From SCDigest's On-Target E-Magazine

March 23, 2011

Logistics News: Latest "State of the Freight" Report Finds Shippers Expect Big Rise in Trucking Costs, Shifting more Freight to Rail and Intermodal

Expectations for Truckload Capacity Highest since Mid-2004, which Presaged Rapid Rise in Rates; Linkage between Fuel Prices and Diversion to Rail/Intermodal

SCDigest Editorial Staff

The latest "State of the Freight" report is out from the market analysts at Wolfe Trahan, and it not surprisingly shows shippers are expecting a sharp increase in truckload shipping costs due to both rates and fuel, and as a result are planning to divert more freight to rail and intermodal.

Each quarter, Wolfe Trahan surveys several hundred shippers across many industries on a variety of logistics issues, with the report based on those responses usually released about two months after the end of the quarter. The Q1 2011 report, issued in March, summarized data collected towards the end of the fourth quarter 2010.

SCDigest Says: |

|

| Wolfe Trahan believes some of the concern about TL capacity stems from what shippers perceive as the potential impact of new government regulations, specifically CSA 2010 and proposed new changes to current Hours of Service rules. |

|

What Do You Say?

|

|

|

|

In total, shippers expect transport budgets to rise sharply over the next 12 month, with average cost increases including fuel coming out at 6.5% for the year. That reflects both expectations for higher shipping costs and a little over 3% on average rise in freight volumes. That's up from expectations for a 4.3% increase in total spend from the previous quarter, as oil prices continued to rise during Q4 from earlier in 2010.

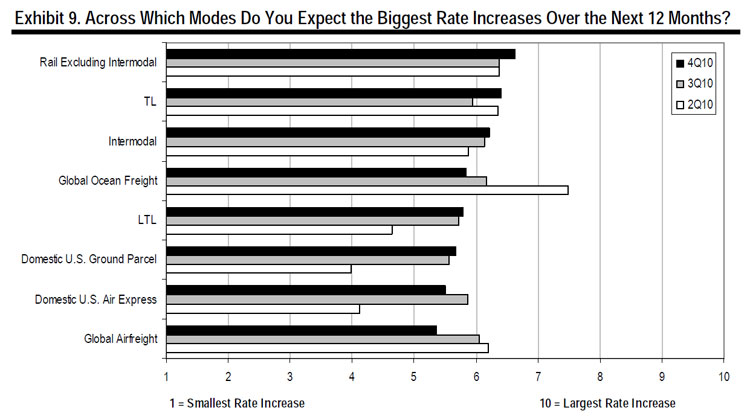

Shippers also see the demand-supply balance moving more in the carriers' favor in several transportation modes. Shippers predict the highest rate increases over the next 12 months in intermodal, followed by ocean shipping, truckload carriage, and rail. (See figure below.) The report says intermodal rates fell by some 30% in Q4 2010, however, after rising in the first half of last year.

Views on truckload capacity where somewhat mixed, but there is clearly concern about the future. 30% of respondents saw TL capacity as being "tight" in Q4, but that's down from the 70% of shippers who felt that way in Q2 of 2010. The number of TL shippers who saw the environment as "balanced" increased from 38% in Q3 to 47% in Q4.

Despite the recent improvements, however, a strong 77% of respondents expect to see very tight or somewhat tight truckload capacities over the coming year. Wolfe Trahan says this is the highest number seen on this measure since mid-2004, and notes that was followed by a multi-year pricing upswing for the carriers and a mini-"capacity crisis" in 2005-06.

All told, shippers expect truckload rate increases before fuel surcharges to average 3.1% over the next 12 months.

On the LTL side, the vast majority see the market right now as "balanced"; with only 6% perceiving tight LTL capacity.

Wolfe Trahan believes some of the concern about TL capacity stems from what shippers perceive as the potential impact of newn government regulations, specifically CSA 2010 and proposed new changes to current Hours of Service rules. The report found an amazing 92% of shippers were opposed to changing the current maximum driving time of 11 hours down to 10, as the Federal Motor Carrier Safety Administration is considering right now. (See Schneider National Exec Tells FMSCA that New Hours of Service Rules will Drop Productivity 5%, have no Impact on Safety.)

As a result of the combined impact of tighter truckload capacities and higher rates, shippers expect a rather significant increase in the percent of their freight volumes that will go intermodal. 38% of shippers are looking to move more freight via intermodal versus pure truck carriage, up from 30% in Q3. Another 16% said they had already moved freight from truck to intermodal over the past year. About 36%, however, said they would not move any freight away from trucking because intermodal carriage did not meet their business or transport needs.

(Transportation Management Article Continued Below)

|