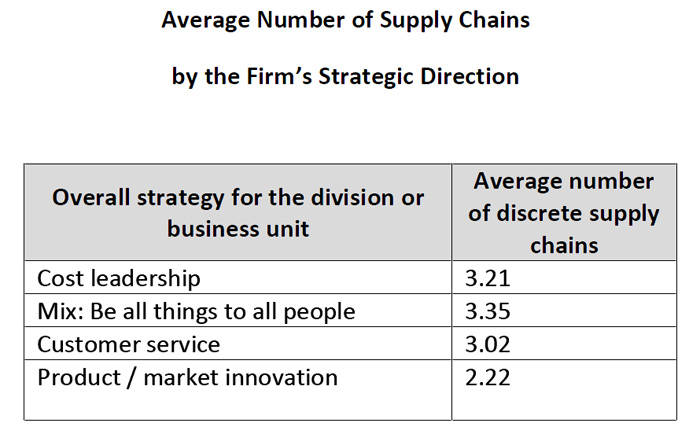

The study addresses that topic by asking companies how many unique supply chains they are operating, cross-tabbed by what they said was their primary value proposition (cost leadership, customer service, product/market innovation, or being "all things to all people", which about 50% of respondents said was their company's strategy.)

As can be seen in the chart below, the average number of supply chains was just a little above three for three out of the four segments, but much lower for the product/market innovation segment, for reasons that are unclear.

Source: 2011 Trends and Issues in Logistics and Transportation

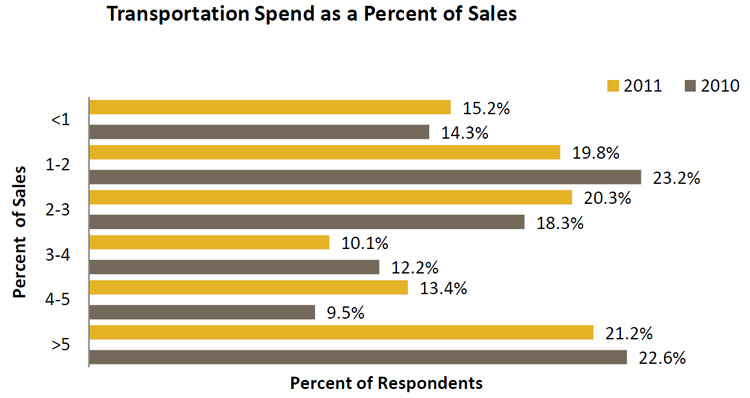

The study also looks at transportation spend as a percent of sales for companies. The chart below shows what percent of respondents have different levels of transport spend relative to revenues in their companies. The spread is actually quite wide and balanced, but as can be seen, the largest percent of any one grouping are those companies spending more than 5% of sales on transportation (21.2% of respondents).

Source: 2011 Trends and Issues in Logistics and Transportation

The study has also found a consistent rise on the number of companies that say their strategy is to be "all things to all people," versus a more specific focus on cost, innovation, etc. Of course, in the business literature on this kind of subject, such as the 1997 book The Discipline of Market Leaders by Michael Treacy and Fred Wiersema, has always held that you had to be good at everything, but that a company could only really excel at one thing.

But with 50.7% of respondents saying they were moving away from a more focused competitive strategy to one that tries to be great at everything (say innovation and cost), up from just 36.8% in 2007, we wonder if this doesn't perhaps overlay directly on segmented supply chain thinking. In other words, segmenting supply chains for different needs is a way to "be all things to all people" while still maintaining a focus on say customer service in some segments and cost leadership in others.

The report provides some data on composite scores for what it calls F-E-D (flexibility, efficiency, and differentiation). We think what in this case is more interesting than the data is the idea of a company creating its own definition of these three components, and then measuring itself internally over time.

Any reaction to the data in this year's Trends and Issues report. Do you like the idea of a F-E-D score? Is it good or not good that more companies are trying a be all things to all people strategy - and are segmented supply chains the key to those efforts? Let us know your thoughts in the Feedback section below.

|