|

Inventories are finally coming down. Wonder why it took so long?

Last year, I published an article on Supply Chain 2015, listing 10 specific changes in supply chain practice that I expect to happen by that time, and have given the related presentation at a number of events. Number three on that list is this: “Inventory Levels will move Sharply Downward for most Companies.”

It’s actually kind of interesting – clearly, the focus on supply chain and its place in the corporate hierarchy have markedly improved over the past decade. We’ve been in the “supply chain era” for nearly three decades now, and if there is anything more central to the practice of supply chain than inventory management I don’t know what it could be.

Well, I supposed you could say the real focus is customer satisfaction/service, and maybe that’s why despite the centricity of inventory management to the practice of supply chain we haven’t really moved the inventory needle very much.

Gilmore Says: |

I may not be the first to say it, but you can bet by 2015 there will be a substantial shift downward in the inventory levels across virtually every industry sector. I may not be the first to say it, but you can bet by 2015 there will be a substantial shift downward in the inventory levels across virtually every industry sector.

Click Here to See

Reader Feedback

|

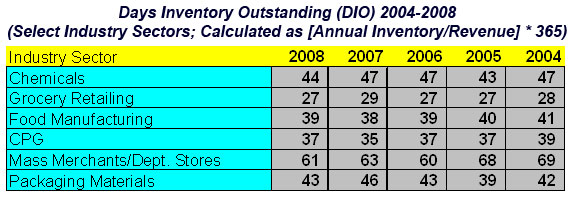

Just for example, below is a chart we produced last year, showing the average inventory levels from 2004 to 2008 for some selected industries. It was pulled together from the annual CFO magazine working capital study, and neither they nor we have put together anything for the 2009 numbers, which should be interesting. The numbers in the chart indicate average Days Inventory Outstanding (DIO) for various industry sectors. (Note: the data uses revenue as the divisor rather than cost of goods, which many argue is the more appropriate value.)

As you can see, not a whole lot of progress (the lower the number, the less inventory a company holds). In fact, it is really only in some healthcare related areas such as pharmaceuticals that any substantial inventory reduction was seen across all sectors in the time period.

At one level this is puzzling, given the many stories of individual companies greatly reducing inventories over the past years. Were these the exceptions? Or does it only last for awhile, so that before long the company reverts to old ways and heads back towards the industry mean? Probably some of both.

One of my favorite SCM anecdotes came from a discussion I was having with a group of consumer packaged goods supply chain execs in the early 2000s when the conversation turned to inventory. Fred Berkheimer, recently retired VP of Logistics at Unilever NA, started laughing and said something like, “My CEO says if we achieved every inventory reduction we promised him from different programs and investments, we’d have hugely negative inventory levels by now. But the reality is we have more inventory than ever.”

Why? The iconic Bud La Londe from Ohio State University wrote a few years ago that the data showed steep drops in work-in-process inventories, but little or no progress in finished goods inventories over some number of years.

SKU proliferation certainly played a role in that. I enjoyed the presentation John Bermudez used to make when he was at AMR Research (he’s at Oracle now, I believe). He had had the bright idea to begin collecting various flavors, formulas and packaging for Crest toothpaste over the years. He’d come with a large grocery bag filled with dozens of different SKUs collected over not that long a time frame. It certainly drove home the point about SKU complexity, micro-segmentation and more.

But that is at last changing. Just as we are in an economy where businesses and consumers are “deleveraging,” most businesses are deleveraging inventory levels as well.

Even Walmart was caught up in the inventory surge, famously letting inventory growth rise to some 90% of sales growth in 2004-05. Then came Inventory DeLoad and other programs from Bentonville, to great effect.

Caught up in a manufacturing strike in 2006, tire maker Goodyear discovered, to its apparent surprise, that it could actually manage just fine with the inventory levels much lower than it was used to carry. Necessity is the mother of invention.

But the recession will turn out to be the real catalyst. First, inventory levels were dramatically cut in most companies to drive cash flow. Worried about the impact on sales, many manufacturers and retailers looked around and said: “Maybe the easiest way to do this is to cut back on SKUs rather starve our best sellers with across the board cuts,” or something along those lines.

In the consumer goods to retail supply chain, the retailers may actually have picked up on this first. As we reported last year, many leading retailers are looking to reduce SKU counts by 15-20% over the next few years (see Will Large Retailers Help Manufacturers Drive Out Supply Chain Complexity?). It turns out that Target, as just one example, is rethinking whether they really need the 88 varieties of Pantene shampoo that some of its stores offer.

Target is testing stores that carry 50% fewer SKUs to see what the reaction is. That is an astounding, game changing concept. Frito-Lat cut SKU counts by some 29% last year. Este Lauder SKU counts were down 10% at the end of last year versus 2008. Kroger is said to be testing stores with 30% fewer SKUs, etc.

These are all retail/consumer goods examples, but it’s happening in other sectors too, my conversations tell me.

What else is happening to drive this, besides what I have discussed above?

- Continued industry consolidation in most markets frankly means smaller brands can be squeezed out, and/or the larger players have more freedom to call the shots

- Consumers and B2B customers may in some cases find less is more. Frito-Lay, for example, is seeing total sales rise with smaller KU assortments.

- The “new normal” relentless focus on price by customers of all types means more will choose low cost over having exactly what they want. Being caught in a high SKU count, higher cost position may not be a good place to be.

- Technology is really providing some answers now. “Inventory optimization” solutions really do enable a more supply chain-wide view of inventory (see video Shifting the Inventory Curve at bottom of page); new store-level DRP solutions have the potential to dramatically improve the flow of inventory throughout the chain (see The Past and Future of Distribution Requirements Planning (DRP)

- The growth of Sales, Inventory & Operations Planning (SIOP), especially with this new mindset, will be more relentless about driving down SKU counts and inventory levels.

- New fulfillment models (DC Bypass, drop shipping) are merging that will lower inventories.

So, I may not be the first to say it, but you can bet by 2015 there will be a substantial shift downward in the inventory levels across virtually every industry sector. That will largely represent true supply chain progress, and it will be real and permanent, at least to some new plateau well below where we have been the last decade or so. As always, there will be ramifications pro and con for companies and individuals.

The Great Inventory Deleveraging is coming.

Do you think we will see at last some real drops in inventory levels starting now and for the next few years? Why despite the seeming progress over the past decade did overall inventory levels seem not to improve? Do you think this current focus on inventory reduction will last, or again creep back? Let us know your thoughts at the Feedback button below.

|