As also shown in the graphic below, the story is much different in LTL, where only about 6% see capacity as being tight right now, nearly the same as Q3 2011 and Q4 2010. More than 60% see the LTL market as balanced, down slightly from the previous quarter in favor of a small increase in the percent who see modest overcapacity in the LTL market.

However, the expectation is that TL capacity will tighten this year, with 66% saying that capacity will tighten moving forward, versus 54% last quarter. Only 21%, however, predict tightening capacity in the LTL market.

Other highlights of the report:

• While expectations for the level of decrease in ocean rates fell, shippers predicted still more reductions in those rates for the third straight quarter.

• Consistent with all the news about "re-shoring," almost 35% of shippers expect more of their production to return from China to the US or Mexico (about split between the two) over the next five years, versus 26% who expect volumes sourced from Asia to increase at their companies. 41% expect no change in sourcing.

• Though the vast majority of shippers (71%) say they are currently paying the same level of accessorial charges (excluding fuel surcharges) to truckers as last year, 19% say those payments are higher year over year, the same percentage as in Q3.

• Shippers in general see improved in troubled LTL carrier YRC Worldwide after its near-death experience and then massive reorganization last summer. 16% say they are seeing YRC's service improving, versus only 4% who see it declining. 15% say they will increase their freight moved by YRC versus 8% that say they will reduce YRC volumes.

• 40% of shippers expect some level of rate increase specifically as a result of changes to hours of service (HOS) rules as the July, 2013 implementation date gets nearer.

• 23% plan on switching some heavy air cargo to ocean, versus just 4% who are planning the opposite switch, indicating a preference for cost over speed.

• Shippers see continued improvements in rail service levels.

That's it for the Q1 report summary. We'll be back with the Q2 2012 report in three months.

Any reaction to this latest State of the Freight report? Let us know your thoughts at the Feedback section below.

|