From SCDigest's On-Target E-Magazine

June 8, 2011

Logistics News: Latest State of the Freight Report Sees Big Increase in Transport Budgets, Highest Level of Tight Truckload Capacity in 10 Year History of the Survey

High Fuel Costs Accelerating Shift to Rail, even as Relative Service Declines, Wolfe Trahan Research Finds

SCDigest Editorial Staff

The analysts at Wolfe Trahan are back again with their latest "State of the Freight" research report for Q2 2011, based as always on survey results from several hundred shippers covering a wide range of transportation and supply chain issues.

The report at its core is meant to support Wolfe Trahan's investment advice to its financial industry clients relative to the transportation sector, but always contains excellent insight of general interest to supply chain professionals.

SCDigest Says: |

|

| Shippers continue to see market tightening in truckload capacity, with 65% of respondents saying truckload capacity was tight in Q1, versus just 30% in Q4 of 2010 and 27% in the first quarter last year. |

|

What Do You Say?

|

|

|

|

The surveys were returned during late April and early May.

Not surprisingly, shippers have expectations for strong increases in total transportation spend over the next 12 months, coming in at projections for an increase of about 9% year over year. However, at a cost component level, about half of that increase is expected to come from fuel surcharges, given rising oil prices. The remaining 4.5% of the 9% total increase would come from some combination of high freight rates and increased shipment volumes, though that specific breakdown is not available.

Other data in the survey, however, point to expectations for significant increases in year over year shipping volumes, with 67% expecting their volumes to increase this year, and 33% expecting increases in the 5-10% range.

That would seem to imply almost no increase in freight rates, because the expectations for fuel surcharge increases plus the expectations for higher volumes would take up most if not all of the 9% total spend increase projections.

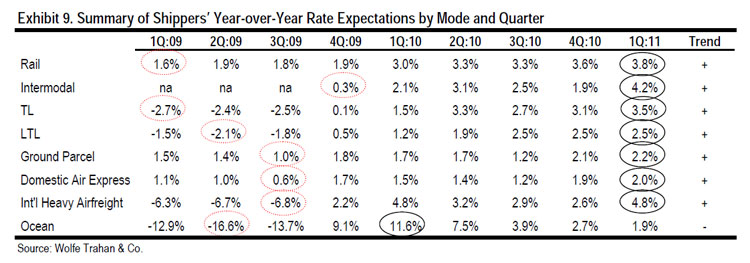

However, respondents also expect pretty strong rate increases in most modes. As shown in the chart below, only ocean rates are expected to fall by Q1 2012, with predictions there for a 1.9% decline. Expected rate hikes for domestic air shipping, ground parcel, and LTL shipping were all in the 2-2.5% range, while there were even higher rate hike expectations for truckload carriage (+3.5%), rail (+3.8%), Intermodal (+4.2) and international heavy air (+4.8%). We supposed some respondents could be factoring in transport efficiency gains or changes to less expensive modes to account for the difference between the rises in component costs and the total budget impact, but we would not expect that much in improvement there.

Shippers continue to see market tightening in truckload capacity, with 65% of respondents saying truckload capacity was tight in Q1, versus just 30% in Q4 of 2010 and 27% in the first quarter last year. That total includes 7% who said the TL market was "extremely tight," versus just 1% the previous quarter.

"More importantly, this represents the highest number of shippers feeling tight capacity in the first quarter in the 10+ years of this survey," the report says.

The report says that only the Western parts of the US do not seem to be feeling at TL capacity pinch at present.

What's more, a significant 77% of respondents expect truckload capacity to tighten even further over the next 12 months.

The story is quite different for less-than-truckload carriage though, with a 59% majority seeing balance capacity in Q1, unchanged from Q4, and only 14% seeing tight LTL capacity. Over the next 12 months, a stronger 31% do expect LTL capacity to tighten, up a bit from the 27% who felt that way last quarter.

Other highlights of the report include:

- Companies seem to have reached a stability level in terms of inventories, with 58% expecting to maintain current target inventory levels over the next 6-12 months, up from 49% in Q4. That change came from a small decreases in all the other options, whether they were related to increasing target inventory levels or decreasing them. Just 2% said their companies were planning to "materially increase" target inventory levels, down from 4% in Q4. Another 16% said they were expecting to somewhat increase inventories, down from 21% in Q4.

(Transportation Management Article Continued Below)

|